Deepak Gupta | Dec 17, 2018 |

Form RFD-1 should not be filed for claiming refund of ITC on Capital goods without payment of IGST

Legal Provisions

As per provisions of sub section (3) of section 16 of the integrated goods and service tax Act, 2017

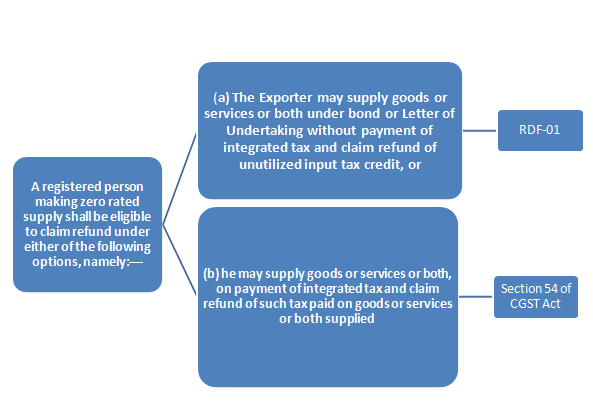

A registered person making zero rated supply shall be eligible to claim refund under either of the following options, namely:

(a) The Exporter may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim refund of unutilised input tax credit, or

(b) he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied

As per provisions of sub rule (1) of rule 89 of the Central goods and service tax Rules, 2017

Application for refund of tax, interest, penalty, fees or any other amount.-(1) Any person, except the persons covered under notification issued under section 55,claiming refund of any tax, interest, penalty, fees or any other amount paid by him, other than refund of integrated tax paid on goods exported out of India, may file an application electronically in FORM GST RFD-01 through the common portal, either directly or through a Facilitation Centre notified by the Commissioner:

As per provisions of sub rule (4) of rule 89 of the Central goods and service tax Rules, 2017

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) x Net ITC Adjusted Total Turnover

Where, –

(A) “Refund amount” means the maximum refund that is admissible;

(B) “Net ITC” means input tax credit availed on inputs and input services during the relevant period other than the input tax credit availed for which refund is claimed under sub-rules (4A) or (4B) or both;

(C) “Turnover of zero-rated supply of goods” means the value of zero-rated supply of goods made during the relevant period without payment of tax under bond or letter of undertaking, other than the turnover of supplies in respect of which refund is claimed under sub-rules (4A) or (4B) or both;

(D) “Turnover of zero-rated supply of services” means the value of zero-rated supply of services made without payment of tax under bond or letter of undertaking, calculated in the following manner, namely:-

Zero-rated supply of services is the aggregate of the payments received during the relevant period for zero-rated supply of services and zero-rated supply of services where supply has been completed for which payment had been received in advance in any period prior to the relevant period reduced by advances received for zero-rated supply of services for which the supply of services has not been completed during the relevant period;

(E) “Adjusted Total Turnover” means the sum total of the value of-

(a) the turnover in a State or a Union territory, as defined under clause (112) of section 2, excluding the turnover of services; and 69

(b) the turnover of zero-rated supply of services determined in terms of clause (D) above and non-zero-rated supply of services, excluding-

(i) the value of exempt supplies other than zero-rated supplies; and

(ii) the turnover of supplies in respect of which refund is claimed under sub-rule (4A) or sub-rule (4B) or both, if any, during the relevant period.

(F) “Relevant period” means the period for which the claim has been filed.

Following Conclusions can be drawn :

FormRFD-01 is filed when exporter is claiming for GST Refund as per sub rule (1) of rule 89 of the Central goods and service tax Rules, 2017 read withSection 16(3)(a) of IGST Act 2017.

As per definition of Net ITC giveninsub rule (4) of rule 89 of the Central goods and service tax Rules, 2017 Net ITC means input tax credit availed on inputs and input servicesduring the relevant period. Ithowever does not includes ITC on capital goods therefore he cannot apply for refund of ITC paid on capital goods.

However if the ITC on capital goods can be utilised whenexporter is claiming for GST Refund as per Section 16(3)(b) of IGST Act 2017

Therefore in absence of any clarification from Government one should not file RDF-01 for claiming ITC refund of capital goodswithout payment of integrated tax.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information.In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"