Currently, there is a misconception going on related to TDS. This misconception is that TDS on all rent is reduced to 2%.

Reetu | Oct 7, 2024 |

Finance Act 2024: TDS on all rent not reduced to 2%

With the beginning of October 2024, TDS rates for various goods and services have changed. In the Budget 2024, many changes in the Tax Deducted at Source (TDS) rates were proposed and asked to be implemented with an effective date.

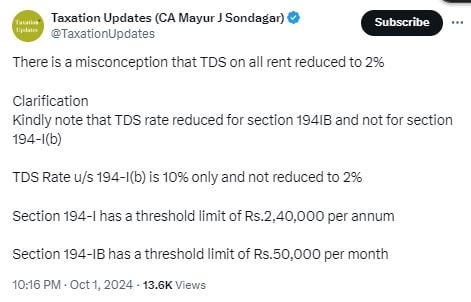

Currently, there is a misconception going on related to TDS. This misconception is that TDS on all rent is reduced to 2%.

CA Mayur J Sondagar talked about this matter and notified clarification.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"