Prime Minister of both India and Singapore witnessed the launch of a cross-border link between the two using their respective Rapid Payment Systems, i.e, UPI and PayNow.

Reetu | Feb 22, 2023 |

India and Singapore Launch Real-time Payment Systems Link for cross-border Payments

Hon’ble Prime Minister of India, Shri Narendra Modi, and the Hon’ble Prime Minister of Singapore, Mr. Lee Hsien Loong, witnessed the launch of a cross-border link between India and Singapore using their respective Rapid Payment Systems, namely Unified Payments Interface (UPI) and PayNow. The option was inaugurated via token transactions by Reserve Bank Governor Shri Shaktikanta Das and Managing Director of the Monetary Authority of Singapore, Mr. Ravi Menon, via the UPI-PayNow linkage.

India has emerged as one of the fastest-growing ecosystems for fintech innovation. Prime Minister Narendra Modi’s visionary leadership has been instrumental in driving globalisation of India’s best-in-class digital payment infrastructure. A key emphasis of the Prime Minister has been on ensuring that the benefits of UPI are not limited to India only, but other countries too benefit from it. The linkage of these two payment systems would enable residents of both countries in faster and cost-efficient transfer of cross-border remittances. It will also help the Indian diaspora in Singapore, especially migrant workers and students through instantaneous and low cost transfer of money from Singapore to India and vice-versa.

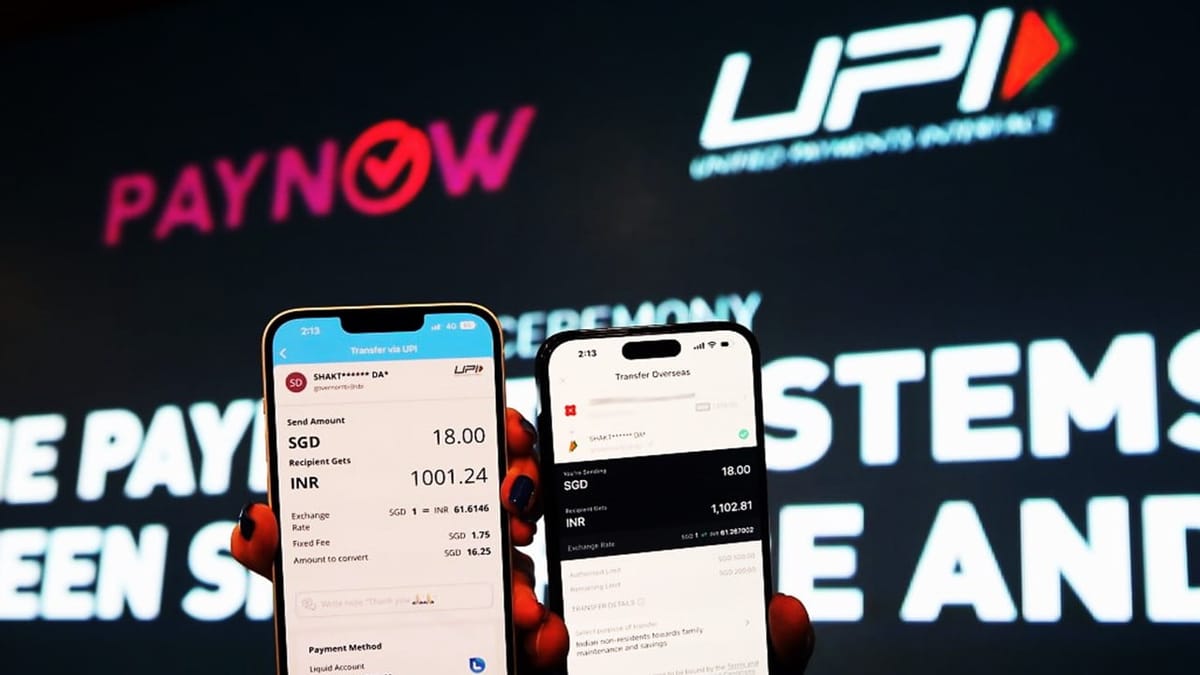

The UPI-PayNow integration will allow users of the two quick payment systems in either nation to send money across borders quickly, securely, and affordably via their respective mobile apps. It is possible to send or receive money from India using only a UPI-id, cellphone number, or Virtual Payment Address for money held in bank accounts or e-wallets (VPA).

Axis Bank and DBS India will initially handle both inbound and outbound remittances, while State Bank of India, Indian Overseas Bank, Indian Bank, and ICICI Bank will handle both. The service will be made available to Singapore users through DBS-Singapore and Liquid Group (a non-bank financial institution). Throughout time, the connectivity will encompass an increasing number of banks.

Customers of the aforementioned participating banks can send money across borders to Singapore by utilising the bank’s internet banking or mobile banking app. An Indian user can initially send up to 60,000 in a single day (equivalent to around SGD 1,000). For the user’s convenience, the system will dynamically calculate and show the amount at the moment of the transaction in both currencies.

The UPI-PayNow linkage is the result of close coordination between the participating banks and non-bank financial institutions, as well as the Reserve Bank of India (RBI), Monetary Authority of Singapore (MAS), and Banking Computer Services Pte Ltd. (BCS), two of the countries’ payment system operators. This interlinkage supports the G20’s financial inclusion aims of promoting quicker, less expensive, and more transparent cross-border payments and will mark an important turning point in the establishment of cross-border payment infrastructure between India and Singapore.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"