Deepak Gupta | Nov 14, 2018 |

How to Generate TDS Certificate in GST | TDS Certificate under GST, System generated TDS Certificate in GST, tds under gst with example, tds under gst notification, who is liable to deduct tds under gst, how to deduct tds on gst bill, tds on gst notification, gstr 7 applicability, tds rate in gst, tds under gst tax guru, how to deduct tds on gst bill, tds under gst with example, tds on gst notification, tds under gst notification, who is liable to deduct tds under gst, tds rate in gst, tds on gst amount, income tax tds on gst, GST, GST bill, GST tax, taxes under GST, TDS under GST, TDS, tax deducted at source, ClearTax, Goods and Service tax, how to generate TDS Certificate under GST, gstr 7 form download, gstr 7 return format, gstr 7 form pdf, gstr 7 applicability, gstr 7 pdf, how to file gstr 7, gstr 7 notification, gstr 7 return format in excel

How to Generate TDS Certificate in GST | TDS Certificate under GST :

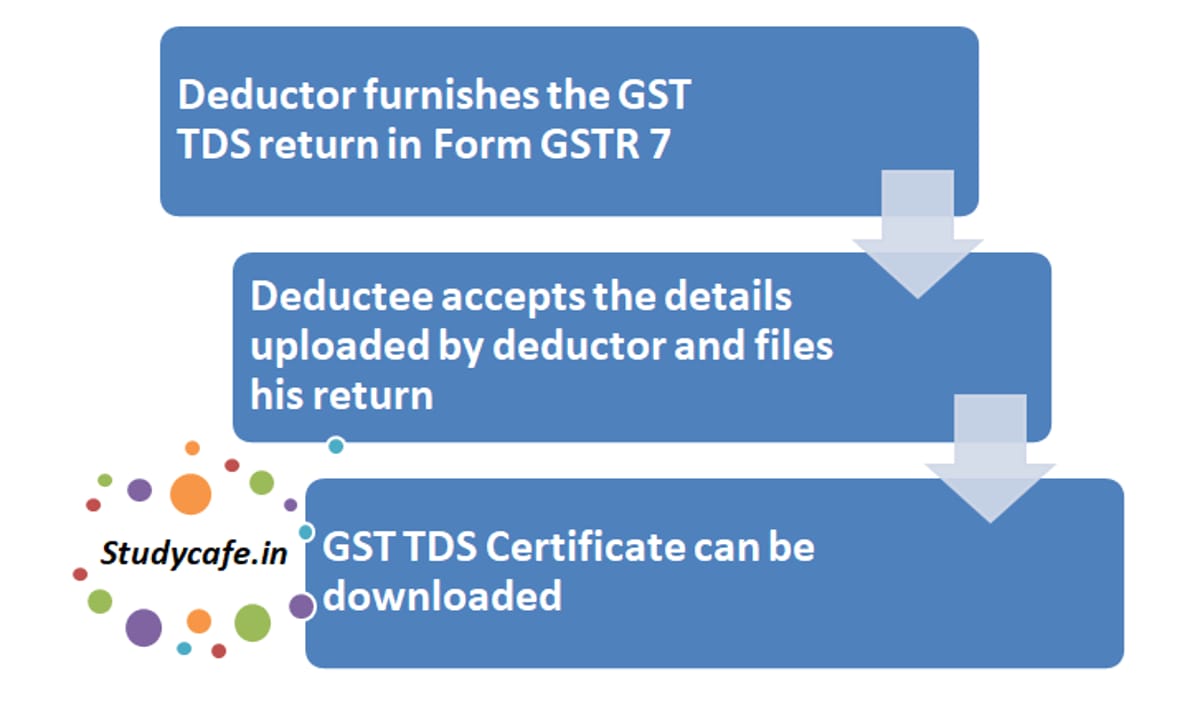

Not many People are aware of the fact that two Conditions are required to be fulfilled for Generation of TDS Certificate in GST.

1. Deductor furnishes a return in Form GSTR 7.

2. Deductee accepts the details uploaded by deductor and files his return.

How to Generate TDS Certificate in GST

Click here to see filling process of GSTR 7

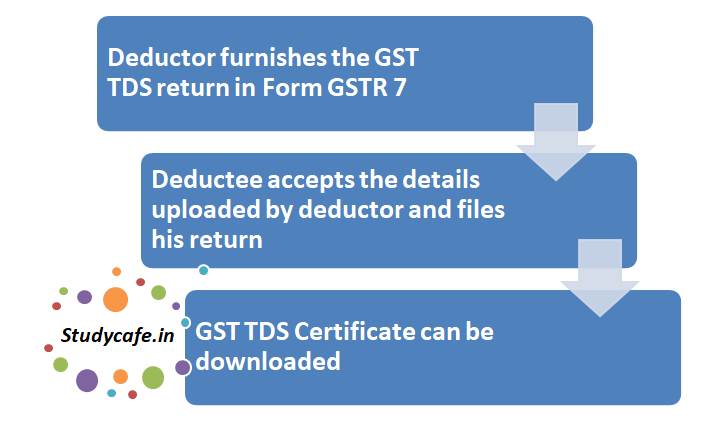

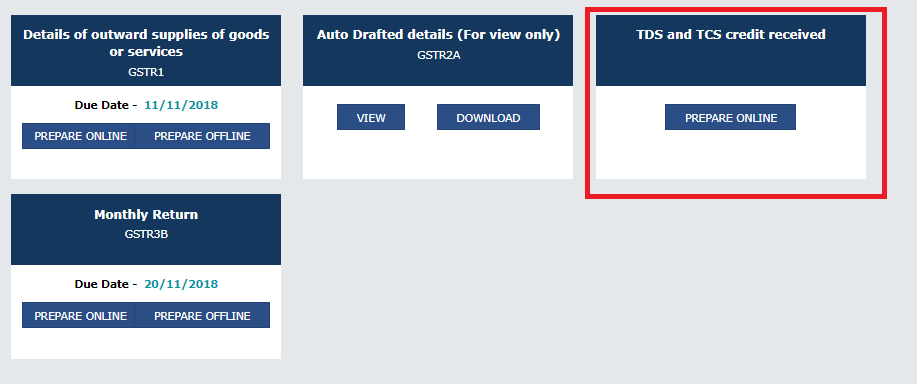

Now many people are confused that how the Deductee will acceptthe TDS Credit received by him. Following process should be followed by the deductee to accept his TDS Credit.

1. He will Login to the GST Portal.

2. Go to File Return TAB

3. Their is the feature of AUTO DRAFTED TDS/TCS DETAILS in File return Tab

4. Click on that Tab. Below mention Screen appears :

5. Now when you click on TDS credit received tab you will get the details of amount for which TDS has been deducted. Deductee is suppose to accept/reject those amount and file the same with the GSTN.

Thus TDS Certificate can only be generated after this complete process.

Points of concern :

Point 1 : As per Section 51(4) of CGST Act 2017

If any deductor fails to furnish to the deductee the certificate, after deducting the tax at source, within five days of crediting the amount so deducted to the Government, the deductor shall pay, by way of a late fee, a sum of one hundred rupees per day from the day after the expiry of such five days period until the failure is rectified, subject to a maximum amount of five thousand rupees.

The due date of filing GSTR 7 is 10th of Next Month and generation of TDS Certificate is 15th of Next Month. Penalty of Rs. 200 (100 for CGST + 100 for SGST) per day subject to maximum of Rs. 10,000 (5,000 for CGST + 5,000 for SGST) is levied on deductor if TDS Certificate is not issued on time.

Thus it is very important for Deductor to furnishes a return in Form GSTR 7 and Deductee to accept the details uploaded by deductor on time.

Point 2 : The TDS credit will be reflected in cash ledger only once when the deductee has Accepted the credit of TDS deducted and deposited by the deductor.

(The Author of this Article can be reached at [email protected])

Disclaimer : The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information . Please refer your consultant before relying on the provisions of this article.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"