Reetu | Feb 23, 2023 |

GST: Excel Calculator for Revised Due Date of Filing Refund Application u/s 54

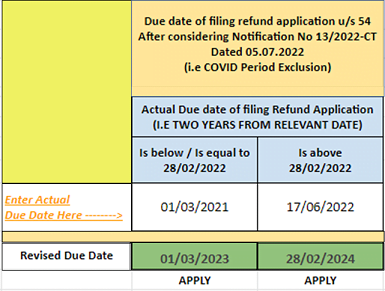

The Calculator for revised due date of filing refund application u/s 54 after considering Notification No 13/2022-CT Dated 05.07.2022 (i.e COVID Period Exclusion).

1. A table has given below showing revised due date:

Enter actual due date & get revised due date-

2. “relevant date” means—

(a) in the case of goods exported out of India where a refund of tax paid is available in respect of goods themselves or, as the case may be, the inputs or input services used in such goods,––

(i) if the goods are exported by sea or air, the date on which the ship or the aircraft in which such goods are loaded, leaves India; or

(ii) if the goods are exported by land, the date on which such goods pass the frontier; or

(iii) if the goods are exported by post, the date of despatch of goods by the Post Office concerned to a place outside India;

(b) in the case of supply of goods regarded as deemed exports where a refund of tax paid is available in respect of the goods, the date on which the return relating to such deemed exports is furnished;

(c) in the case of services exported out of India where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services, the date of––

(i) receipt of payment in convertible foreign exchange, 1[or in Indian rupees wherever permitted by the Reserve Bank of India] where the supply of services had been completed prior to the receipt of such payment; or

(ii) issue of invoice, where payment for the services had been received in advance prior to the date of issue of the invoice;

(d) in case where the tax becomes refundable as a consequence of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court, the date of communication of such judgment, decree, order or direction;

(e) in the case of refund of unutilised input tax credit under clause (ii) of the first proviso to sub-section (3), the due date for furnishing of return under section 39 for the period in which such claim for refund arises

(f) in the case where tax is paid provisionally under this Act or the rules made thereunder, the date of adjustment of tax after the final assessment thereof

(g) in the case of a person, other than the supplier, the date of receipt of goods or services or both by such person; and

(h) in any other case, the date of payment of tax

This calculator has been developed by Mr. Jacky Bhansali and was shared by him on his Twitter channel. Here is the google link to use the same.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"