DEEPAK | Jun 5, 2019 |

GST – New Return Prototype

Goods and Services Tax Network (GSTN) has released a web-based prototype of the offline tool of new return system. These new GST Returns will replace GSTR-3B, GSTR-1. These newly proposed prototype are user-friendly and will provide all details such as invoice upload, upload of purchase register for matching with a system-created inward supplies.

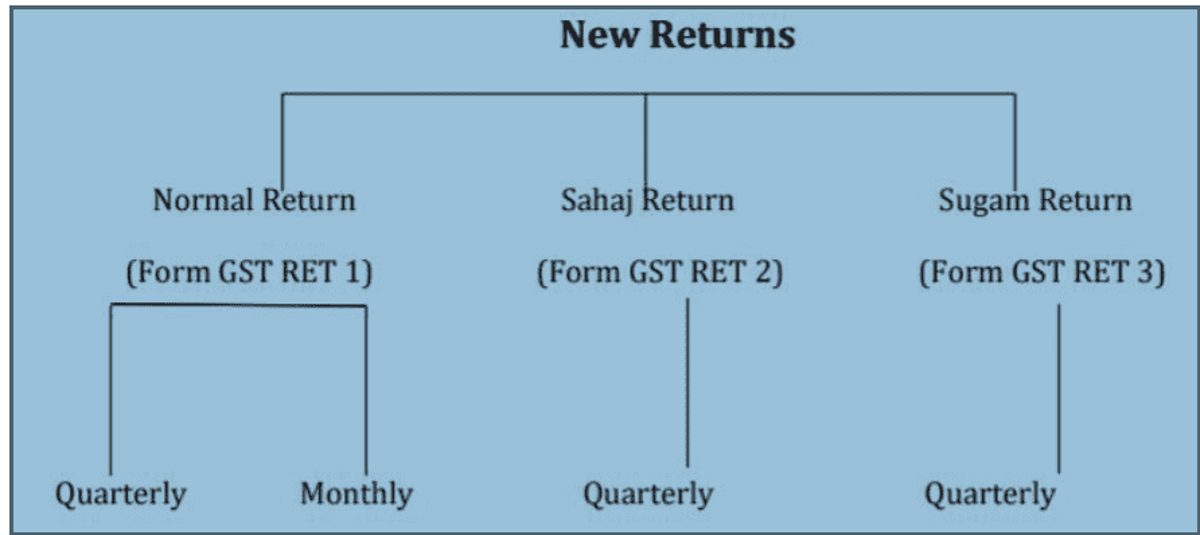

Frequency of Filling Newly Proposed Returns

GST RET 2 and GST RET 3 are mainly for Smaller taxpayers.

Features of New Return Prototype

Purpose of New Prototype

While the actual Offline Tool of ANX-1 and ANX-2 are being designed for taking feedback on use of Offline Tool of New returns and suggestions from users to provide matching facility with taxpayers purchase register to find out mismatches of invoices not uploaded or incorrectly uploaded by suppliers, it was thought valuable to run it again as a Prototype to get feedback on user interface and functionalities to enable us to deliver the best suited product.

You May Also Like : ICAI Has Approved To change The Branch Name of 18 Regional Councils

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"