Deepak Gupta | Oct 5, 2018 |

How to amend B2C Invoice to B2B in GSTR1, how to amend gstr1, how to add missing invoice in gstr 1, how to modify gstr 1 after submission, how to change b2c to b2b in gst, how to rectify a b2b invoice shown as b2c, how to delete invoices in gstr 1, amended b2b invoices in gstr 1, 9a – amended b2b invoices

How to Amend B2C Invoice to B2B in GSTR1 :

As we are aware that September 2018 is last month to avail GST credit for F.Y 2017-18. A common query from taxpayers is what happens if a B2B Invoice is recorded as B2C. This can happen because of any of the following reasons:

1.) Purchaser has not submitted GSTIN .

2.) Purchaser has submitted GSTIN, but it is not recorded in Accounting System

3.) Purchaser has applied for GST Registration, but has still not received GSTIN.

Let’s Assume in the Month of March 2018 B2B invoice has shown to B2C. Total Invoice value was 1180, Taxable Amount was Rs. 1000 and GST 180. Later on we came to know that invoice shown in March 2018 was Actually B2B invoice but by any reason it has been shown to B2C. Therefore we need to amend that B2C invoice to B2B in coming month GSTR1. We can amend that in Oct Month GSTR-1 as well but it is advisable to Amend in Sep 2018 Return so that your customer can also take credit of the invoice otherwise in Oct’2018 return your customer will not be able to take credit as it pertains to F.Y 2017-18.

How to Amend B2C to B2B has been explained below in step by Step process:

1. Login to GST Portal https://gst.gov.in with your user name and password.

2. Go to Return Dashboard and then select GSTR1 for the month we are filing.

3. Under GSTR-1 you will see a option under Table 10 amended B2C(Others). Click on that Option.

4. Select Financial Year, Month and State for which Amendment is Required then click on Amend Details.

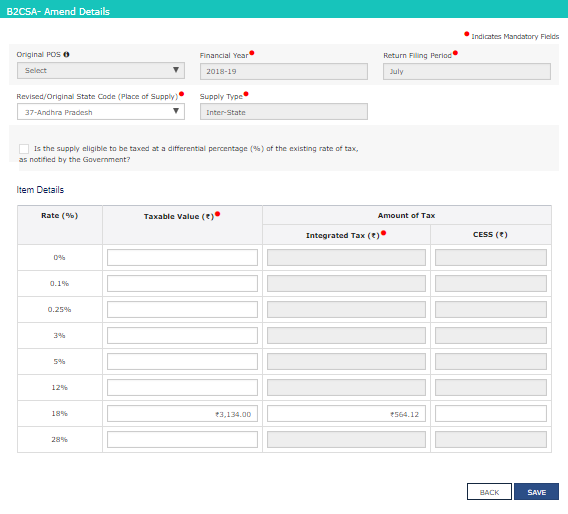

5. Once you click on Amend details below option will come. Here you have to reduce the amount of the invoice and taxable value which needs to be shown as B2B. Now We need to reduce 1000 from the Taxable value and 180 from the Tax part.

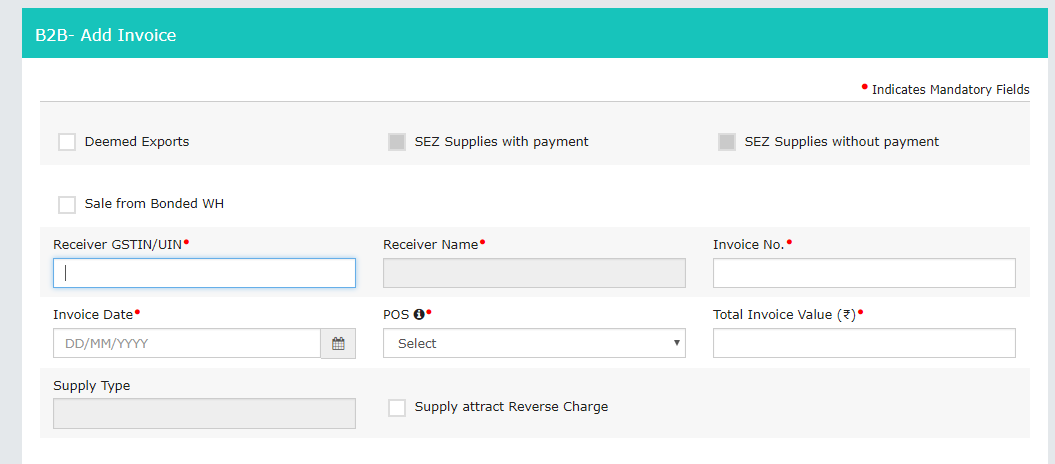

6. Invoice and Taxable Amount Reduced from Table 10 needs to be added under Table 4 Along with Invoice Amount, Invoice date and GSTN details.

Here we need to add mention GSTN, Invoice Number, Invoice Date Total Invoice value i.e 1180 and Taxable Value 1000 and 180 under the Tax part. After Adding all the details of the B2B invoice click on Save. By this way B2C invoices can be amended to B2B invoice. Your total sale value will same by doing this.

You may also refer : How to Amend B2B invoices in GSTR 1

This Article has been Written by CA Deepak Gupta. He Can be reached at gupta.k.deepak@gmail.com.

Disclaimer: The contents of this article are solely for informational purpose. It does not constitute professional advice or recommendation of firm. Neither the authors nor firm and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any information in this document nor for any actions taken in reliance thereon. Readers are advised to consult the professional for understanding applicability of this newsletter in the respective scenarios. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. No part of this document should be distributed or copied (except for personal, non-commercial use) without our written permission.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"