Deepak Gupta | Mar 11, 2019 |

Future GST Returns : Normal, Sahaj and Sugam

sahaj and sugam gst forms, sugam gst return, gst sugam return format, gst sugam form, Sahaj gst return, gst Sahaj return format, gst Sahaj form, Future GST Returns : Normal, Sahaj and Sugam

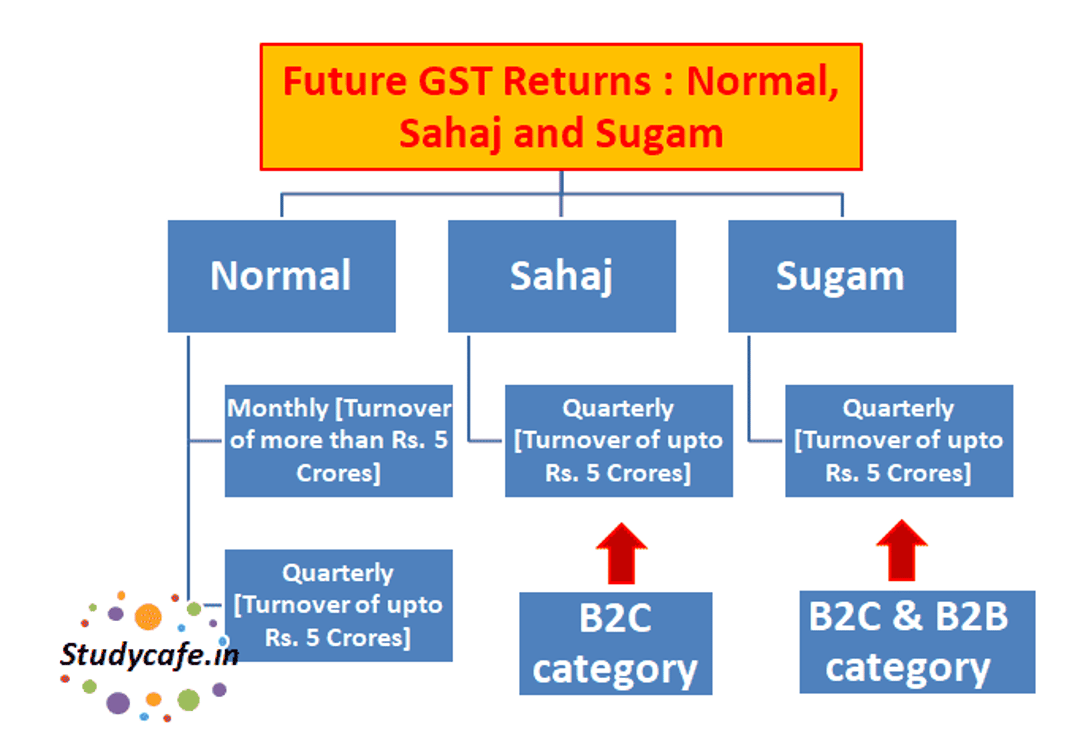

We all know that proposed format of Future GST Returns, named as Normal, Sahaj and Sugam have been released by CBIC. These new forms would begin on pilot basis from 1st April 2019 and would be mandated from July 2019 onwards.

The taxpayers with turnover of upto Rs. 5 Crs and who are opting to file quarterly returns can choose to file any of the Quarterly Return i.e. Sahaj, Sugam or normal Quarterly Return.

You May Also Refer : New GST Return format Normal, Sahaj & Sugam released by GSTN

Normal Return or Form GST Ret-1 can be monthly or quarterly return [As the case may be]

Tax payer opting to file Normal Return or Form GST Ret-1 shall be able to declare all types of outward supplies, inward supplies and take credit on missing invoices.

Sahaj Return or Form GST Ret-2[QuarterlyReturn]

Tax payer opting to file Sahaj Return or Form GST Ret-2 shall be able to declare Outward supply under B2C category and inward supplies attracting reverse charge only.

Taxpayer opting to file Sahaj Return or Form GST Ret-2 shall not be able to take credit on missing invoices and shall not be allowed to make any other type of inward or outward supplies.

You May Also Refer : All About GST Return Sahaj or GSTR Sahaj

Sugam Return or Form GST Ret-3[QuarterlyReturn]

Tax payer opting to file Sugam Return or Form GST Ret-3 shall be able to declare Outward supply under B2B and B2C category and inward supplies attracting reverse charge only.

Taxpayer opting to file Sugam Return or Form GST Ret-3 shall not be able to take credit on missing invoices and shall not be allowed to make any other type of inward or outward supplies.

You May Also Refer : All About GST Return Sugam or GSTR Sugam

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"