GSTN has issued an advisory on the Validation of Bank Account Details while Adding a Bank Account as Non Core Amendment.

Reetu | Oct 22, 2024 |

GSTN Advisory on Validation of Bank Account Details while Adding Bank Account as Non-Core Amendment

The Goods and Services Tax Network (GSTN) has issued an advisory on the Validation of Bank Account Details while Adding a Bank Account as a Non-Core Amendment.

GSTN has implemented a validation process for cases where a taxpayer attempts a non-core amendment to update bank account details. Taxpayers are urged to follow the procedure specified in the link below when entering bank account information on the portal.

The procedure is as follows:

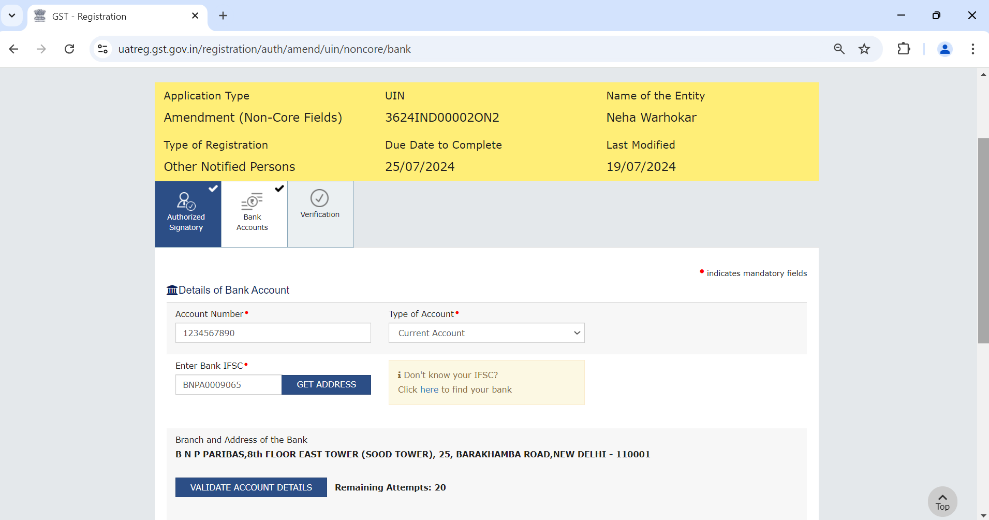

(I) When the bank account details are entered, the taxpayer is required to click on the “VALIDATE ACCOUNT DETAILS” button.

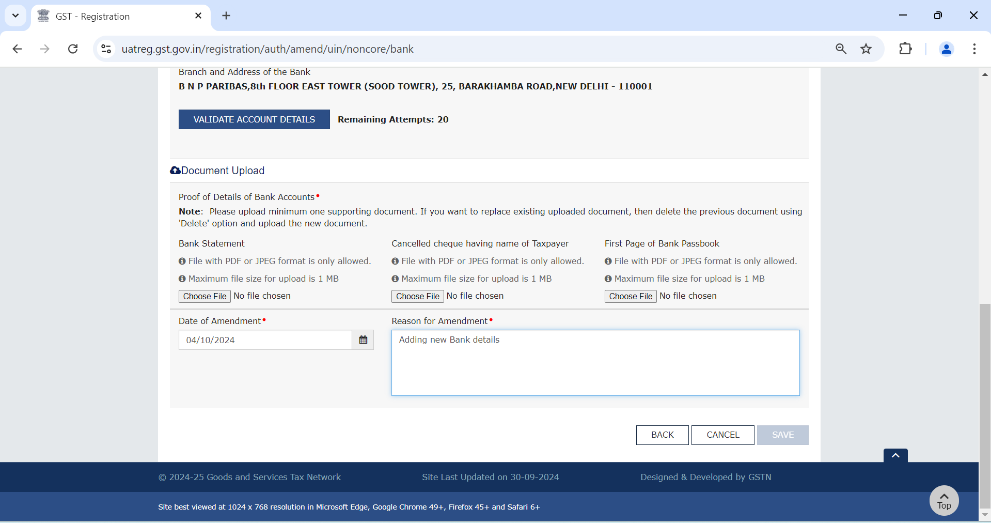

(II) Prior to clicking the “Validate Account” button, the “Save” button at the bottom of the screen as shown remains disabled.

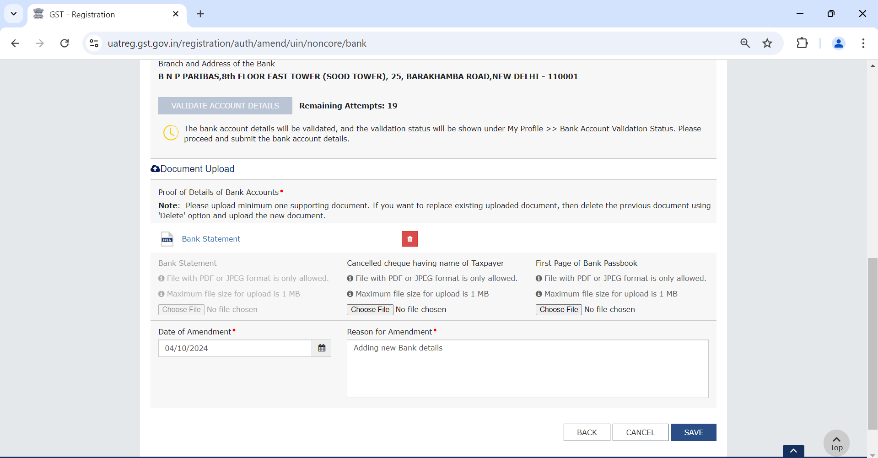

(III) The “Save” button will become active only after the “Validate Account Details” button is clicked.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"