The schedule for registration and payment of examination fees for secondary and senior secondary courses for the NIOS Public Examination

Saloni | Jun 11, 2024 |

NIOS Exam Schedule 2024: NIOS Released Schedule for Secondary and Senior Secondary Programs

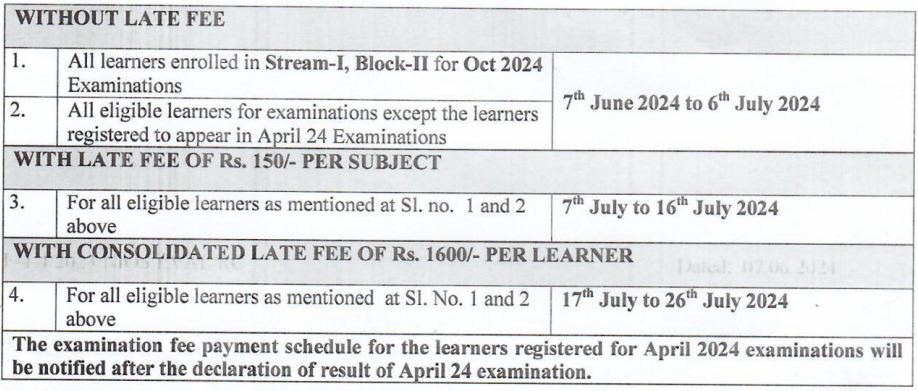

NIOS Exam Schedule 2024: The National Institute of Open Schooling, NIOS has scheduled the public examination for Secondary and Senior Secondary courses to be conducted in October-November 2024. The learners of Senior Secondary courses must maintain a compulsory gap of 2 years from Block/Session and the passing year of Secondary Examination for the motive of obtaining the passing certificate. If the candidate does not possess a compulsory gap of 2 years, then the candidate will only be able to register for a maximum of four subjects (Only include the subjects they have already passed) for the upcoming examination 2024 to be conducted in October-November 2024. Hence candidates carefully select the subject/subjects accordingly for the public examination. The requisite examination fee will only be paid through online mode on the official website of NIOS i.e., http://sdmis.nios.ac.in.

Below are some frequently asked questions related to NIOS Exam Schedule 2024:

Q.1: Who is the authority responsible for conducting the public examination?

Ans: The National Institute of Open Schooling, NIOS is responsible for conducting the public examination for Secondary and Senior Secondary courses.

Q.2: When is the NIOS public examination 2024 scheduled to be conducted?

Ans: The NIOS public examination 2024 for Secondary and Senior Secondary courses is scheduled to be conducted in October-November 2024.

Q.3: How many years of compulsory gap is required for NIOS Senior Secondary courses?

Ans: The learners of Senior Secondary courses must maintain a compulsory gap of 2 years from Block/Session and the passing year of the Secondary Examination.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"