Reetu | Jul 21, 2022 |

GSTN Notifies Implementation of mandatory mentioning of HSN codes in GSTR-1

The Goods and Services Tax Network (GSTN) has notifies Implementation of mandatory mentioning of HSN codes in GSTR-1.

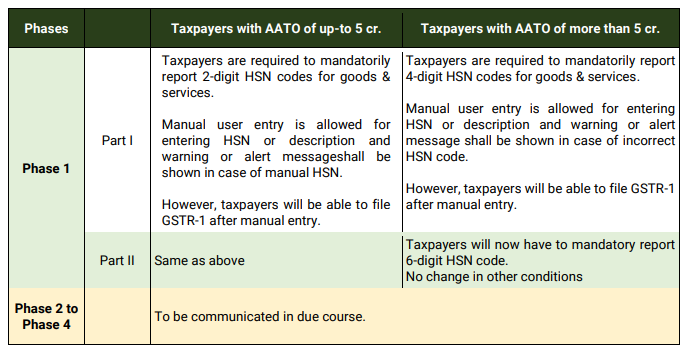

Vide Notification No. 78/2020 – Central Tax dated 15th October, 2020, it is mandatory for the taxpayers to report minimum 4 digits or 6 digits of HSN Code in Table-12 of GSTR-1 on the basis of their Aggregate Annual Turnover (AATO) in the preceding Financial Year. To facilitate the taxpayers, these changes are being implemented in a phase-wise manner on GST Portal.

To facilitate the taxpayers, these changes are being implemented in a phase-wise manner on GST Portal as below:

Phase Wise Manner

For detailed advisory Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"