Studycafe | Feb 1, 2021 |

GST PMT-06 35% Option Challan Enabled on GST Portal

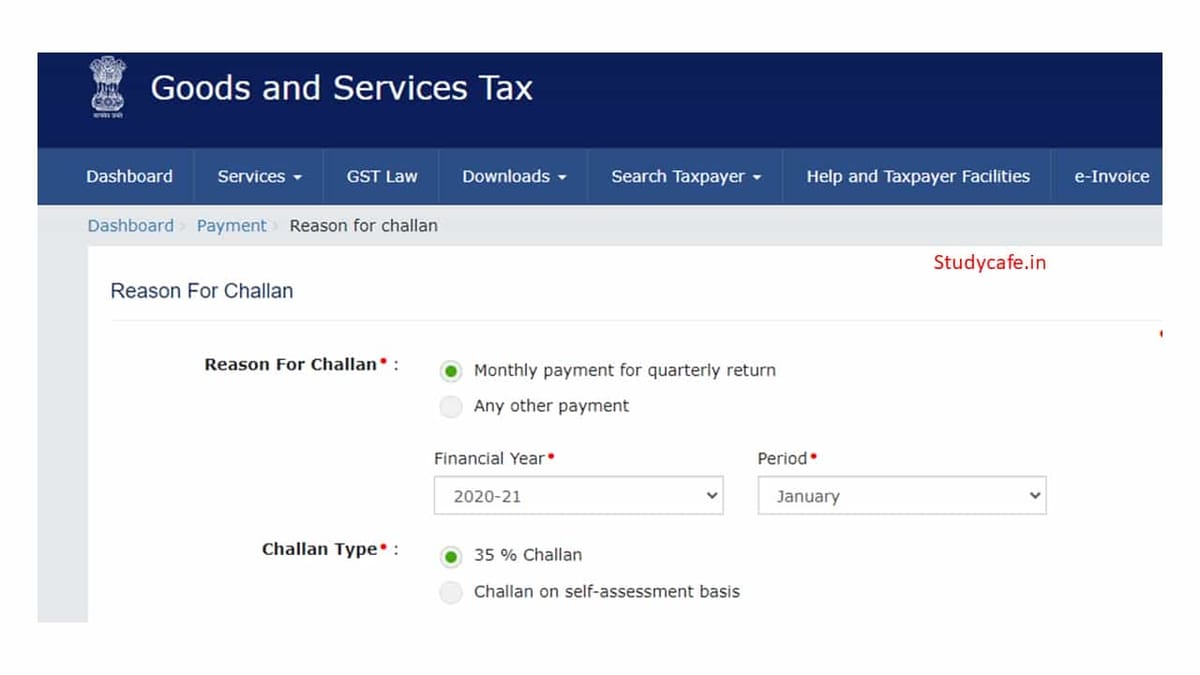

The reason for challan can be selected from the Reason for Challan page (Services -> Payments -> Create Challan). This page displays reason as Monthly payment for quarterly return and Any other payment.

35% Challan

Challan on Self-Assessment Basis

Note: For taxpayers whose AATO is greater than ₹5Cr., the filing preference shall be monthly only, and they will not be able to generate challan with ‘Monthly payment for quarterly return’ reason.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"