Deepak Gupta | Mar 8, 2018 |

Reasons for notice of defective return in Income Tax under section 139(9)

Before discussing Reasons for notice of defective return in Income Tax, we should understand that why it is important to file timely response of notice under section 139(9) i.e. notice of defective return in income tax.

As per section 139(9) when assessee has not rectified defective return on time, his return would be treated as invalid. Invalid return is equal to no return filed, which means that assessee will now file belated return with interest & penalty.

Where the Assessing Officer considers that the return of income furnished by the assessee is defective, he may intimate the defect to the assessee and give him an opportunity to rectify the defect within a period of fifteen days from the date of such intimation or within such further period which, on an application made in this behalf, the Assessing Officer may, in his discretion, allow; and if the defect is not rectified within the said period of fifteen days or, as the case may be, the further period so allowed, then, notwithstanding anything contained in any other provision of this Act, the return shall be treated as an invalid return and the provisions of this Act shall apply as if the assessee had failed to furnish the return :

Provided that where the assessee rectifies the defect after the expiry of the said period of fifteen days or the further period allowed, but before the assessment is made, the Assessing Officer may condone the delay and treat the return as a valid return.

S.No. | Form | Reason of Defect | Corrective Action |

| 1 | ITR 1 | Tax Deducted as per Schedule TDS 1 that is TDS of Salary is greater than Gross Total Income | Income should be properly matched as per 26-AS while filing response to defective return. |

| 2 | Tax Deducted as per Schedule TDS 2 that is TDS other than Salary is greater than Gross Total Income | Income should be properly matched as per 26-AS while filing response to defective return. | |

| 3 | ITR 3 | The assessee has not filled Part A that is P&L or Balance Sheet or both and gross receipts as per and has entered a positive value in Schedule of income from Business & Profession. This is the one of the largest Reasons for notice of defective return in Income Tax. | PART A – BS (Balance Sheet) In case where regular books of accounts of the business or profession are maintained, please enter the details as per your Balance Sheet of the Proprietory Business or Profession as on 31st March, 2017 in the given format of Source of Funds & Application of Funds .In case where regular books of accounts of the business or profession are not maintained, please enter the details of Debtors, Creditors, Stock-in-trade and Cash balance under No account case . PART A – P&L (Profit and Loss Account) |

| 4 | In case income has been deducted from Schedule of income from Business & Profession but the same has not been shown in Schedule of other income/income under the head house property/capital gains etc. as the case may be. | Assessee should ensure that the income which is being deducted from Schedule of income of Business & Profession is later being shown in correct schedule. | |

| 5 | Sales/Gross receipts of business or profession is greater than Tax Audit limit and Audit & Auditor information is not completely/correctly filled. | Enter the audit details in below format. Date of furnishing of the audit report Name of the auditor signing the tax audit report Membership no. of the auditor Name of the auditor (proprietorship/ firm) Proprietorship/firm registration number Permanent Account Number (PAN) of the proprietorship/ firm Date of report of the audit | |

| 6 | Sales/Gross receipts of business or profession is greater than Tax Audit limit and the Audit condition has been flagged as no . | The Audit condition should be flagged yes . | |

| 7 | Depreciation is claimed in Part A P&L but Schedule DPM /DOA not filled. | Depreciation should be filled in Both Part A- P/L & Schedule DPM /DOA. | |

| 8 | ITR 4 | Presumptive income u/s 44AD is less than 8% or 6% of Gross Receipt or Sales turnover. Presumptive income under section 44ADA is less than 50% of Gross Receipts Presumptive income u/s 44AE is less than Rs 7500 p.m. per vehicle in case assessee is engaged in the business of plying, hiring or leasing such goods carriages & he did not own more than ten goods carriages at any time during the previous year. | Enter presumptive income not less than 6% of S.No. 1A of utility. Enter presumptive income not less than 8% of S.No. 1B of utility.Enter presumptive income from profession not less than 50% of Gross Receipts u/s 44ADAEnter presumptive income not less than Rs 7500 p.m. per vehicle. |

| 9 | ITR 4 | Code mentioned under Nature of Business is incorrect. | Ensure to fill correct business codes in the Nature of Business . |

| 10 | Mainly ITR 3 | Deduction claimed under Chapter VIA under sections 80IA, 80IB,80IC, 80G but the relevant Schedules not filled | Relevant Schedules should be filed while claiming deductions. |

| 11 | All ITR forms | Brought Forward Loss has been claimed in Part B Total Income but Schedule Carried Forward Loss has not been filled. | Relevant Schedules should be filed while carry forwarding losses. |

| 12 | ITR 6 | Assessee has income taxable under provisions of MAT but he has not filed form 29-B | Form 29-B should be filed duly signed by auditor. |

| 13 | ITR 7 | Trusts are having income more than slab limit but they have not filed Form 10B. | Form 10-B should be filed duly signed by auditor. |

| 14 | The Audit condition has been flagged as no . | The Audit condition should be flagged yes . | |

| 15 | All ITR forms | Assessee has not verified his return on time can also be one of the Reasons for notice of defective return in Income Tax . | Income Tax Return should be timely verified. |

For Regular Updates Join : https://t.me/Studycafe

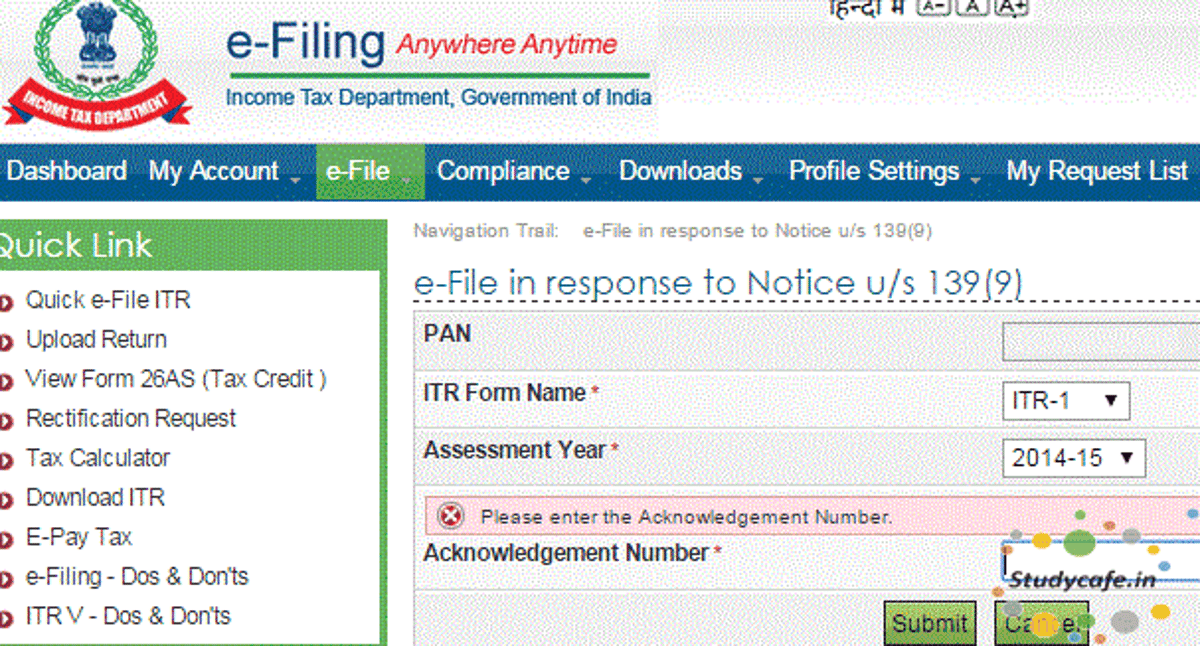

1. Login to e-Filing website with User ID, Password, Date of Birth/ Date of Incorporation and Captcha.

2. Go to e-File and click on “e-File in response to Notice u/s 139(9)”.

3. Select Form Name and Assessment Year. [Click here to download income tax utilities.]

4. Enter the Acknowledgement Number and click on “Submit”.

5. Enter communication reference number, CPC date, Receipt date, verification Pin mentioned in the Notice u/s 139(9), browse and attach the XML.

6. Click on”Submit” button.

On successful validation, the success message is displayed on the screen

After verification & wait for processing of ITR, to get the intimation from IT department under section 143(1). You will receive another email from IT department once your income tax return gets processed. This email is called Intimation under section u/s 143(1)

Message for Readers

This Article has been made as per ITR forms prescribed for AY 17-18 & is subject to change in FY 18-19. Also the assumptions, eligible deductions, method of computing income has been taken as per Finance Act 2017.

The reasons mentioned in this article are as per knowledge of the author. In case any other reasons are known to you please comment in the section given below. The same shall be incorporated in this article.

For any other suggestion or query, please comment below.

Tags : Reasons for notice of defective return in Income Tax, how to file defective return u/s 139 (9), error code 810 in income tax return, revised income tax return under section 139 (5), explanation (d) under section 139(9) read with section 44aa, defective return meaning, invalid return u/s 139(9), 139(9) error code 31, 143(1b) of income tax act, Some of the reasons of notice of defective return in income tax !!, notice under section 139(1) of income tax, how to file defective return, Reasons for notice of defective return in Income Tax, notice under section 139(1) of income tax, how to file defective return, rectifying defective return,Reasons for notice of defective return in Income Tax, Defective Return Notice Under Section 139(9) Guide, How Should you Respond to a Defective Income Tax Return Notice , Defective Return under Section 139(9), What is defective Income Tax Return and their Consequences , Common Reason for E-filed Defective Returns , defective return can be revised, how to file defective return u/s 139 (9), error code 810 in income tax return, invalid return u/s 139(9), what will be next step after the income tax return is treated as “invalid return” , explanation (d) under section 139(9) read with section 44aa, error code 89 income tax, defective return meaning, Defective Return under Section 139(9), Reason of Defective return, Defective Return Notice, Defective Return Notice under section 139(9)

Tags : Section 143, section 139(9), Income Tax Act, Defective return,Reasons for notice of defective return in Income Tax

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"