Deepak Gupta | May 31, 2017 |

Last Date of STF reporting Extended to 30th June 2017

Last Date of STF reporting has been extended to 30th June 2017, earlier the last date was 31st May,2107.SFT will subsitute the earlier requirement of filing the AIR or Annual Information Report.

STF stand s for Statement of Financial Transaction which needs to be reported in form no. 61A. It is a document for reporting high value transaction. The user guide for reporting STF transaction has been issued by Income tax department. To download the same click here.

The new document for High Value Transactions under STF has to be necessarily filed by different individuals including professionals, financial institutions as well as business set-ups.This STF statement will include information relating to all high-value transactions including cash deposits, property sale or purchase, mutual fund units, debentures, sale of shares etc.

All the business entities and individuals have to do this reporting. Among professionals, doctors, lawyers as well as architects are also required to report high value transactions. The salaried class is excluded from the requirement of filing the STF. Any wrong or misleading information would lead to fine/penalty of Rs. 50,000/- .

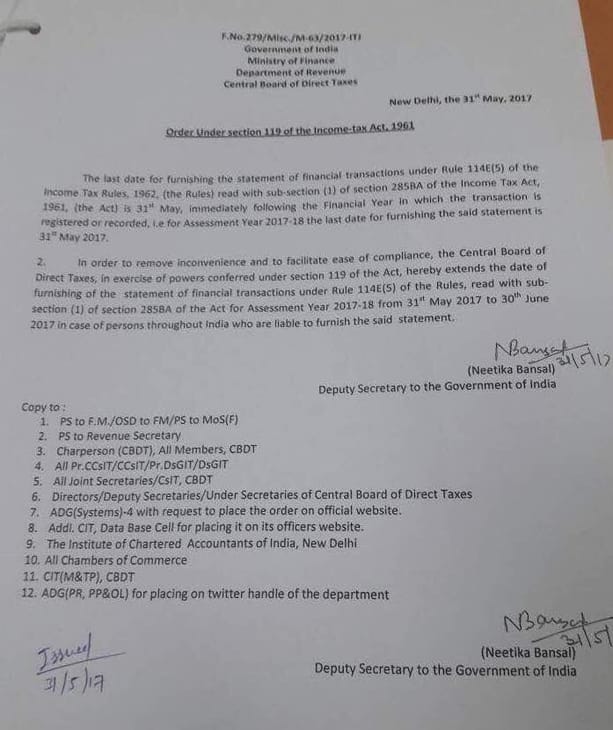

Below is extract official notification.

You may also like :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"