The Institute of Chartered Accountants of India (ICAI) has announced a important update for CA Final candidates regarding permanent exemptions in papers.

Reetu | Mar 3, 2025 |

ICAI issued Guidelines for making Exhausted Exemptions Permanent for CA Final May 2025

The Institute of Chartered Accountants of India (ICAI) has announced a important update for CA Final candidates regarding permanent exemptions in papers.

Those candidates who had secured the Exemption in MAY 2023 Examination which was valid till November 2024 Exam, will have the option to make the exemption permanent after declaration of November 2024 Result.

Exemption in any paper/s that has become exhausted upon declaration of the result of immediately succeeding third exam will be shown to the candidates as per dates given in the Important Dates.

The Candidates desirous of making the exhausted exemption permanent will have to apply for the same through their dashboard of SSP.

Candidates will get only ONE chance to make exemption permanent (i.e. exemption secured in MAY 2023 and getting exhausted in November 2024 exam will be shown before the conduct of May 2025 exam as per specified dates and if not made permanent by the candidate during that period then that exemption will lapse forever). Candidates can apply for permanent exemption only once, between March 1, 2025, and March 20, 2025, through their SSP dashboard.

If a candidate has exemptions for two papers in the same group (e.g., papers 1 and 2 of Group-I) available during this window, they must apply for both exemptions permanent or let them lapse. He or she cannot choose to continue the exemption in one paper while allowing it to lapse in the other.

If a candidate is granted a Permanent exemption for any group, he or she must pass the relevant group with at least 50% in each of the remaining papers. Refer to Regulation 38D(8) for the final.

After inputs are taken, there will be no correction or late fee windows.

Candidates will have the option to surrender and re-appear in the permanently exempted paper(s).

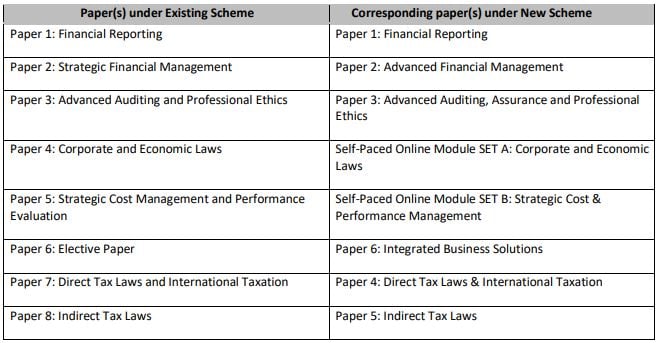

Candidates who obtain an exemption in Paper-4 of the Final exam in May 2022, November 2022, May 2023, or November 2023 will be granted PERMANENT exemption from apprearing in the Self-Paced Module SET-A and will not be required to apply.

Candidates who receive an exemption in Paper-5 of the Final exam in May 2022, November 2022, May 2023, or November 2023 will be granted PERMANENT exemption from appearing in the Self-Paced Module SET-B and will not be required to apply.

If there is a Permanent Exemption (50PE) in a group, then, no new exemption will be granted in that group.

If a candidate chooses to make the exemption permanent after exhausting it, the Exempted Marks will be limited to 50, and extra marks from the permanent exempted paper cannot be used to meet the 50% aggregate marks criterion of the same or other Group.

Candidates are made aware in the announcement dated 24-08-2023 about exemption rules under the transition from old to new scheme.

Candidates who need any clarification can write to – final.exemption@icai.in.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"