Reetu | May 22, 2023 |

One Time Settlement Policy for VAT Defaulters Soon

The government is preparing to implement a one-time settlement scheme for approximately 44,000 state tax defaulters, including the Value Added Tax and Central Sales Tax.

According to sources, the government is developing a case to release roughly 27,000 defaulters who owe the government a relatively tiny sum. The government will focus its efforts on people whose tax default is of high value and will attempt to reclaim tax from them.

One Time Settlement Policy for Tax Defaulters

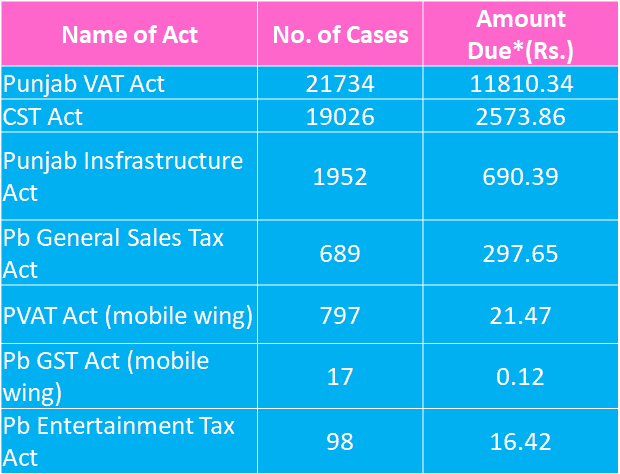

It has been learned that the majority of tax defaulters did not pay tax under the Punjab VAT Act, 2005 (21,734 defaulters owing Rs 11,810.34 crore in tax, interest, and penalty). Defaulters under the Central Sales Tax Act (19,026 defaulters owing Rs 2,573.86 crore), the Punjab Infrastructure (Development and Regulation) Act (1,952 defaulters owing Rs 690.39 crore), and the Punjab General Sales Tax Act (689 defaulters owing Rs 297.65 crore) are the next in line.

Aside from that, there are certain defaulters under the PVAT and the Punjab Entertainment Tax Act. There are 44,313 people who have not paid their taxes, and the total amount owed to them is Rs 15,410.35 crore. All of these lawsuits have been pending since the introduction of the Goods and Services Tax in 2017. The GST absorbed the vast majority of these levies.

According to a top official in the state revenue department, approximately Rs 5,000 crore in unpaid taxes are owed by government good procurement organisations.

A Cabinet subcommittee appointed to prepare a draught of the OTS policy has allegedly agreed on the programme’s general outline. This sub-committee is chaired by Finance Minister Harpal Cheema, and its members include Education Minister Harjot Bains and Sports Minister Gurmeet Singh Meet Hayer.

The committee has decided that the OTS policy will allow them to focus on collecting greater value amounts while also cleaning up their ledgers by forgiving small dues from a bigger group of defaulters. Cheema stated that the draught is being finalised and would be presented to the Cabinet soon for final approval.

Source: Tribune India

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"