In a significant development, there is major update for GST taxpayer, GST portal is now allowing reporting Negative Values in Outward Supply in Table 3.1 of GSTR-3B.

Reetu | Jan 23, 2025 |

GST Portal Major Update: GST Portal allows Negative Values in Outward Supply Table 3.1 of GSTR-3B

In a significant development, there is major update for GST taxpayer, GST portal is now allowing reporting Negative Values in Outward Supply in Table 3.1 of GSTR-3B.

Earlier, GST portal introduced a update, allowing taxpayers to report negative values in GSTR-3B, the summary return for regular GST taxpayers. GSTN issued an advisory on the GST portal, stating that negative values could be reported in Tables 4A and 4D of GSTR-3B. Negative values were allowed for reporting when the value of all credit notes exceeds the total value of outward supplies and debit notes in Table 4B.

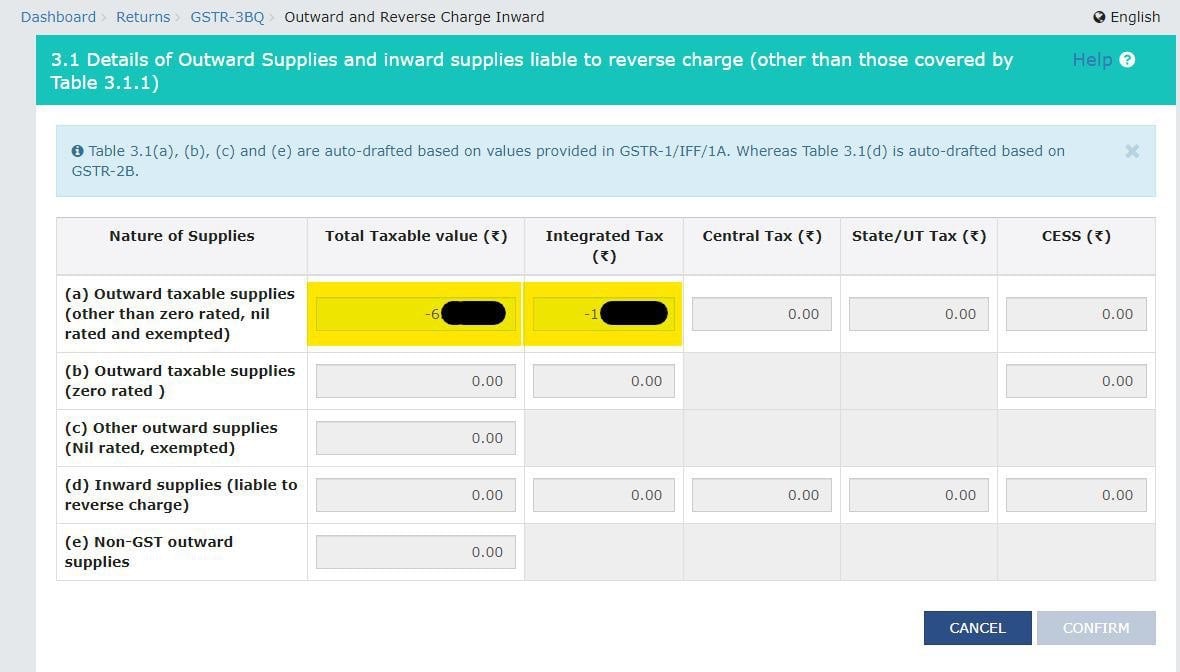

Now, GST portal comes with another update related to reporting negative values. This time portal allows reporting of negative values in outward supplies in Table 3.1 of GST Return GSTR-3B. Table 3.1 which basically shows the details of outward supplies and inward supplies liable to reverse charge. This will enable taxpayers to report the correct figures in months where there were just sales returns and no sales transactions.

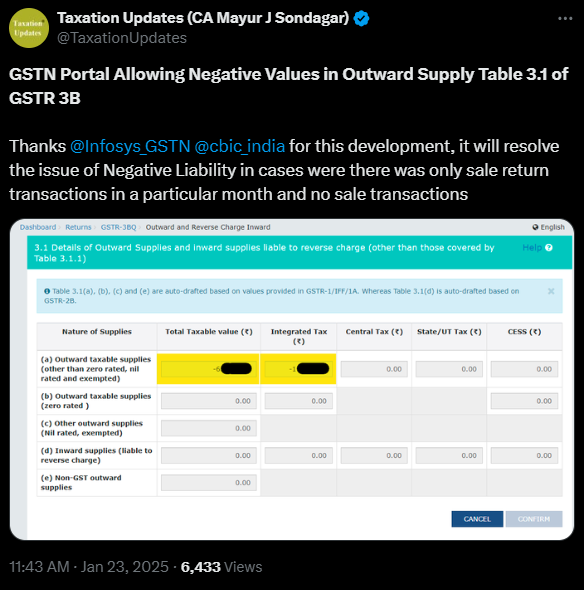

Finally, it will resolve the issue of Negative Liability in cases where there was only sale return transactions in a particular month and no sale transactions.

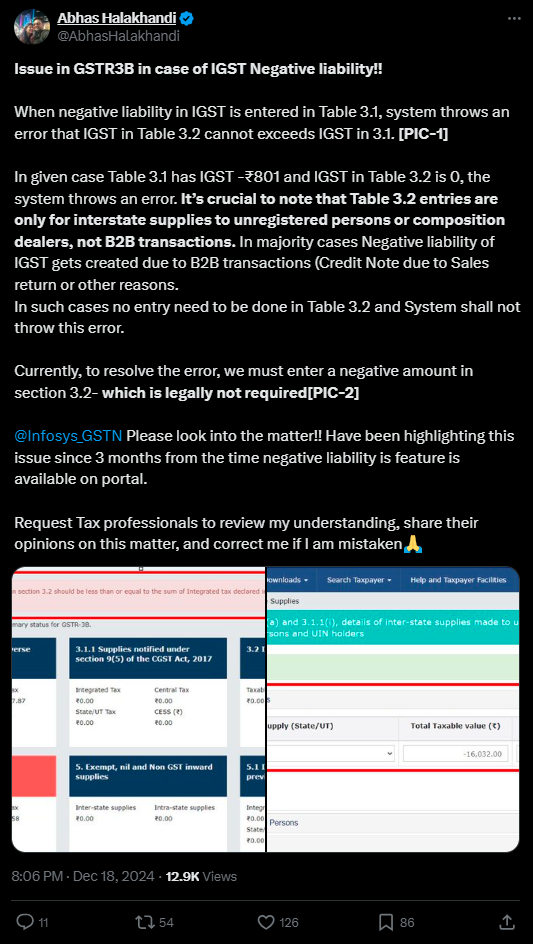

All professionals in the tax community applaud the current update, which was previously identified as a serious concern in discussions on the social media platform Twitter.

The GST portal’s recent update, which allows for the reporting of negative values in GSTR-3B, is an important development towards making the tax filing procedure easier for taxpayers.

It is essential for taxpayers to stay updated and follow the GSTN’s instructions when generating GSTR-2B and reviewing the system-generated GSTR-3B PDF before filing GSTR-3B.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"