Studycafe | Apr 6, 2020 |

GST Due Dates and Recent Notification Issued On 3rd April 4, 2020

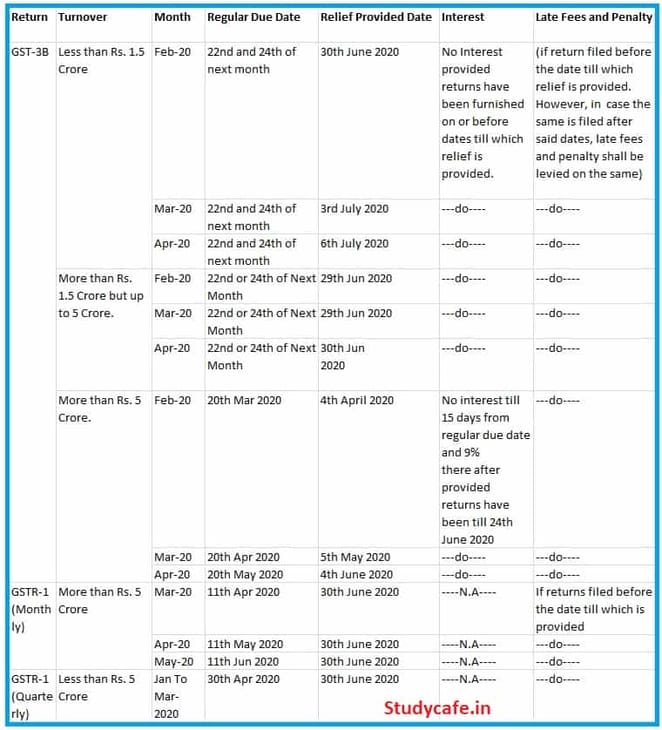

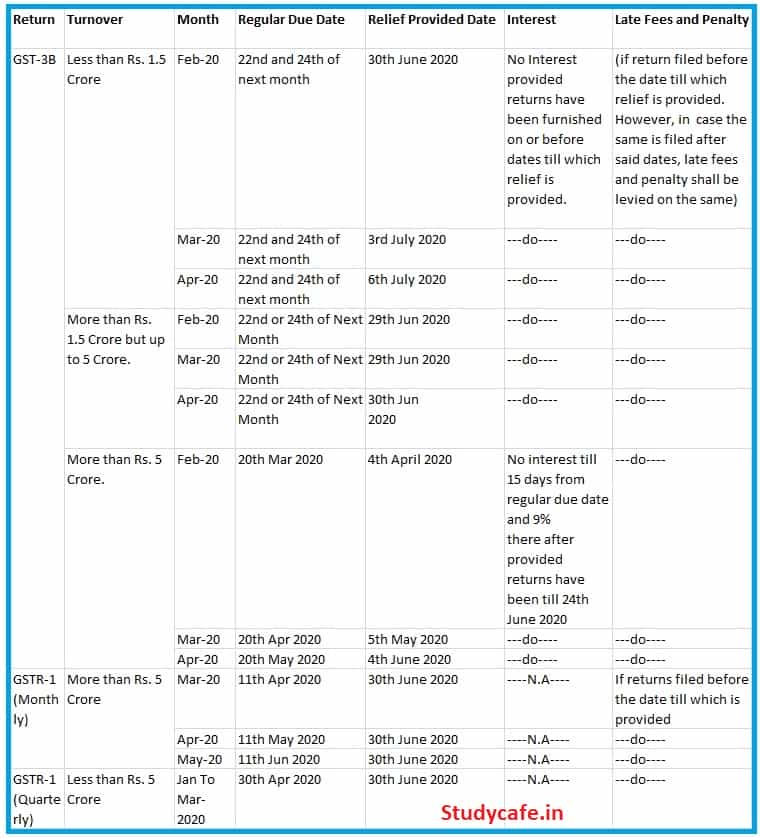

Article discusses, Returns and Compliances Relief in respect of due date on account of COVID-19 and Notification 31, 32, 33, 36 /2020.

GST Due Dates and Recent Notification Issued On 3rd April 4, 2020

Interest Calculation for more than 5 Crores aggregate turnover [Circular No. 136/6/2020]

| Sr. No | Due date of Month Mar-2020 3B | Date of filing of GST 3B | No of days delay | Whether condition for reduced interest fulfilled to 24th Jun 2020 | Remark |

| 1 | 20.04.2020 | 02.05.2020 | 11 | Yes | No Interest |

| 2 | 20.04.2020 | 20.05.2020 | 30 | Yes | No Interest for 15 days & remaining 15 days liable to 9%. |

| 3 | 20.04.2020 | 24.06.2020 | 65 | Yes | No Interest for 15 days & remaining 50 days liable to 9%. |

| 4 | 20.04.2020 | 30.06.2020 | 71 | No | Interest @ 18% for 71 days |

Due Date for Month of May 2020 3B [Notification No 36/2020]

| Due Dates | Turnover |

| 27.06.2020 | Turnover Limit > 5 Crore. |

| 12.07.2020 | Turnover Limit < 5 Crore. States Covered :- CHHATISGARH, MP, GUJARAT, MAHARASHTRA, KARNATAKA, GOA ,KERALA, TN, TELANGANA, AP, DAMAN AND DIU, DADARA AND NAGAR HAVELI, PUNDUCHERRY, ANDAMAN AND NICOBAR ISLAND AND LASHADWEEP. |

| 14.07.2020 | Turnover < 5 Crore. State Covered :- HP, PUNJAB, UTTARAKHAND, HARYANA, RAJASHTHAN, UP, BIHAR, SIKKIM, ARUNACHAL PRADESH, NAGALAND , MANIPUR, MIZORAM, TRIPURA, MEGHALAYA, ASSAM, WB, JHARKHAN, ODISHA, J&K, LADAKH,CHANDIGARH AND DELHI. |

Rule 36(4) restricts the claim of ITC in GSTRB 3B. ITC claim is restricted to 10% above the ITC as per 2A.

Considering the lock down situation, the Government has relaxed the provisions of Rules 36(4). Therefore for the GST returns relating to periods from February 2020 to August 2020, ITC as per Books can be

Claimed without considering the ITC as per GSTR Books can be claimed without considering the ITC as per GSTR 2A

Important :-

However , the ITC claimed has to be matched in a cumulative manner with GSTR 2A before filing GSTR 3B of September 2020 with following Rules 36(4).

Intimation in respect of opting to pay tax under composition for the F.Y 2020-2021 can be filed till 30.6.2020 in form CMP-02.

Statement in Form GST ITC-03 in relation to above intimation to be filed to 31.07.2020 (Rules 44(4)).

Composition Dealer…

Registered person availing the benefit provided under Notification 2/2019 shall be required to furnish details of self-assessed tax in form GST CMP-08 for Quarter ending March 2020 by 07.07.2020.

The yearly return for 2019-2020 shall be required to be filed in Form GSTR-4 by the above persons till 15.07.2020.

Validity of E-Way Bills:

Where E-way Bills expires between 20.03.2020 and 15.04.2020, Validity deemed to have been extended till 30.04.2020.

Extension of time limit till 30th June:

For completion of compliance of any action due date of which falls between 20th march 2020 to 29th June 2020.

Activities of Authority/ Commissioner/Tribunal to which extension appeal etc: Time limit extended upto 30.06.2020

Completion of proceedings, Passing of any order, Issuance of Notice, Intimation, Notification, Sanction or approvals.

Filing of appeal, reply, application, furnishing of any report, documents returns, statement, and records.

Compiled by Adv.Krunal Ice cream wala. Author can be Reached at [email protected]

You May Also Refer:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"