CA Pratibha Goyal | Jul 20, 2022 |

GST on Goods and Transport Agency Services: Know the New GST Rates and ITC Conditions for GTA

This article discusses new GST Rates and Input Tax Credit (ITC) Conditions Applicable in the case of Services provided by the Goods and Transport Agency (GTA).

GTA has been considered the backbone of the Indian Economy. That is the reason, this sector has always got special attention and benefits in the Goods and Service Tax (GST) Regime as well. One of the benefits given to this sector was the applicability of the Reverse Charge Mechanism (RCM) where the responsibility of GST Payment comes to the Service Receiver.

Prior to 18th July 2022, GTA had two Options:

You May Also Refer: GST on Service by way of renting of residential Property

Vide Notification No. 03/2022-Central Tax (Rate) dated 13th July 2022 the GTA is being given the option to pay GST at the rate of 5% on Forward Charge Mechanism without the Availment of Input Tax Credit.

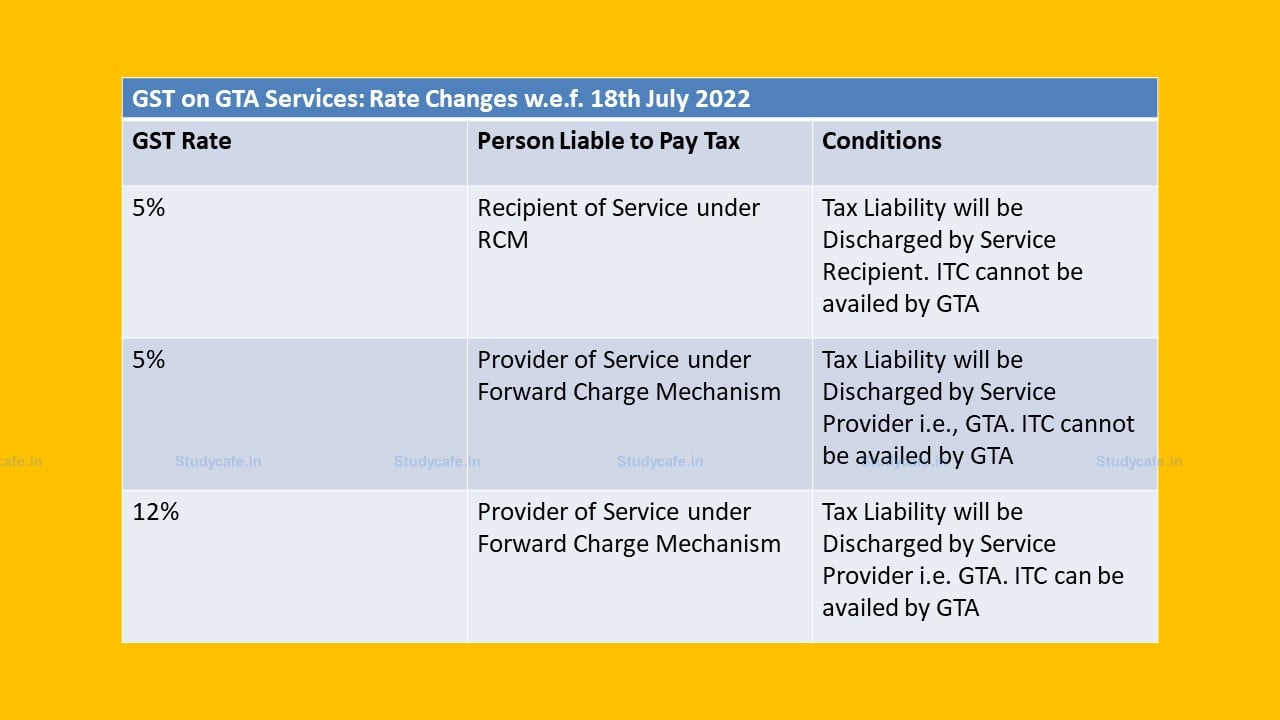

Options with GTA w.e.f. 18th July 2022:

The New GST Rate is summarised by below mentioned Table

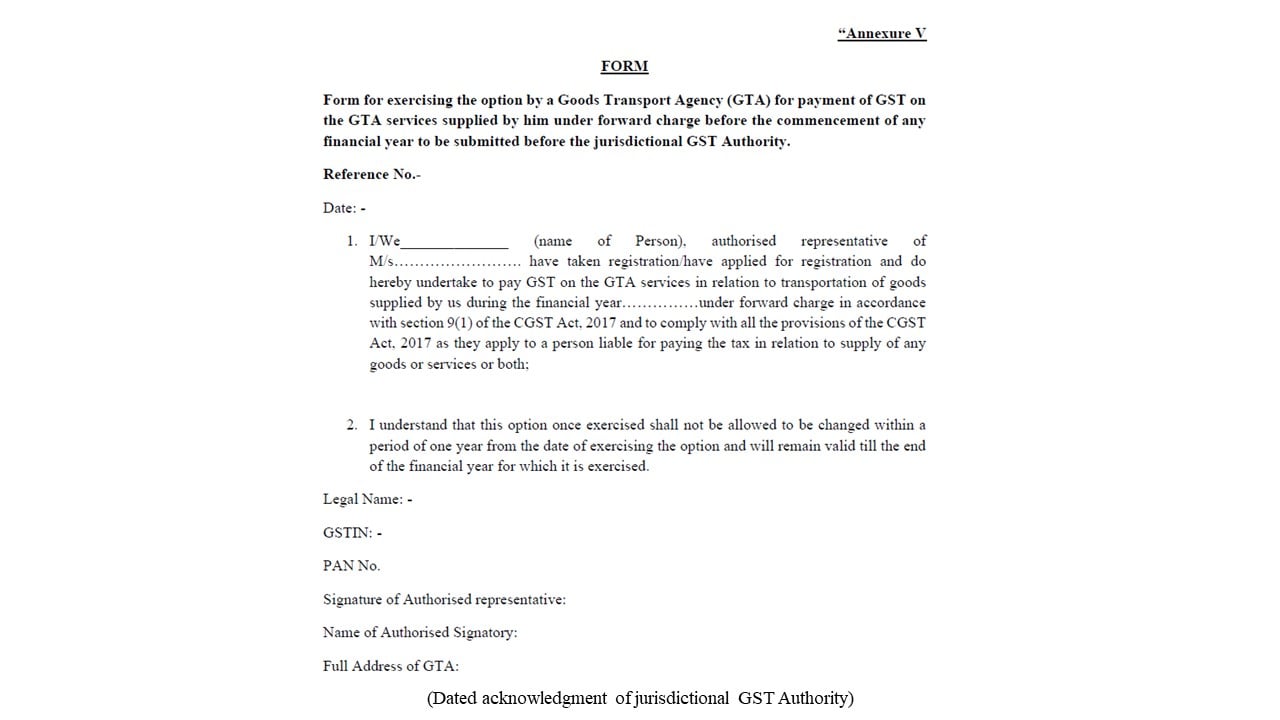

Form for exercising the option by a Goods Transport Agency (GTA) for payment of GST on the GTA services supplied by him under forward charge before the commencement of any financial year to be submitted before the jurisdictional GST Authority.

The last date for exercising the above option for any financial year is the 15th of March of the preceding financial year.

The option for the financial year 2022-2023 can be exercised by 16th August 2022. Provided further that invoice for supply of the service charging GST at the rate of 5% may be issued during the period from the 18th July 2022 to 16th August 2022 before exercising the option for the financial year 2022-2023 but in such a case the supplier shall exercise the option to pay GST on its supplies on or before the 16th August 2022.

Declaration

I/we have taken registration under the CGST Act, 2017 and have exercised the option to pay tax on services of GTA in relation to transport of goods supplied by us during the Financial Year _____ under forward charge.

Earlier there was exemption on services provided by GTA where

(a) Goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage does not exceed one thousand five hundred rupees;

(b) goods, where consideration charged for transportation of all such goods for a single consignee does not exceed rupees seven hundred and fifty;

Same is now withdrawn

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"