Shuba Lakshmanan | Nov 11, 2021 |

Order quashed on considering independent supply of goods & services as composite supply

An advanced ruling is a mechanism whereby taxpayers can get answers or clarifications regarding supply of goods and services, directly from tax authorities and the primary objectives for such a mechanism are to reduce litigation, attract FDI due to transparent tax liability, provide certainty with respect to tax liability and disclose ruling in an inexpensive and transparent manner. The Authority for Advanced Ruling (AAR) constituted by the tax authorities interprets tax laws for the taxpayers and it was created to address any issues faced by taxpayers and assist them by providing a decision on the clarification sought. The AAR’s appallet authority is the AAAR (Appellate Authority or National Appellate Authority for Advanced Ruling). Section 95 to Section 106 in Chapter XVII of CGST Act covers the procedures and rules related to advance rulings. An application is made by the taxpayer on the clarification sought by them. The taxpayer is provided an opportunity of being heard by the AAR. If there is consensus on resolution on the clarification sought between the AAR and taxpayer, an ‘Advance Ruling’ is issued by the AAR and on the contrary, the matter is referred to the AAAR.

The question of law which is address through this AAAR are as follows:

The applicant, Assistant Commissioner of Central Tax, is the jurisdictional CGST authority. The appeal is made in terms of an order passed by the Karnataka Authority for Advanced Ruling (AAR) vide its order no. KAR/ADRG 20/2021 dated 6.Apr.2021 in the application presented by M/S. BEML Limited. The facts of the application made by M/S.BEML Ltd. to Karnataka AAR are enumerated below.

M/S.BEML Ltd. had entered into a contract with M/S. BMRCL (Bangalore Metro Rail) for the manufacture and supply of Standard Gauge Intermediate Cars which involved 6 separate independent activities to be performed, that comprised of both supply of goods and services. M/S.BEML Ltd. had separated the 6 independent activities as independent cost centers tagged as A to H and the contract which was entered into between M/S.BEML and M/S. BMRCL(respondent company herein) provided a detailed split of the activities involved, nature of work, along with deliverables and pricing for each activity. The contract no. 3 RS-DM dated 25.Mar.2017 was entered between the parties and since at that point GST was not applicable, the parties had made provision for adoption of GST, if enforced. Further, on completion of each milestone of the contract, M/S.BEML had charged GST (enforced at actual time of supply) at varying rates on the supply of goods and services. M/S.BMRCL has disputed the GST charged on 4 supplies as they classified the activities undertaken by M/S.BEML as composite supply. Details are as below.

| Cost Centre | Description of activity | Supply | GST rate applied by BEML |

| A | Preliminaries and general requirements for rolling stock including design which is incidental to supply of rolling stock. | Goods | 5% & 12 % w.e.f 01.Oct.2019 |

| C | Delivery and receipt of indigenous manufacturing | Goods | 5% & 12 % w.e.f 01.Oct.2019 |

| D | Commissioning and accepting of trains / cars in depot | Service | 18% |

| E | Taking over of unit / train for revenue service | Service | 18% |

| G | Supply of unit exchange spares, mandatory spares and consumable spares and special tools, testing and diagnostic equipment. | Goods | 18% / 28% |

M/S.BMRCL paid applicable GST on supplies made under cost centers A and C but disputed the GST charged on cost centre activities delivered under D, E and G. They were of the opinion that activities under D, E and G are incidental and naturally bundled under the principle activity listed under A and hence are composite supplies and the GST rate applicable would be only 5% and 12% w.e.f 01.Oct.2019 and not 18%.

In the application made by M/S.BEML to Karnataka AAR, the AAR ruled that activities undertaken under D, E and G are indeed composite supplies and the GST rates applicable will be lower than what was actually charged and issued order KAR/ADRG 20/2021 dated 06.Apr.2021. The applicant herein was aggrieved by the order passed and presented their counter to the appellate authority on following grounds.

(a) Circular No. 47/21/2018-GST dated 08.Jun.2018 which confirmed that, when supply of goods in terms of spare parts used and supply of service in terms of labor involved are invoiced separately, then the GST rate applicable will be separate rates based on the nature of supply made. This was also confirmed through an order passed by Kerala AAR in the case of Vista Marine and Hydraulics 2019(30) G.S.T.L 671.

(b) Circular No. 34/8/2018-GST dated 01.Mar.2018 where the question raised was if bus body building is a supply of goods or services, the circular confirmed that each case has to be analyzed independently w.r.t facts and circumstances and based on nature of supply be classified as composite supply or otherwise.

In the personal hearing held on 06.Aug.2021, the applicant presented their case as above. The respondent company namely M/S.BMRCL, through its authorized representative contended that since the major portion of the contract was attributable to Cost Centre C activities, the other activities listed under cost centers D, E and G are attributable to the major activity under Cost centre C and hence the activities are ‘naturally bundled’ and should be considered as composite supply. They relied on Rajasthan AAR order issued with reference to similar turnkey projects in the case TAG Solar Systems and pleaded that the appeal filed by the department may not be allowed.

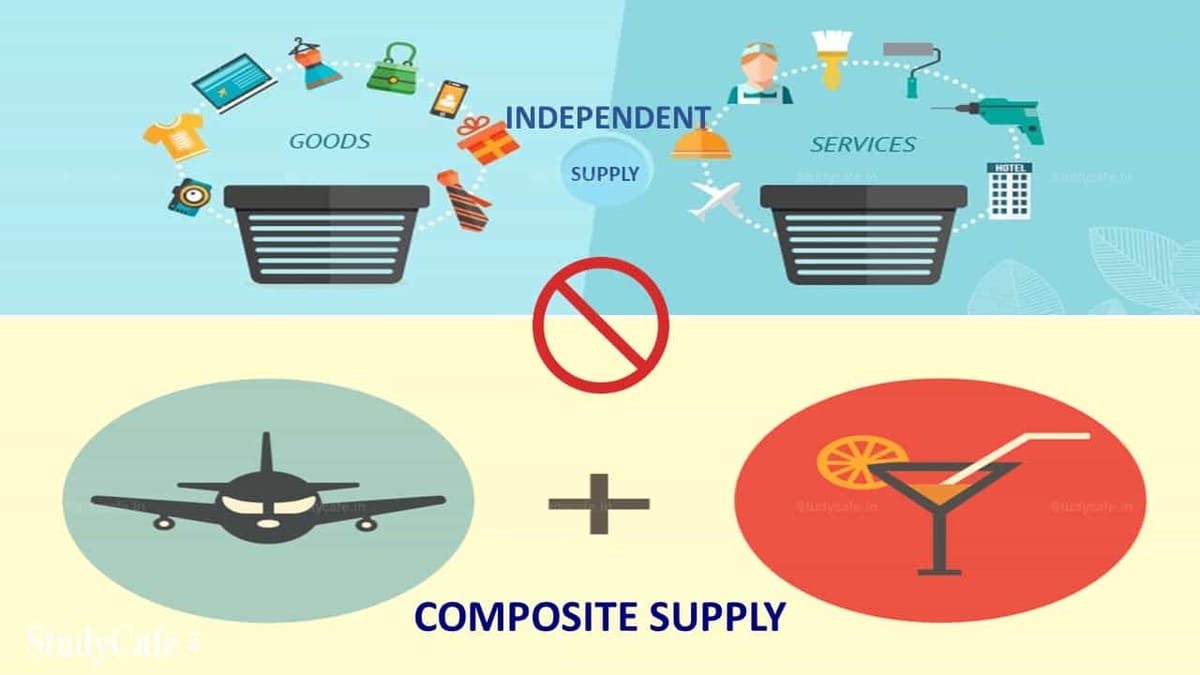

The AAAR took note of the arguments and representations of both the applicant and the respondent company into records. First it defined a composite supply as given under section 2(30) of CGST Act, 2017 as follows.

“Composite supply means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply”

The AAAR further explained that a composite supply implies that one supply cannot be done in the course of business without the other and forms a ‘natural bundle’ and should be mutually inclusive. The appellate further quoted the definition of ‘naturally bundled’ under Section 2(30) of CGST Act to mean that the different deliverables under a composite supply are integral or interdependent to the overall supply and it stated that even if one is not provided, it will affect the overall nature of supply. The AAAR contended that in this case, it failed to see the ‘natural bundle’ concept necessary to classify a supply of goods and services as composite supply.

The appellate authority acknowledged that the contract is a single contract but the milestones set under the contract are independent of each other and not interdependent and the supply identified under Cost Centers C,D, E and G are clearly distinguishable and identified with separate pricing and invoiced accordingly. Hence the appellate authority seconded the views of the Department and concluded that each supply made by the cost centers are to be assessed independently basis the nature of supply. Further the appellate authority mentioned that the form of agreement is immaterial in the case and it is the substance which has to be considered.

Based on the aforementioned reasoning, the AAAR ordered vide KAR/AAAR-08/2021 dated 03.Sep.2021 that the application made by the Department be allowed and the GST rates for each cost centre activity has to be variable as quoted in the above table.

To Read Ruling Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"