Post Office Savings Account (POSA): Features, Eligibility & Benefits

The Post Office Savings Account is a deposit account offered and regulated by the Indian Postal Service. The Central Government of India backs it up by notification no. G.S.R. 921(E) issued under section 3A of the Government Savings Promotion Act, 1873 (5 of 1873). Individual depositors can use the Post Office Savings Scheme to deposit their money and earn a predetermined rate of interest. This programme intends to reach out to rural areas, low-income investors, and impoverished people.

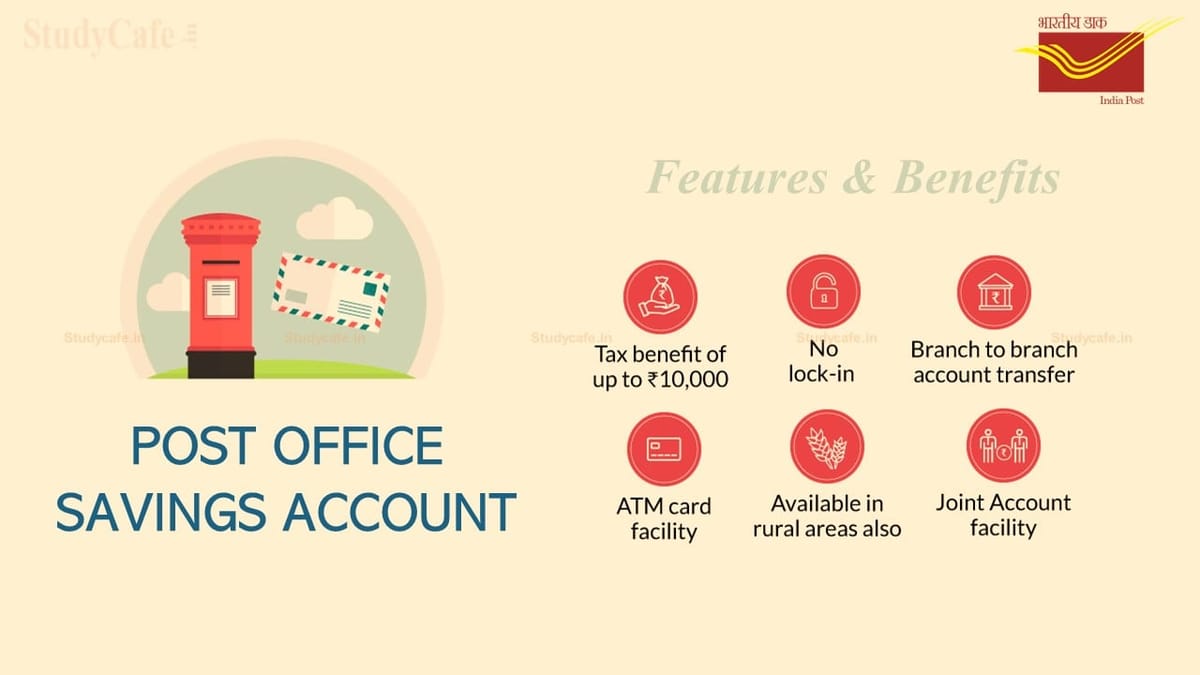

Many depositors in remote areas can now open accounts and preserve their hard-earned money in a secure deposit scheme thanks to this programme. Rather than keeping money in cash, these people now keep it in a savings account and deposit it. We may compare the Post Office Savings Account to a savings bank account in many respects. It has a fixed interest rate, full and partial deposit withdrawals, internet and mobile banking, and an ATM card, among other things.

Post Office Savings Account Interest Rates 2022

- The annual interest rate on a post office savings account (POSA) is 4%. Interest will be paid on the lowest balance at the credit of an account between the closing of the 10th day and the end of the month for a calendar month. After each year, such interest will be credited to the account.

- Only whole rupee values will be used to compute interest. The amount of interest will be rounded to the closest rupee.

- Interest is available if the amount is less than 500 rupees at any moment between the tenth and the final day of the month.

- If you close the account, the interest will be calculated for the month before the account is closed.

- The interest will be paid only at the end of the month before the month in which the account is closed if the account holder dies.

Features of a Post Office Savings Account

- It is not possible to convert a single account to a joint account or vice versa.

- At the time of opening the deposit account, a nomination is required.

- A passbook will be given to you. You can check your account balance at the post office by presenting your passbook.

- The account can only be opened with cash. It is not possible to transfer funds from another account.

- Interest income from the PO savings account is tax-free up to Rs 10,000, just like any other savings bank interest.

- You can effortlessly move your account from one post office branch to another.

- The account is simple to use, just like any other savings account at a bank.

- The account has features such as a passbook, chequebook, and quick deposit and withdrawal.

Eligibility for Post Office Savings Account

Individuals who meet the following criteria are eligible to open a post office savings account:

- Individual who is an adult.

- A joint account can be opened by more than one adult.

- A minor who is able the age of 10 years.

- On behalf of a juvenile, a single adult can open an account.

- A single adult can open a bank account on behalf of a mentally ill person.

- A single post office savings account can be opened by a single person.

- On their behalf, a minor or a person of unsound mind can open a single account.

- If one of the joint account holders dies, the account will be continued by the surviving account holder. The account will be regarded as though it belonged to the lone living account holder. The joint account must be closed if the sole surviving account holder already has a savings account.

- After reaching the majority, the minor must apply to the appropriate Post Office for conversion in his or her name. A new account opening form and KYC documents must be submitted by the minor.

- By filing a Form-2 application and relinquishing the passbook, you can close the account.

Benefits of Opening a Post Office Savings Account

The advantages of opening a post office savings account are as follows.

- You can nominate your legal representative using the nomination facility. Your legal heir will receive the deposit amount in the event of your death.

- Transferability is a feature of the programme. You can effortlessly transfer your account from one Po branch to another if you move from one area to another.

- Even a minor can open an account in his or her name. When the minor reaches the age of majority, he or she can transfer in his or her name.

- Taxpayers are excused from paying interest on amounts up to Rs 10,000.

- In CBS Post offices, electronic services such as internet banking, online deposit, and withdrawal are also available.

- A single-holder account can also be made into a joint account.

- You will be provided with complete liquidity. This deposit arrangement does not have a lock-in period. PO savings account programmes, unlike other post office savings systems, do not have a minimum deposit period.

StudyCafe Membership

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

Join MembershipIn case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"