Mergers & Acquisitions- Under Provisions of ITA,1961

FCS DEEPAK P. SINGH | Jun 20, 2022 |

Mergers & Acquisitions- Under Provisions of ITA,1961

Dear Friends,

As you are aware that an organisation in long term on the basis of quality, standard, services ,after sales services etc. recognized by the people. In recent time some organisations have become so big that their reserves are bigger than GDPs of some of small countries. A business entity always try to achieve more and more profit and markets. They are exploring new and emerging markets for their products and services in India as well as abroad. Liberalisation and Globalization have brought all world together and use of modern technologies we are able to trade all over the world. An entity acquires resources, technology, finance, markets , infrastructure ,etc. for its growth through various ways. An entity may enter into new market by Acquisition, acquisition, takeover or business restructuring. Acquisitions and acquisitions are manifestations of an inorganic growth process. While mergers can be defined to mean unification of two players into a single entity, acquisitions are situations where one player buys out the other to combine the bought entity with itself. It may be in form of a purchase, where one business buys another or a management buyout, where the management buys the business from its owners. Further, de-mergers, i.e., the division of a single entity into two or more entities also require being recognized and treated on par with mergers and acquisitions regime.

Mergers and acquisitions are used as instruments of momentous growth and are increasingly getting accepted by Indian businesses as critical tool of business strategy. They are widely used in a wide array of fields such as information technology, telecommunications, and business process outsourcing as well as in traditional business to gain strength, expand the customer base, cut competition or enter into a new market or product segment. Mergers and acquisitions may be undertaken to access the market through an established brand, to get a market share, to eliminate competition, to reduce tax liabilities or to acquire competence or to set off accumulated losses of one entity against the profits of other entity.

Mergers and acquisitions (M&A) in India are near an all-time high, led by more first-time buyers than ever before, accounting for more than 80 per cent of the deals closed in 2020 and 2021—a marked increase from less than 70 per cent through 2017 to 2019.[ This is according to Bain & Company’s new report – India M&A: Acquiring to Transform.]

There were 85 strategic deals valued at more than $75 million in 2021, out of which the percentage of first-time buyers is almost 80 per cent. There were 80 strategic deals valued at more than $75 million in 2020, out of which the percentage of first-time buyers, is 80 per cent. For the years 2020 and 2021, the percentage of first-time buyers is highest compared to the percentage for the years 2017 till 2019.

The nature of deals is more broad-based, including more mid-sized deals ranging from $500 million- $1 billion, compared to the mega $5 billion deals that drove activity in 2017-19. This greater deal momentum has been driven by an accelerated disruption across sectors, and companies are using M&A to transform their businesses for a post-Covid world. Cash reserves and foreign direct investment inflows at their highest-ever levels, availability of private equity (PE) dry powder is resilient, and interest rates are at a low. Armed with this capital, one of the ways companies are responding to disruption and growth expectations is through acquisitions.

THE CONCEPT OF MERGER & AMALGAMANTION UNDER INCOME TAX ACT, 1961

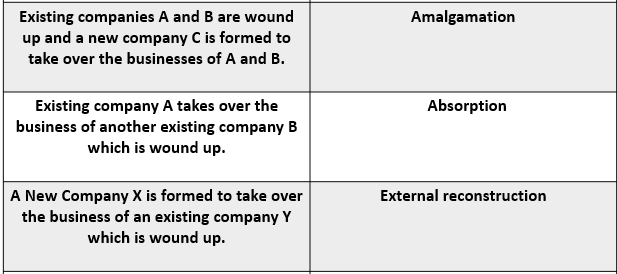

Amalgamation is a blending of two or more existing companies /undertakings into one company/ undertaking. The shareholders of two blending companies substantially become shareholders of the blended company. There will be an Amalgamation ,when two or more companies/undertakings are acquired by a new company.

WHY COMPANIES AMALGAMATE OR MERGED

UNDER INCOME TAX ACT, 1961 SECTION 2(1B) OF INCOME TAX ACT defines ‘Amalgamation’ as merger of one or more companies with another company or merger of two or more companies to form one company in such a manner that:-

INVESTOPEDIA: an amalgamation is a combination of two or more companies into a new entity. Amalgamation is distinct from a merger because neither company involved survives as a legal entity. Instead, a completely new entity is formed to house the combined assets and liabilities of both companies.

The term amalgamation has generally fallen out of popular use in the United States, being replaced with the term’s merger or consolidation even when a new entity is formed. But it is still commonly used in countries such as India.

KEY TAKEAWAYS:

A MERGER: is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies’ complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company’s reach, expand into new segments, or gain market share. All of these are done to increase shareholder value. Often, during a merger, companies have a no-shop clause to prevent purchases or mergers by additional companies.

KEY TAKEAWAYS:

Mergers are a way for companies to expand their reach, expand into new segments, or gain market share.

A merger is the voluntary fusion of two companies on broadly equal terms into one new legal entity.

The five major types of mergers are conglomerate, congeneric, market extension, horizontal, and vertical.

LET’S UNDERSTAND

TYPES OF MERGERS

THE DIFFERENT TYPES OF MERGERS IN INDIA ARE AS FOLLOWS:

1.HORIZONTAL MERGER: A Horizontal Merger takes place between the companies dealing with similar products. The purpose of merger is to reduce competition, acquire a dominant market position, and expand the market reach. For example, Mergers of Brooke Bond and Lipton India; Hindustan Unilever and Patanjali.

2. VERTICAL MERGER -The main aim of a vertical merger is to combine two companies which deal in the same types of products. However, the stages of production at which they are operating are different. For example, Reliance Industries and FLAG Telecom group.

3. CO-CENTRIC MERGERS – The term Co-centric Merger denotes that the organisations serve the same type of customers. In this case, the products and services of both companies complement each other even if they are entirely different. For example, Axis Bank acquiring Freecharge; Citi Group acquiring Salomon Smith Barney; Flipkart acquiring Walmart India.

4. CONGLOMERATE MERGERS – When two or more unrelated industries/ companies merge with each other, it is termed as Conglomerate Mergers. The aims and objectives of both companies are completely different from each other. However, the main purpose of this type of merger is to boost business in terms of operations, profits and size. For example, Voltas Ltd and L&T.

5.CASH MERGERS- When the shareholders are offered cash in place of the shares of the newly formed company, it is known as Cash Mergers.

6.FORWARD MERGERS– When a company chooses to merge with its customers, it is known as Forward Merger. For example, ICICI Bank acquired Bank of Mathura.

7. REVERSE MERGERS – In Reverse Mergers, a company decides to merge with its suppliers. For example, Gujarat Godrej Innovative Chemicals acquired Godrej soap.

TYPES OF AMALGAMATIONS

The two main types of amalgamation are amalgamation in the nature of a merger and amalgamation in the nature of a purchase. To understand both these types in detail let us go through them one by one.

2. AMALGAMATION IN THE NATURE OF A PURCHASE –If the shareholders of the transferor company fail to meet the minimum requirements and conditions, then they cannot retain their positionin the new entity and the amalgamation process takes place like a purchase which is made by the stronger transferee company wherein only the shareholders of the transferee company become shareholders in the new entity.

When the conditions for the amalgamation in the nature of merger are not satisfied, the same is termed as Amalgamation in the Nature of Purchase. In this method, a transferor company acquires a transferee company and the shareholders of the transferee company do not have any proportionate shareholding in the amalgamated company.

Although both these types seem fairly similar, it is important to differentiate them and know the difference because both the types need different methods of accounting.

TRANSACTIONS NOT TREATED AS AMALGAMATION Section 2(1B)specifically provides that in the following two cases there is no “ amalgamation” for the purpose of Income Tax through element of “ Merger” exists;

a). where property of one company which merges sold to the other company and merger is a result of transaction of sale;

b). where company which merges is wound up in liquidation and the liquidator distributes its property to other company.

THE VALUATION OF ASSETS TRANSFERRED IN THE SCHEME OF “ AMALGAMATION”

WHEN A CAPITAL ASSET( Other than Block of Assets ) IS TRANSFERRED[Explanation 7 of Section 43(1)– when an asset is transferred in a scheme of amalgamation , to an India Company, the Actual Cost of transferred asset will be taken to be same as it would have been if the amalgamating company had continued to hold the capital asset for the purpose of its own business.

SECTION (14) – OF ITA ,1961 – CAPITAL ASSET” means property of any kind held by an assessee, whether or not connected with his business or profession, but does not include-

(i) any stock- in- trade, consumable stores or raw materials held for the purposes of his business or profession;

(ii) For personal effects, that is to say, movable property (including wearing apparel and furniture, but excluding jewellery) held for personal use by the assessee or any member of his family dependent on him.

Explanation.- For the purposes of this sub- clause,” jewellery” includes-

(a) ornaments made of gold, silver, platinum or any other precious metal or any alloy containing one or more of such precious metals, whether or not containing any precious or semiprecious stone, and whether or not worked or sewn into any wearing apparel;

(b) precious or semi- precious stones, whether or not set in any furniture, utensil or other article or worked or sewn into any wearing apparel;

(iii) agricultural land in India, not being land situate-

(a) in any area which is comprised within the jurisdiction of a municipality (whether known as a municipality, municipal corporation, notified area committee, town area committee, town committee, or by any other name) or a cantonment board and which has a population of not less than ten thousand according to the last preceding census of which the relevant figures have been published before the first day of the previous year; or

(b) in any area within such distance, not being more than eight kilometres, from the local limits of any municipality or cantonment board referred to in item (a), as the Central Government may, having regard to the extent of, and scope for, urbanisation of that area and other relevant considerations, specify in this behalf by notification in the Official Gazette;

(iv) 6 1/2 per cent Gold Bonds, 1977 , or 7 per cent Gold Bonds, 1980 , or National Defence Gold Bonds, 1980 , issued by the Central Government;

(V) Special Bearer Bonds, 1991 , issued by the Central Government.

SECTION 43 (1) ” actual cost” means the actual cost of the assets to the assessee, reduced by that portion of the cost thereof, if any, as has been met directly or indirectly by any other person or authority:

Explanation 7– Where, in a scheme of amalgamation, any capital asset is transferred by the amalgamating company to the amalgamated company and the amalgamated company is an Indian company, the actual cost of the transferred capital asset to the amalgamated company shall be taken to be the same as it would have been if the amalgamating company had continued to hold the capital asset for the purposes of its own business.

2. WHEN A BLOCK OF ASSET IS TRANSFERRED [ Explanation 2 to Section 43(6)]-where in any previous year Block of Assets is transferred in a scheme of Amalgamation by an amalgamating company to the amalgamated company , then Actual Cost of Block of Assets in case of amalgamating company will be the Written Down Value of Block of Assets as in case of amalgamating company for the immediately preceding year as reduced by the amount of depreciation actually allowed in relation to the said previous year.

PLEASE NOTE THAT This rule is applicable only when the amalgamating company is an Indian Company.

Section 43(6) in The Income- Tax Act, 1995 ” written down value” means-

Explanation 2.- Where in any previous year, any block of assets is transferred,-

(a) by a holding company to its subsidiary company or by a subsidiary company to its holding company and the conditions of clause (iv) or, as the case may be, of clause (v) of section 47 are satisfied; or

(b) by the amalgamating company to the amalgamated company in a scheme of amalgamation, and the amalgamated company is an Indian company, then, notwithstanding anything contained in clause (1), the actual cost of the block of assets in the case of the transferee- company or the amalgamated company, as the case may be, shall be the written down value of the block of assets as in the case of the transferor- company or the amalgamating company for the immediately preceding previous year as reduced by the amount of depreciation actually allowed in relation to the said preceding previous year.

TAX RELIEF’S AND BENEFITS IN CASE OF AMALGAMATION

If an amalgamation takes place within the meaning of section 2(1B) of the Income Tax Act, 1961, the following tax reliefs and benefits shall available:-

TAX RELIEF TO THE AMALGAMATING COMPANY:

i) EXEMPTION FROM CAPITAL GAINS TAX [Sec. 47(vi)] : Under section 47(vi) of the Income-tax Act, capital gain arising from the transfer of assets by the amalgamating companies to the Indian Amalgamated Company is exempt from tax as such transfer will not be regarded as a transfer for the purpose of Capital Gain.

Below mentioned two conditions must be satisfied;

a). the scheme of amalgamation satisfies the conditions of Section 2(1B) ; and

b). the amalgamated company is an Indian Company.

SECTION 47- of Income Tax Act, 1961

Nothing contained in section 45 shall apply to the following transfers :— (vi) any transfer, in a scheme of amalgamation, of a capital asset by the amalgamating company to the amalgamated company if the amalgamated company is an Indian company;

ii) EXEMPTION FROM CAPITAL GAINS TAX IN CASE OF INTERNATIONAL RESTRUCTURING [Sec. 47(via)] Under Section 47(via), in case of amalgamation of foreign companies, transfer of shares held in Indian company by amalgamating foreign company to amalgamated foreign company is exempt from tax, if the following two conditions are satisfied:

a). Shares in Indian company are held by foreign company;

b). The business of above foreign company (including Share of Indian Company) is taken by another foreign company in a scheme of amalgamation.

b). At least twenty-five(25) per cent of the shareholders of the amalgamating foreign company continue to remain shareholders of the amalgamated foreign company;

b). Such transfer does not attract tax on capital gains in the country, in which the amalgamating company is incorporated.

SECTION 47- provides that

Nothing contained in section 45 shall apply to the following transfers :—

(via) any transfer, in a scheme of amalgamation, of a capital asset being a share or shares held in an Indian company, by the amalgamating foreign company to the amalgamated foreign company, if—

(a) at least twenty-five per cent of the shareholders of the amalgamating foreign company continue to remain shareholders of the amalgamated foreign company, and

(b) such transfer does not attract tax on capital gains in the country, in which the amalgamating company is incorporated;

iii) ALLOTMENT OF SHARES IN AMALGAMATED COMPANY TO THE SHAREHOLDERS OF AMALGAMATING COMPANY [SECTION 47(Vii)& 49(2)] any transfer by a shareholder in a scheme of amalgamation of shares held by him in the amalgamating company shall not be regarded as transfer if –

a). transfer is made in consideration of allotment to him of shares in the amalgamated company; and

b). amalgamated company is an Indian company.

Section 49(2)-provides that in above case the Cost of Shares of the amalgamating company shall be Cost of Shares to the amalgamated company.

SECTION 47(Vii) of Income Tax Act– any transfer by a shareholder, in a scheme of amalgamation, of a capital asset being a share or shares held by him in the amalgamating company if-

(a) the transfer is made in consideration of the allotment to him of any share or shares in the amalgamated company, and

(b) the amalgamated company is an Indian company.

SECTION 49(2) OF IT ACT– Where the capital asset being a share or shares in an amalgamated company which is an Indian company became the property of the assessee in consideration of a transfer referred to in clause (vii) of section 47, the cost of acquisition of the asset shall be deemed to be the cost of acquisition to him of the share or shares in the amalgamating company.

SECTION 49(1e) OF IT ACT-

(1) Where the capital asset became the property of the assessee—

(i) on any distribution of assets on the total or partial partition of a Hindu undivided family;

(ii) under a gift or will;

(iii) (a) by succession, inheritance or devolution, or

(b) on any distribution of assets on the dissolution of a firm, body of individuals, or other association of persons, where such dissolution had taken place at any time before the 1st day of April, 1987, or

(c) on any distribution of assets on the liquidation of a company, or

(d) under a transfer to a revocable or an irrevocable trust, or

(e) under any such transfer as is referred to in clause (iv) or clause (v) or clause (vi) or clause (via) or clause (viaa) or clause (viab) or clause (vib) 71[or clause (vic)] or clause (vica) or clause (vicb) or clause (vicc) or clause (xiii) or clause (xiiib) or clause (xiv) of section 47.

PLEASE NOTE THAT:

To find out whether or not the shares in the amalgamated company are long-term capital asset or not, the period of holding shall be determined from the date of acquisition of shares in the, amalgamating company.

The indexation for calculating Capital Gain Tax will start from the date of acquisition of shares in the amalgamating company.

If besides shares in amalgamated company the shareholders of amalgamating company are allotted something more , says bonds or cash etc., in consideration of transfer of their shares in the amalgamating company , then the shareholders cannot get benefit under Section 47(vii) and such transfer shall be chargeable to Capital Gains[ CIT Vs. Gautam Sarabhai Trust(1988)173 ITR216 Guj.]

iv) CONSEQUENCE IF CAPITAL ASSETS ARE TRANSFERRED AS STOCK-IN TRADE[ Section 43C];

Special provision for computation of cost of acquisition of certain assets SECTION 43C;

(1) Where an asset [not being an asset referred to in subsection (2) of section 45] which becomes the property of an amalgamated company under a scheme of amalgamation, is sold after the 29th day of February, 1988, by the amalgamated company as stock-in-trade of the business carried on by it, the cost of acquisition of the said asset to the amalgamated company in computing the profits and gains from the sale of such asset shall be the cost of acquisition of the said asset to the amalgamating company, as increased by the cost, if any, of any improvement made thereto, and the expenditure, if any, incurred, wholly and exclusively in connection with such transfer by the amalgamating company.

(2) Where an asset [not being an asset referred to in sub-section (2) of section 45] which becomes the property of the asaessee on the total or partial partition of a Hindu undivided family or under a gift or will or an irrevocable trust, is sold, after the 29th day of February, 1988, by the assessee as stock-in-trade of the business carried on by him, the cost of acquisition of the said asset to the assessee in computing the profits and gains from the sale of such asset shall be the cost of acquisition of the said asset to the transferor or the donor, as the case may be, as increased by the cost, if any, of any improvement made thereto, and the expenditure, if any, incurred, wholly and exclusively in connection with such transfer (by way of effecting the partition, acceptance of the gift, obtaining probate in respect of the will or the creation of the trust), including the payment of gift-tax, if any, incurred by the transferor or the donor, as the case may be.”.

THE provisions of Section 43C are applicable to the following cases of revaluation;

Where Stock-in-trade of the amalgamating company is taken over at revalued price by the amalgamated company under scheme of amalgamation;

Where a capital asset of the amalgamating company is taken over as Stock-in trade by the amalgamated company after revaluation under scheme of amalgamation.

Let’s understand through an example: ABC Ltd., has purchased an immovable property on April 6, 1984 for Rs. 2.00 Lakhs and spend Rs. 1.00 Lakh for making some alterations. This asset is later transferred to XYZ Ltd., which is mainly dealing in immovable properties ,at Rs. 3.50 Lakhs in a scheme of amalgamation. XYZ Ltd., sells the stock-in trade for Rs. 5.00 Lakhs on May 6, 2019 . The business income of XYZ Ltd., will be Rs. 2.00 Lakhs [5.00 Lakhs-Rs. 2.00 Lakhs -Rs. 1.00 Lakhs].

TAX RELIEF TO THE SHAREHOLDERS OF AN AMALGAMATING COMPANY:

i) Exemption from Capital Gains Tax [Sec 47(vii)] Under section 47(vii) of the Income-tax Act, capital gains arising from the transfer of shares by a shareholder of the amalgamating companies are exempt from tax as such transactions will not be regarded as a transfer for capital gain purpose, if:

a). The transfer is made in consideration of the allotment to him of shares in the amalgamated company; and

b). Amalgamated company is an Indian company.

TAX RELIEF TO THE AMALGAMATED COMPANY:

A) Carry Forward and Set Off of Accumulated loss and unabsorbed depreciation of the amalgamating company [Sec. 72A]: Section 72A of the Income Tax Act, 1961 deals with the mergers of the sick companies with healthy companies and to take advantage of the carry forward of accumulated losses and unabsorbed depreciation of the amalgamating company. But the benefits under this section with respect to unabsorbed depreciation and carry forward losses are available only if the followings conditions are fulfilled:-

There should be an amalgamation of –

(a) a company owning an industrial undertaking (Note 1) or ship or a hotel with another company, or

(b) a banking company referred in section 5(c) of the Banking Regulation Act, 1949 with a specified bank (Note 2), or

(c) one or more public sector company or companies engaged in the business of operation of aircraft with one or more public sector company or companies engaged in similar business.

Note 1. The term ‘Industrial Undertaking’ shall mean any undertaking engaged in :

Note 2.

B). The amalgamated company should be an Indian Company.

C.) The amalgamating company should be engaged in the business, in which the accumulated loss occurred or depreciation remains unabsorbed, for 3 years or more.

D). The amalgamating company should hold continuously as on the date of amalgamation at least three-fourth of the book value of the fixed assets held by it two years prior to the date of amalgamation.

E). The amalgamated company holds continuously for a minimum period of five years from the date of amalgamation at least three-fourths in the book value of fixed assets of the amalgamating company acquired in a scheme of amalgamation

F). The amalgamated company continues the business of the amalgamating company for a minimum period of five years from the date of amalgamation.

G). The amalgamated company fulfils such other conditions as may be prescribed to ensure the revival of the business of the amalgamating company or to ensure that the amalgamation is for genuine business purpose.

H). The amalgamated company , which has acquired an industrial undertaking of the amalgamating company by way of amalgamation , shall achieve the level of production of at least 50% of the installed capacity of the said undertaking before end of four years from the date of amalgamation and continue to maintain the said minimum level of production till the end of five years from the date of amalgamation. The Central Government may relax above condition in desired situations.

I). The amalgamated company shall electronically furnish to the AO a certificate in Form 62 duly verified by an accountant , with reference to the books of account and other documents showing particulars of production along with the return of income for the AY relevant to FY falling within a period of five years from the date of amalgamation.

The requirements of furnishing Form 62 will arise for the first time only when amalgamated company fulfils conditions of achieving level of production of 50% of installed capacity of undertaking of amalgamating company within four years period.

CONSEQUENCES WHEN ABOVE CONSIDITIONS ARE SATISFIED – if the above conditions are satisfied then accumulated business loss and unabsorbed depreciation of the amalgamating company shall be deemed to be business loss and unabsorbed depreciation of the amalgamated company for the previous year in which amalgamation is affected.

CONSEQUENCES WHEN ABOVE MENTIONED CONDISTIONS ARE NOT SATISFIED AFTER ADJUSTING BUSINESS LOSS/ DEPRECIATION – in case above specified conditions are not fulfilled then that part of brought forward loss and unabsorbed depreciation which has been setoff by amalgamated company shall be treated as income of the amalgamated company for the year in which failure to fulfil above conditions occurred.

PLEASE NOTE THAT

CONCLUSION: we are recovering from COVID-19 pandemic era in which whole world has stopped due to deadly COVID-19 virus and business activities have also been at hold. The business houses are starting their activities of merger and acquisitions. The government has also taken various steps to promote development of business enterprises in India. There are various promotional schemes started by the government in various laws, such as FEMA, Income Tax Act, GST, Securities Act etc. The government has also given emphasis on ease of doing business. The government has also increase FDI limits in various sectors and ease FEMA Rules and regulations. The foreign companies are investing in India and establishing their manufacturing hubs. The Merger and Amalgamation activities have given various exemptions in Income Tax Act,1961 on fulfilments of all specified conditions.

DISCLAIMER : the article presented here is only for sharing information and knowledge with the readers. The views are personal and shall not be considered as professional advice. In case of necessity do consult with tax consultants.

References:

https://swaritadvisors.com/merger-and-amalgamation

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"