CA Pratibha Goyal | Mar 13, 2024 |

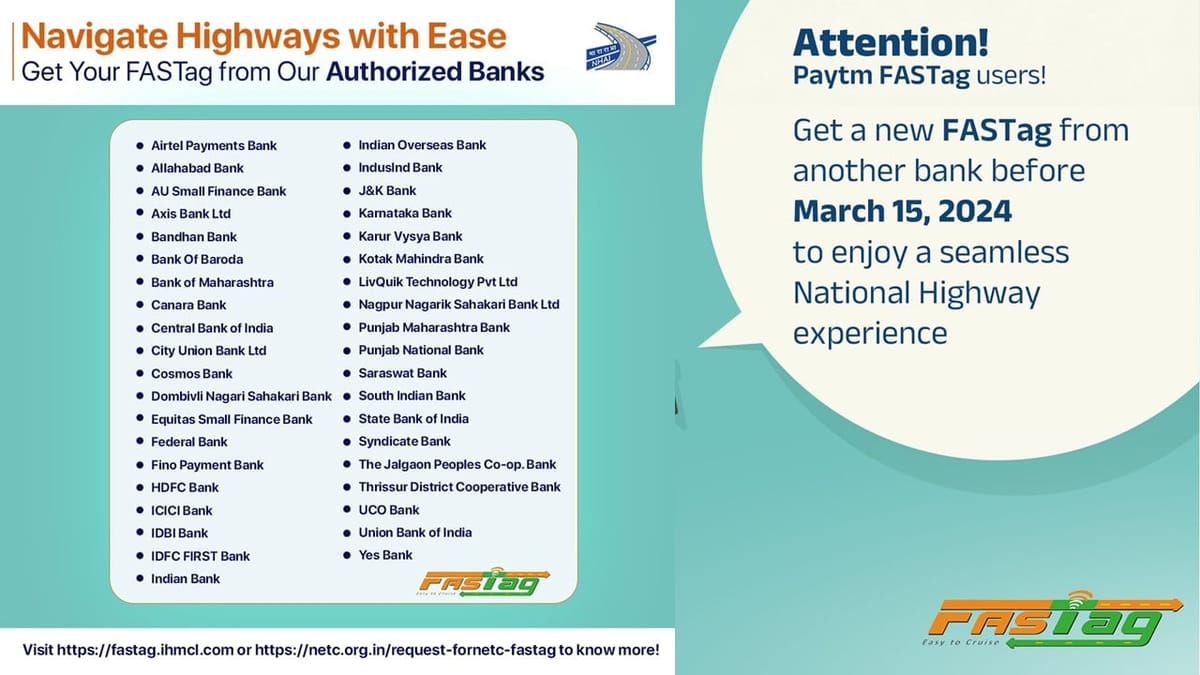

NHAI removes Paytm Payment Bank from Aothorised issures asked user to procure New FastTag till this Date

Before March 15, 2024, NHAI has encouraged Paytm FASTag users to obtain a new FASTag issued by another bank in order to guarantee a smooth travel experience and prevent trouble at toll plazas. By doing this, traveling on National Highways will be free from fines and additional fees.

According to the Reserve Bank of India’s recommendations on limitations on Paytm Payments Bank, users of Paytm FASTags will not be able to top up or recharge their balances after March 15, 2024. They may, however, continue to pay the toll after the designated day by using their current balance.

If users have any additional questions or need help with Paytm FASTag, they can contact their individual banks or consult the FAQs on the IHMCL website. All Paytm FASTag users have been asked by the NHAI to take preventative action in order to guarantee a smooth travel experience on the nation’s National Highways.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"