CA Pratibha Goyal | May 8, 2023 |

Ministry of Finance revises monetary limit for adjudication under FEMA, 1999

The Notification Number S.O. 2128(E) date the 8th May, 2023 reads as follows:

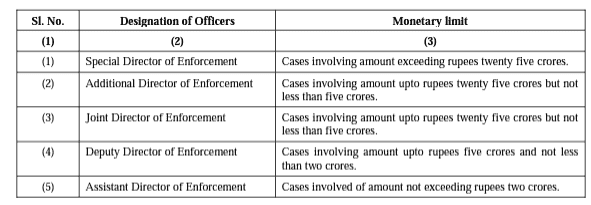

In exercise of the powers conferred by section 16 of the Foreign Exchange Management Act, 1999 (42 of 1999) and in supersession of the notification of the Government of India in the Ministry of Finance, Department of Revenue, published in the Gazette of India, Extraordinary, Part-II, section-3, sub-section(ii) vide number S.O. 4990(E), dated the 27th September 2018, except as respects things done or omitted to be done before such supersession, the Central Government hereby appoints the following officers of the Directorate of Enforcement specified in Column(2) of the Table below as the Adjudicating Authorities for holding an inquiry in the manner prescribed after giving a reasonable opportunity of being heard for the purpose of imposing any penalty under section 13 of the said Act, involving an amount or value as specified in column (3) of the said Table.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"