Naman Sharma | Jan 17, 2023 |

IGNOU June TEE 2022 Date Sheet: IGNOU June TEE datasheet released; Exam will held in two shifts

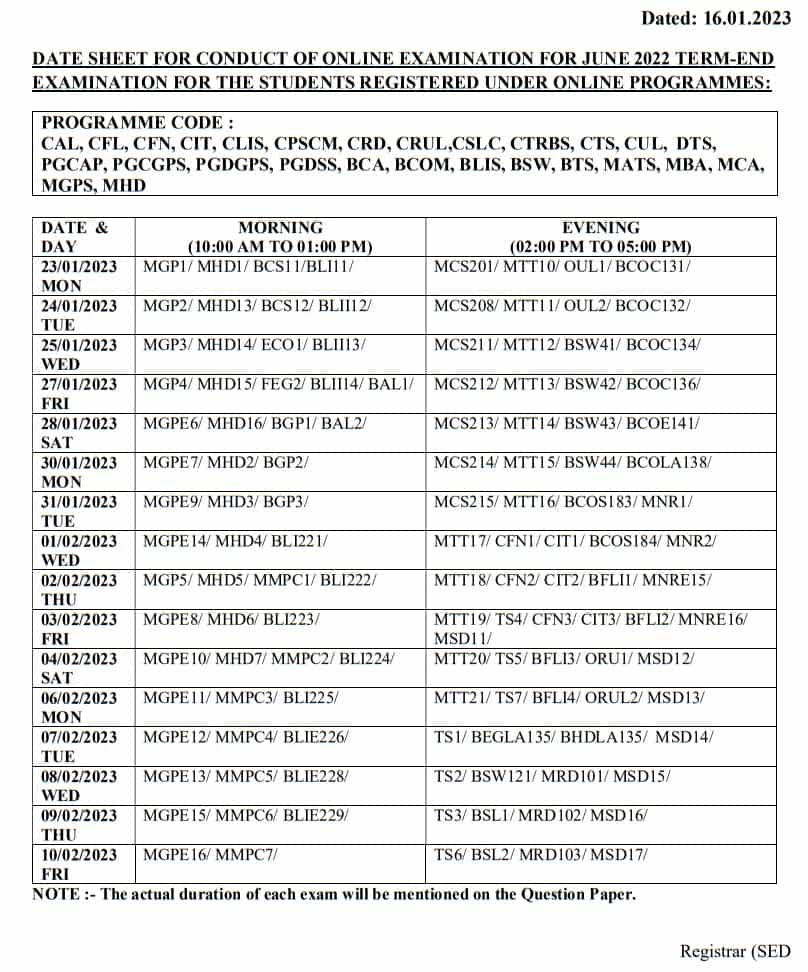

IGNOU June TEE 2022 Date Sheet: The Indira Gandhi National Open University, IGNOU, has released the June 2022 Term-End Examination (TEE) datasheet. All applicants can get the IGNOU June TEE 2022 date sheet from the main site, which is ignou.ac.in.

The IGNOU June TEE 2022-23 exams will be held from January 23 to February 10, 2023. The TEE June 2022 IGNOU will be held in 2 shifts the morning shift from 10 a.m. to 1 p.m. and the afternoon shifts from 2 p.m. to 5 p.m.

The Date sheet is released for these programs: CAL, CFL, CFN, CIT, CLIS, CPSCM, CRD, CRUL, CSLC, CTRBS, CTS, CUL, DTS, PGCAP, PGCGPS, PGDSS, BCA, BCOM, BLIS, BSW, BTS, MATS, MBA, MCA, MGPS, MHD.

Step 1: Visit the official web page at ignou.ac.in.

Step 2: On the homepage, click on the link IGNOU June TEE 2022 date sheet.

Step 3: A new PDF file will open, allowing candidates to check the exam dates.

Step 4: Download the IGNOU date sheet and keep a hard copy for future reference.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"