Priyanka Kumari | Dec 27, 2023 |

Know all about Special Amnesty Scheme for condoning delay in filing GST Appeal

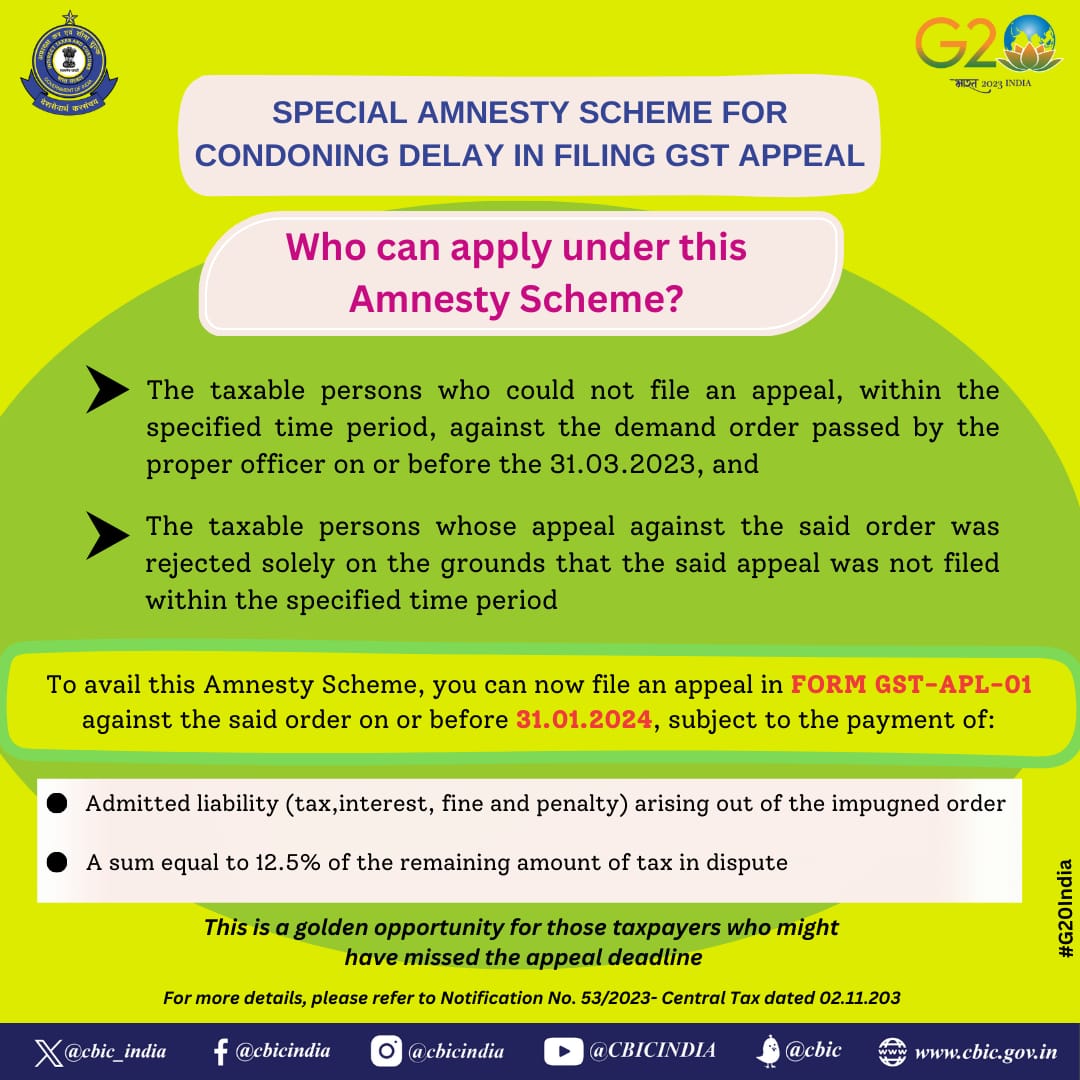

The Central Board of Indirect Taxes and Customs (CBIC) notified a Special Amnesty Scheme for Condoning Delay in Filing GST Appeal.

The special amnesty scheme intends to act as a lifeline to those who did not agree with a GST tax demand order. Those who fail to file their taxes incur charges in the form of late fees as a penalty.

Who can apply under this Scheme?

1. The taxpayers who were unable to submit an appeal within the specified period against the demand order passed by the proper officer on or before 31.03.2023,

2. The taxable individuals whose appeal against the aforementioned order was denied solely because the said appeal was not submitted within the specified period.

To take advantage of this Amnesty Scheme, you must file an appeal in FORM GST-APL-01 against the stated order by 31.01.2024, subject to the payment of:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"