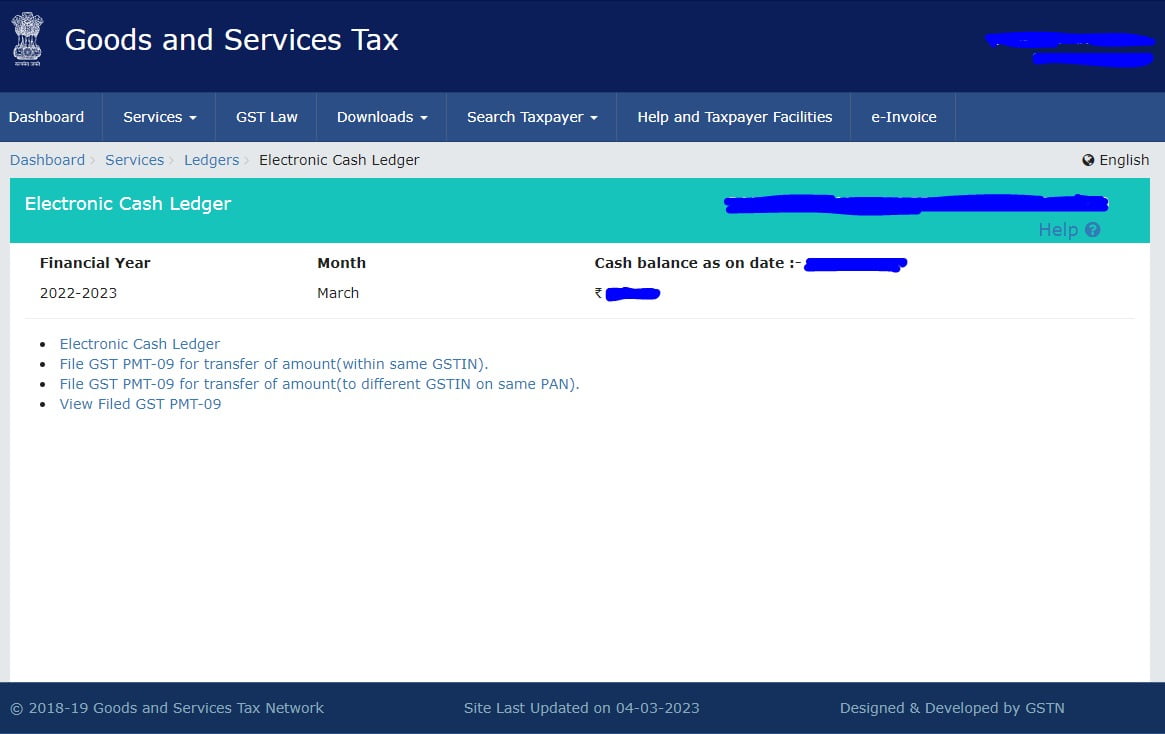

GSTN has enabled the option to use the amount in the cash ledger of one GSTIN (entity with the same PAN) by another GSTIN via transfer through form GST PMT-09, which has been made effective in the GST site.

Reetu | Mar 7, 2023 |

GSTN enabled option to utilize the amount in Cash Ledger of one GSTIN by another GSTIN having same PAN

The Goods and Services Tax Network (GSTN) has enabled the option to use the amount in the cash ledger of one GSTIN (entity with the same PAN) by another GSTIN via transfer through form GST PMT-09, which has been made effective in the GST site.

Rule 87(14) of the Central Goods and Services Tax Rules, 2017 (“the CGST Rules”).

On the common portal, a registered person may transfer any amount of tax, interest, penalty, fee, or other amount available in the electronic cash ledger under the Act to the electronic cash ledger for central tax or integrated tax of a distinct person as specified in sub-section (4) or, as the case may be, sub-section (5) of section 25, in FORM GST PMT- 09:

However, no such transfer shall be permitted if the registered individual has any unpaid liability in his electronic liability register.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"