Reetu | Dec 28, 2023 |

GSTN enables Online Filing of Annexure-V by Newly Registered GTAs Opting for Forward Charge

The Goods and Services Tax Network (GSTN) has launched a much-anticipated feature, allowing for the online submission of Annexure-V on the GST Portal. This functionality is designed primarily for newly registered Goods Transport Agencies (GTAs) that want to use Forward Charge.

The newly added feature allows users to upload manual Annexure V that was previously submitted to the jurisdictional office prior to the start of the online filing option. For GTAs navigating tax compliance, this streamlined method provides better simplicity and efficiency.

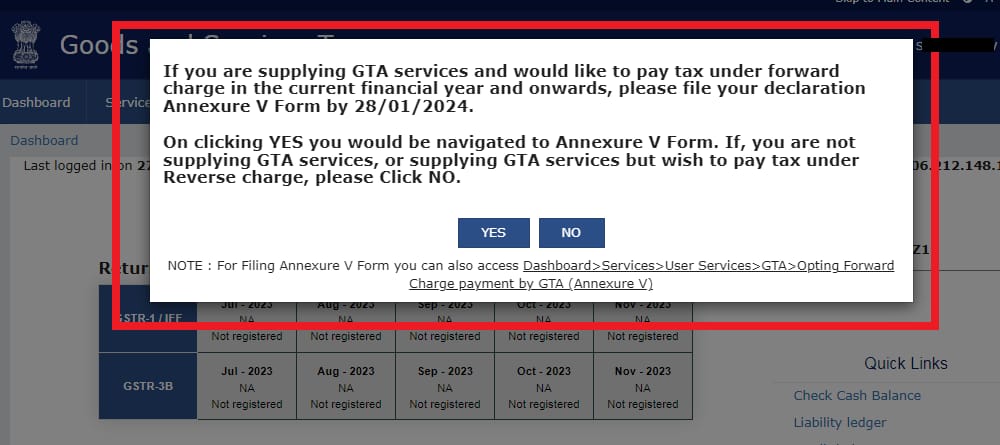

The declaration through Annexure V Form must be completed by January 28, 2024, for Goods Transport Agencies providing services and preferring to pay tax under Forward Charge for the current fiscal year and beyond. By selecting “YES” throughout the filing process, customers are sent to the Annexure V Form, allowing for a smooth transition to the Forward Charge mechanism. Those who are not engaged in delivering GTA services or wish to pay tax under Reverse Charge can, on the other hand, select “NO.”

Users can access the Annexure V Form by going to the Dashboard and selecting Services > User Services > GTA > Opting Forward Charge Payment via GTA (Annexure V). This technique offers accessibility and clarity for taxpayers using the online filing system.

The introduction of this function signifies a significant shift in the GTA compliance environment. GSTN wants to improve transparency and decrease administrative difficulties for newly registered GTAs opting for Forward Charge by offering a digital channel for Annexure-V filing.

GSTN’s adoption of online filing for Annexure-V constitutes an important step towards digital transformation and the streamlining of tax compliance procedures. Goods Transport Agencies, particularly those using Forward Charge, are encouraged to take advantage of this feature and file their statements on time in order to meet the January 28, 2024 deadline. This initiative supports the commitment to developing a more efficient and user-friendly tax environment in response to taxpayers‘ changing needs.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"