The Ministry of Finance has introduced the Section 43B(h) of Income Tax to ensure timely payment to MSMEs.

Reetu | Feb 9, 2024 |

Late Payment to MSME: Decoding Section 43B(h) of Income Tax

The Ministry of Finance has introduced the Section 43B(h) of Income Tax to ensure timely payment to MSMEs.

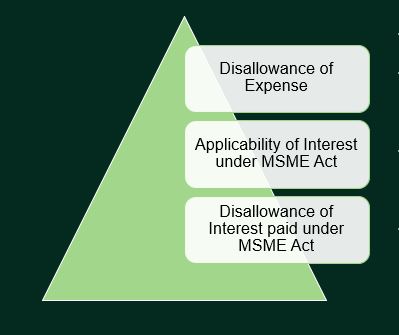

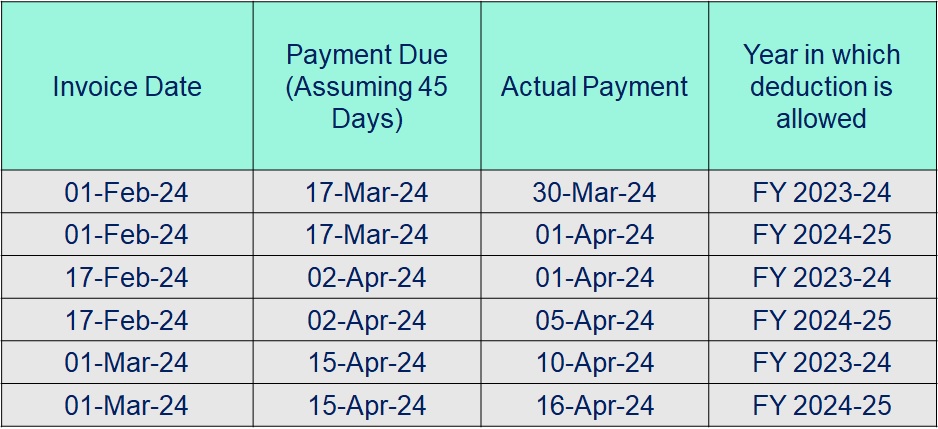

In the Finance Act 2023, the Finance Ministry introduced Section 43B(H), which would ensure payment towards the goods supplied by MSMEs within 45 days. This is as per provisions provided under Section 15 of the MSMED Act, 2006, to ensure prompt payments so that MSMEs will not be affected by delays in any fund flow issues.

Decoding Section 43B(h) of Income Tax Act 1961: Ensuring timely payment to MSMEs

Certain deductions to be only on actual payment

43B. Notwithstanding anything contained in any other provision of this Act, a deduction otherwise allowable under this Act in respect of….

.. (h) any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006) [inserted by the Finance Act, 2023, w.e.f. 1-4-2024]

shall be allowed (irrespective of the previous year in which the liability to pay such sum was incurred by the assessee according to the method of accounting regularly employed by him) only in computing the income referred to in section 28 of that previous year in which such sum is actually paid by him:

Provided that nothing contained in this section [except the provisions of clause (h)] shall apply in relation to any sum which is actually paid by the assessee on or before the due date applicable in his case for furnishing the return of income under sub-section (1) of section 139 in respect of the previous year in which the liability to pay such sum was incurred as aforesaid and the evidence of such payment is furnished by the assessee along with such return.

Liability of buyer to make payment

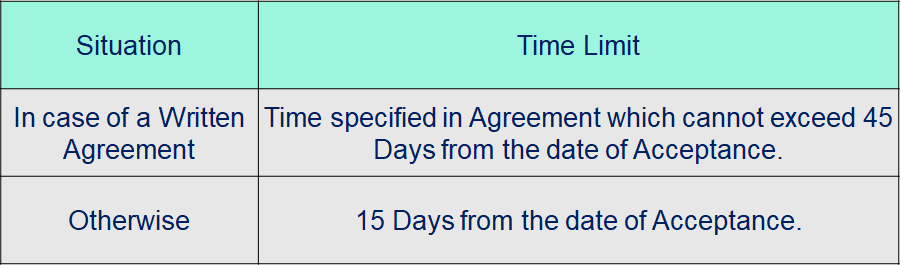

15. Where any supplier, supplies any goods or renders any services to any buyer, the buyer shall make payment therefor on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance.

Definitions.

2(b) “appointed day” means the day following immediately after the expiry of the period of fifteen days from the day of acceptance or the day of deemed acceptance of any goods or any services by a buyer from a supplier.

Explanation.—For the purposes of this clause,—

(i) “the day of acceptance” means,—

(a) the day of the actual delivery of goods or the rendering of services; or

(b) where any objection is made in writing by the buyer regarding the acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier;

(ii) “the day of deemed acceptance” means, where no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of services;

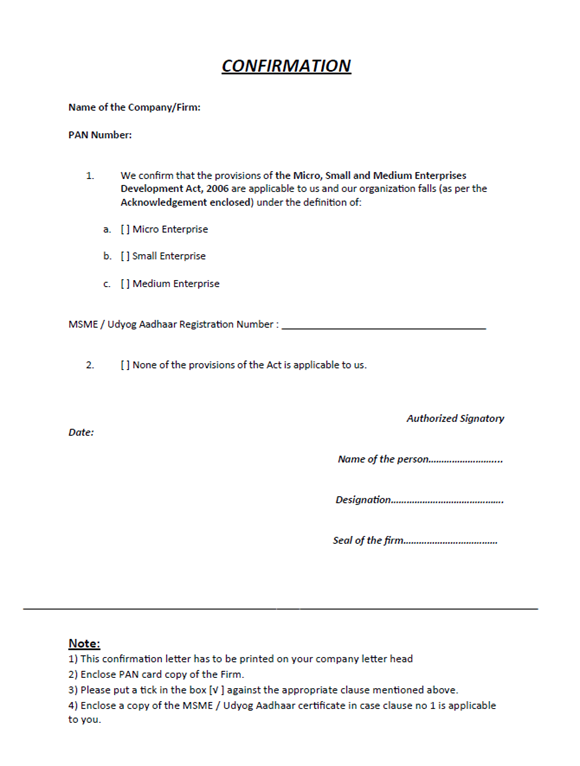

Note: Supplier should be registered on UIDAI Portal for claiming MSME Benefit.

Take annual declarations and perform ageing for the selected list of suppliers on a regular basis.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"