Priyanka Kumari | Feb 9, 2024 |

MSME Sector contributes 29.1% Gross Value Added in India’s GDP

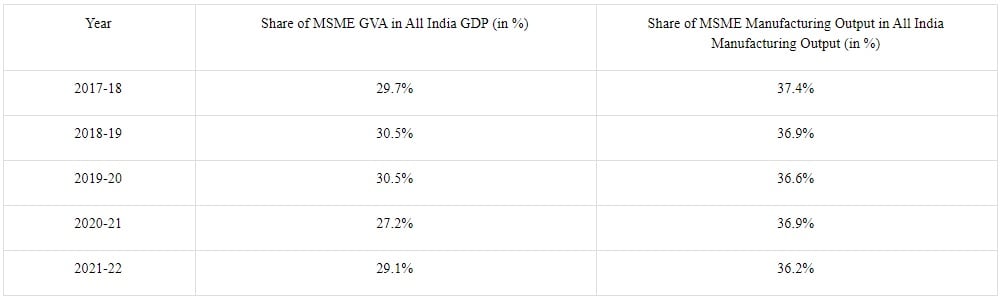

As per the latest information received from the Ministry of Statistics & Programme Implementation, share of MSME Gross Value Added (GVA) in all India GDP and Share of MSME Manufacturing Output in All India Manufacturing Output (in %) are as follows:

The Ministry of Micro, Small, and Medium Enterprises implements a variety of schemes and programmes to support and develop the country’s MSME sector, including credit support, new enterprise development, formalisation, technological assistance, infrastructure development, skill development and training, and market assistance for MSMEs.

MSME Champions Scheme, Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), Prime Minister’s Employment Generation Programme (PMEGP), Micro and Small Enterprises – Cluster Development Programme (MSE-CDP), and Raising and Accelerating MSME Performance (RAMP) are some of the schemes/programmes.

Further Government has taken a number of initiatives to support the MSME Sector. Some of them are:

1. Collateral-free loans up to Rs. 500 lakh (w.e.f. 01.04.23) are available to MSEs with guarantee coverage of up to 85% for various loan categories through the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) under the Credit Guarantee Scheme.

2. Self-Reliant India Fund provides an equity infusion of Rs. 50,000 crore. This project has a Rs.10,000 crore fund from the Government of India.

3. No global tenders for procurement up to Rs. 200 crore.

4. Roll out of Raising and Accelerating MSME Performance (RAMP) programme with an outlay of Rs. 6,000 crore over 5 years..

5. The integration of the Udyam Portal and the Ministry of Labour and Employment’s National Career Service (NCS) allows registered MSMEs to look for job seekers on the NCS.

6. MSMEs received relief under Vivad se Vishwas – I in the form of a return of 95% of the deducted performance security, bid security, and liquidated damages. Relief was also offered to MSMEs excluded from contract execution due to default.

7. Launch of the ‘PM Vishwakarma’ Scheme on September 17, 2023, to support traditional artists and craftspeople in 18 trades.

8. Samadhaan Portal for monitoring of outstanding dues to MSEs from buyers of goods and services w.e.f. 30.10.2017.

The Udyam Registration Portal was launched on 01.07.2020 to facilitate ease of registration for MSMEs and access to all the Schemes and benefits.

The registration process is free of cost, paperless and digital. As of 05.02.2024, more than 3.64 crore MSMEs with an employment of more than 16.86 crore, have registered on Udyam Portal (this includes the Informal Micro Enterprises (IMEs) registered on Udyam Assist Platform (UAP)).

On 11.01.2023, the government also introduced the Udyam Assist Platform to bring informal micro enterprises (IMEs) inside the formal purview of Priority Sector Lending advantages.

The following steps have been taken by the government to promote MSMEs:

Shri Bhanu Pratap Singh Verma, Minister of State for Micro, Small and Medium Enterprises, provided this information in a written reply to the Lok Sabha.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"