Reetu | Apr 27, 2022 |

GSTR-1 Return’s Biggest Change at GST Portal

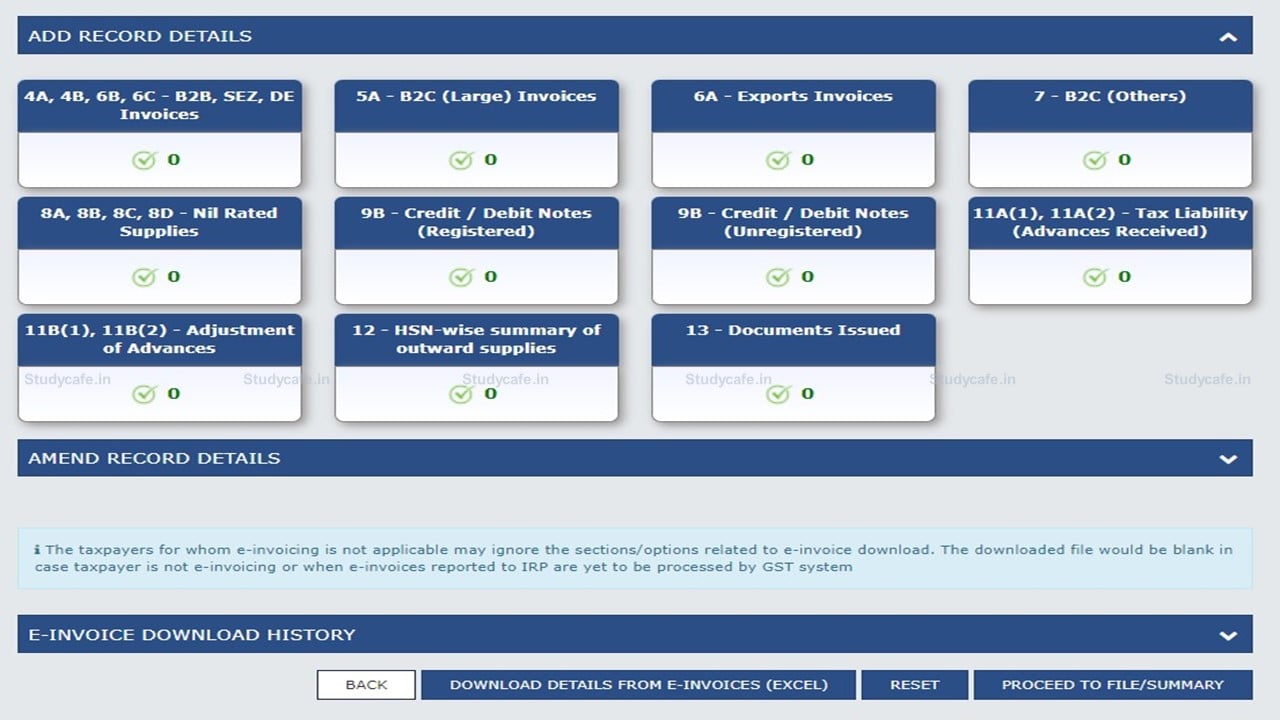

The “submit” button on the GSTR-1 return has been replaced by “proceed to file/ summary.”

You no longer need to prepare a GSTR-1 summary and submit it before filing.

The return will be ready to file once you click the “proceed to file/ summary button.” This is a good start toward making compliance easier.

Refer: Know all the GSTR-1/IFF enhancements deployed today on GST Portal

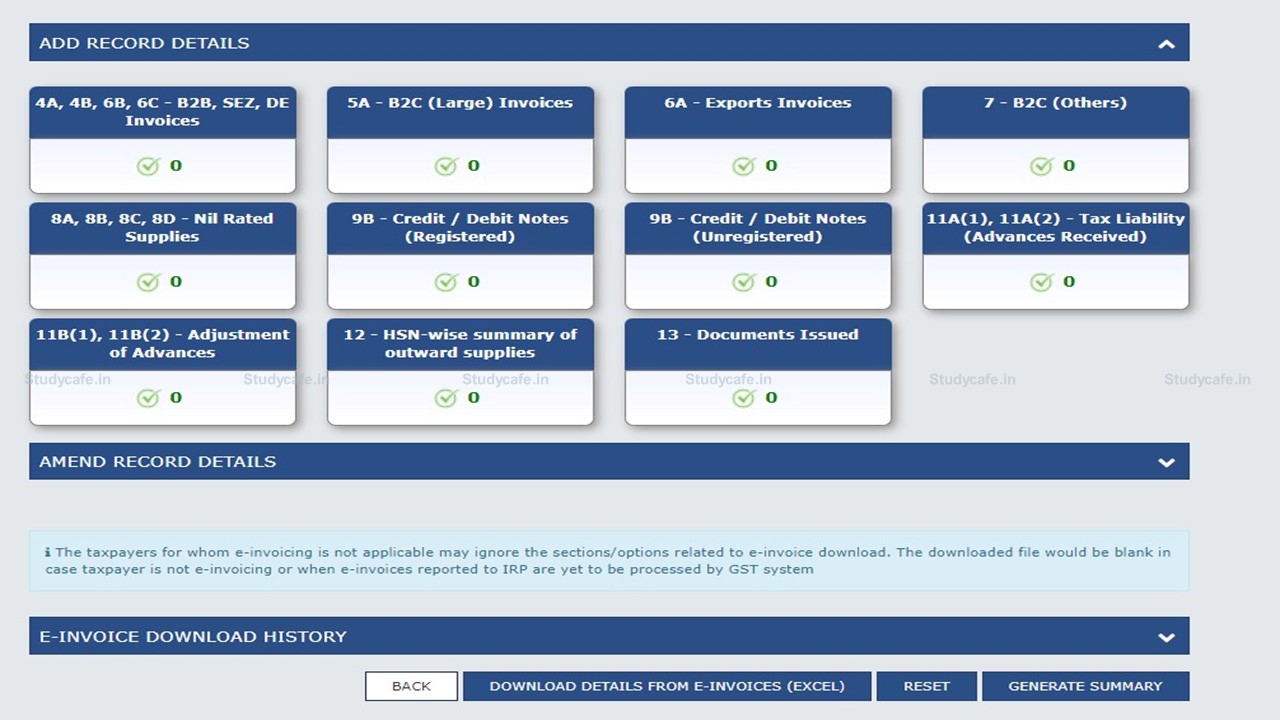

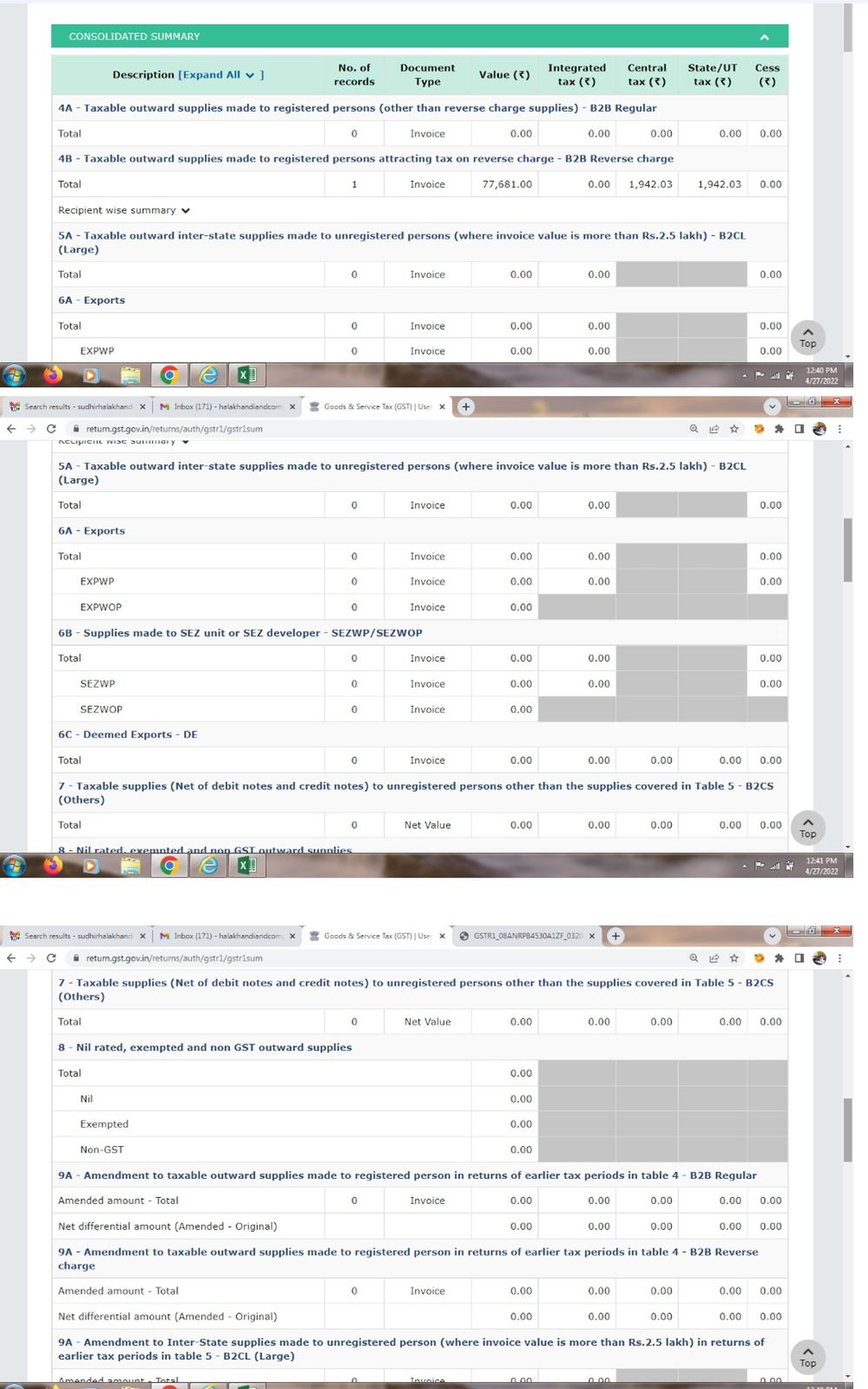

The following images show the most recent update:

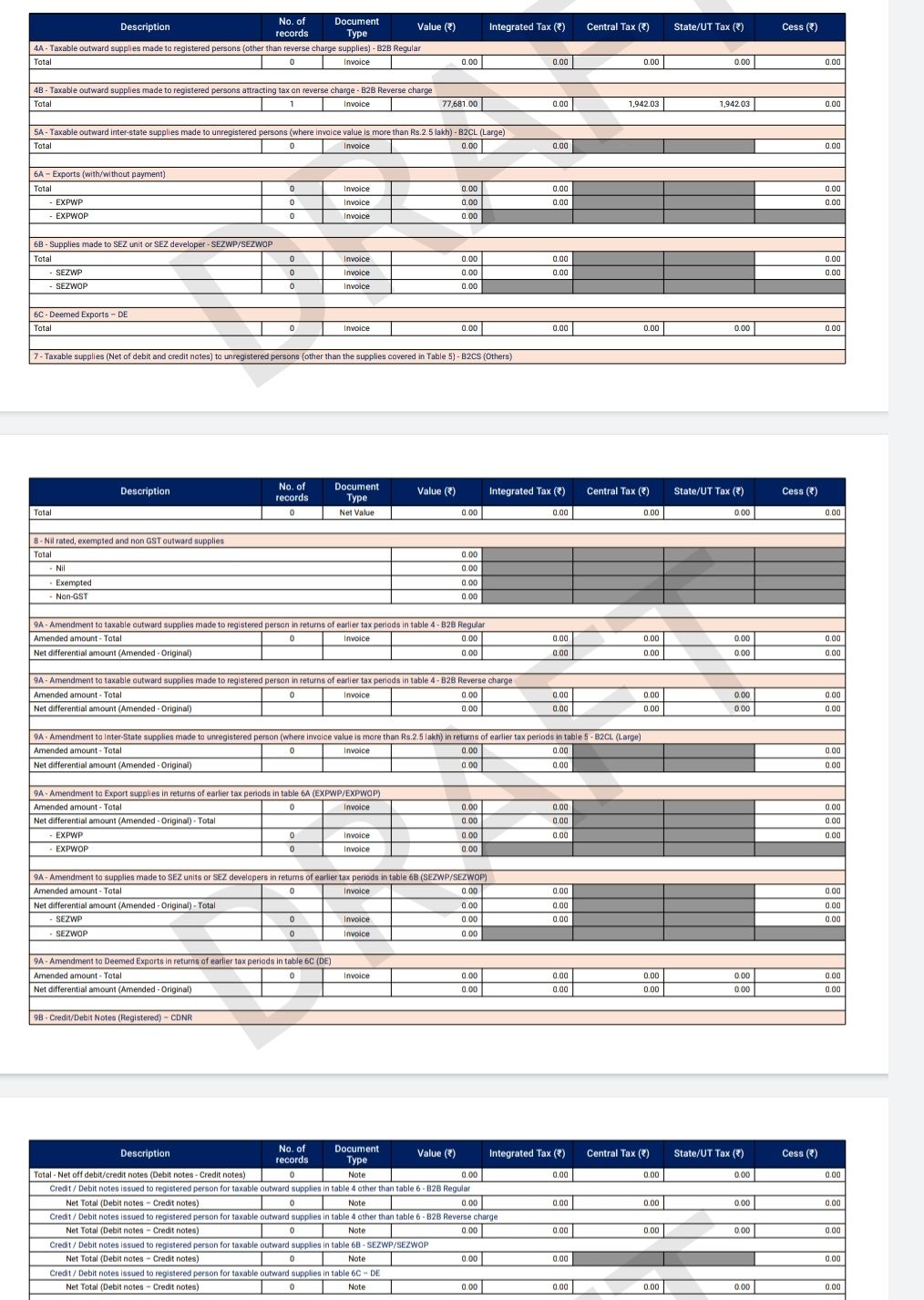

Also Consolidated Expandable Summary view is now available before filing, with all required bifurcations like:

We have the Option to Download it in pdf as well.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"