Reetu | Mar 28, 2025 |

GST Amnesty Scheme: Tax to be paid only for related period; No Refund of Tax Already paid

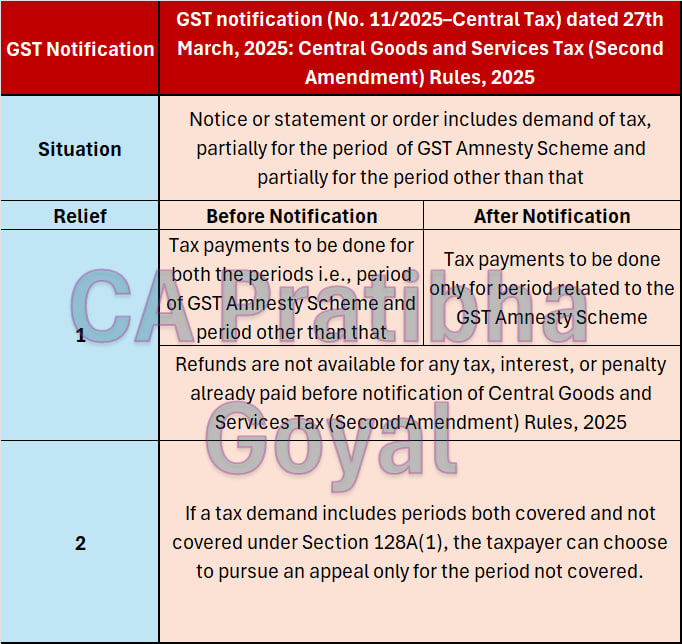

The Central Board of Indirect Taxes and Customs (CBIC) has notified that tax is to be paid under the GST Amnesty Scheme for the related period and there will be no tax refund if already paid. CBIC notified this via issuing a notification.

The Language of notification is as follows:

In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely:—

(1) These rules may be called the Central Goods and Services Tax (Second Amendment) Rules, 2025.

(2) They shall come into force on the date of their publication in the Official Gazette.

In the Central Goods and Services Tax Rules, 2017,–

(a) in rule 164, –

(i) in sub-rule (4), after the words “after payment of the full amount of tax”, the words “related to period mentioned in the said sub-section and” shall be inserted.

(ii) after sub-rule (4), the following Explanation shall be inserted, namely: –

“Explanation, – No refund shall be available for any tax, interest, and penalty, which has already been discharged for the entire period, prior to the commencement of the Central Goods and Services Tax (Second Amendment) Rules, 2025, in cases where a notice or statement or order mentioned in sub-section (1) of section 128A, includes a demand of tax, partially for the period mentioned in the said sub-section and partially for a period other than mentioned in the said sub-section.”.

(b) in rule 164, in sub-rule 7, after the first proviso, the following proviso shall be inserted, namely: –

“Provided further that where the notice or statement or order mentioned in sub-section(1) of section 128A of the Act includes demand of tax, partially for the period mentioned in the said sub-section and partially for the period other than that mentioned in the said sub-section, the applicant instead of withdrawing the appeal, shall intimate the appellate authority or Appellate Tribunal that he does not wish to pursue the appeal for the period mentioned in the said sub-section and the relevant authority shall, after taking note of the said request, pass such order for the period other than that mentioned in the said sub-section, as he thinks just and proper.

Explanation,– For the removal of doubt, it is clarified that the appeal application shall be deemed to have been withdrawn to the extent of the said intimation for the period from the 1st July, 2017 to the 31st March, 2020 or part thereof, for the purpose of sub-clause (3) of section 128A.”

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"