Reetu | Oct 25, 2022 |

GSTN Implements Mandatory Mentioning of HSN codes in GSTR-1

The Goods and Service Tax Network(GSTN) has notified the implementation of the mandatory mentioning of HSN codes in GSTR-1.

As per Notification No. 78/2020 – Central Tax dated 15th October, 2020, it is mandatory for the taxpayers to report minimum 4 digit or 6 digit of HSN Code in table-12 of GSTR-1 on the basis of their Aggregate Annual Turnover (AATO) in the preceding Financial Year.

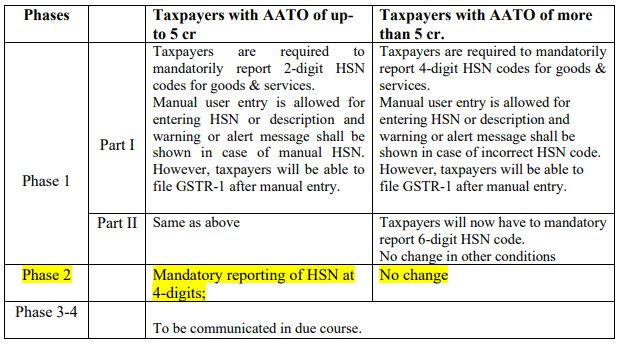

To facilitate the taxpayers, these changes are being implemented in a phase-wise manner on GST Portal as below:

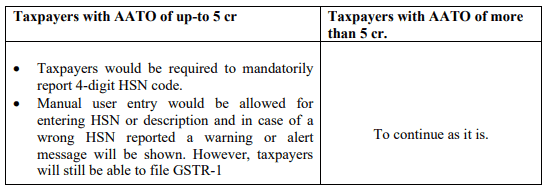

Part I & Part II of Phase 1 has already been implemented from 01st April 2022 & 01st August 2022 respectively and is currently live on GST Portal. From 01st November, 2022, Phase-2 would be implemented on GST Portal and the taxpayers with up to Rs 5 crore turnover would be required to report 4-digit HSN codes in their GSTR-1 as per below mentioned scheme.

The taxpayers are advised to correct the HSN details where there is an error and a warning message is shown. However, it is not a mandatory validation for filing GSTR-1.

Further phases would be implemented on GST Portal shortly and respective dates of implementation and nature of change would be updated from time to time.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"