ITR filing due date is 31st July 2024. Taxpayers are facing many issues on the income tax portal while filing ITR. Various technical issues are faced by individuals with their income tax and Aadhaar services.

Reetu | Jun 26, 2024 |

ITR Filing Season: What issues Taxpayers are facing on the IT Portal?

The Income tax return filing due date is next month i.e. 31st July 2024. Taxpayers are in the action of filing their ITR before the deadline so that they don’t face any further consequences for late filing of ITR.

However, taxpayers are facing many issues on the income tax portal while filing ITR. Various technical issues are faced by individuals with their income tax and Aadhaar services.

Users mentioned issues with the Income Tax India portal, such as poor performance and technical issues. Some taxpayers reported difficulties verifying their ITRs due to Aadhaar OTP issues.

Both Income Tax India and Aadhaar officials reacted by urging customers to send their information via email or direct messages for further assistance. Tax filers and users are unhappy because the portal does not work properly while submitting and seeking assistance from the Income Tax Department.

Many taxpayers and users are tweeting about their disappointment and irritation on social media, hoping that the tax department will take some action to resolve the issue.

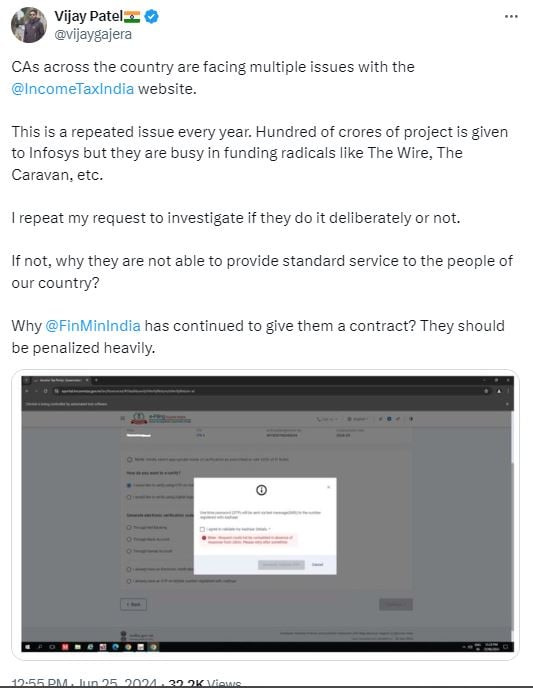

One person wrote, “CAs across the country are facing multiple issues with the @IncomeTaxIndia website. This is a repeated issue every year. Hundred of crores of projects is given to Infosys but they are busy in funding radicals like The Wire, The Caravan, etc. I repeat my request to investigate if they do it deliberately or not. If not, why they are not able to provide standard service to the people of our country? Why @FinMinIndia has continued to give them a contract? They should be penalized heavily.”

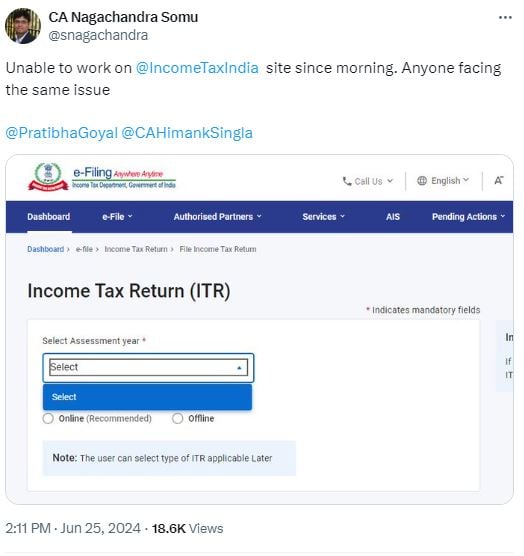

A Chartered Accountant by profession tweeted, “Unable to work on @IncomeTaxIndia site since morning. He also asked if Anyone was facing the same issue.

Other person wrote, “Why don’t @FinMinIndia @IncomeTaxIndia kick out Infy? It’s just beginning of ITR filings for AY 2024-25 and professionals encountering glitches. How long tax-professionals have to do free testing job to an inefficient company? #Incometax”

One user said, “#IncomeTax site down it seems. Unable to access any data in the filing screens. All lists showing as empty. Anyone facing the same issue? @IncomeTaxIndia”

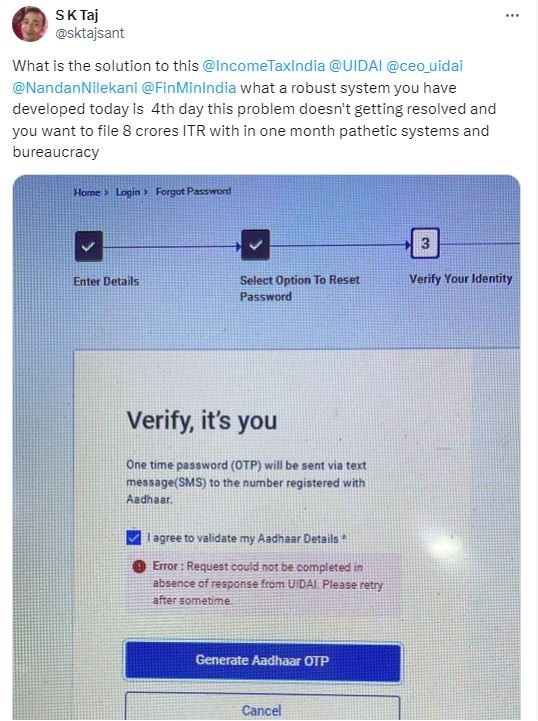

Another user wrote, “What is the solution to this @IncomeTaxIndia @UIDAI @ceo_uidai @NandanNilekani @FinMinIndia what a robust system you have developed today is 4th day this problem doesn’t getting resolved and you want to file 8 crores ITR with in one month pathetic systems and bureaucracy”

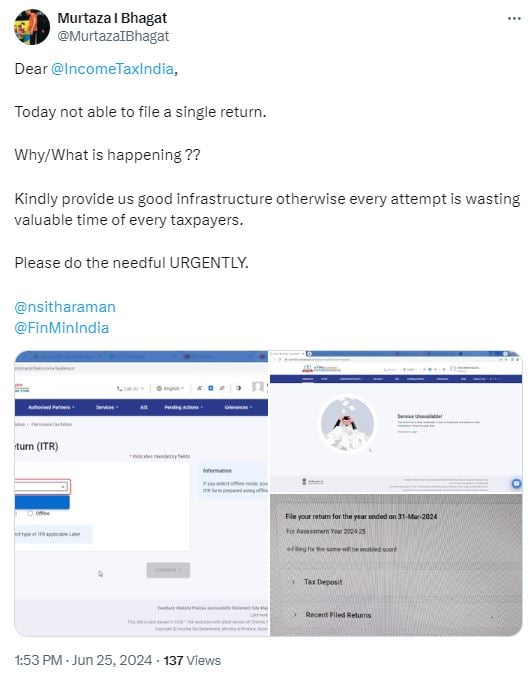

A taxpayer tweeted, “Dear @IncomeTaxIndia, Today not able to file a single return. Why/What is happening ?? Kindly provide us good infrastructure otherwise every attempt is wasting valuable time of every taxpayers. Please do the needful URGENTLY. @nsitharaman @FinMinIndia”

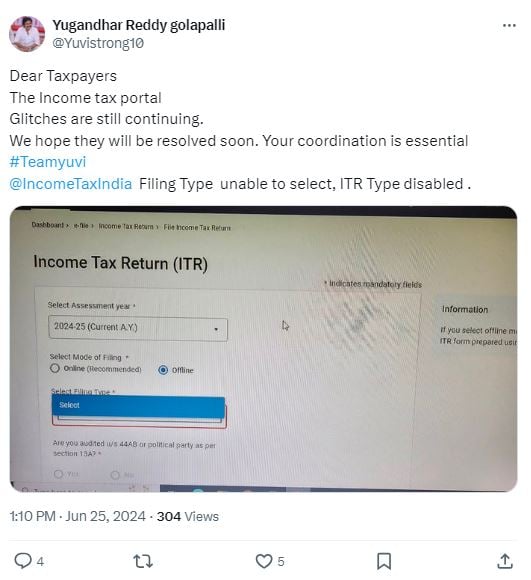

Another taxpayer tweeted, “Dear Taxpayers, The Income tax portal Glitches are still continuing. We hope they will be resolved soon. Your coordination is essential #Teamyuvi @IncomeTaxIndia Filing Type unable to select, ITR Type disabled.”

Various people tweeted about the glitches and issues they are facing currently. We Hope that the department will resolve the issues quickly.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"