Deepak Gupta | Jan 18, 2018 |

Recommendations made during the 25th meeting of the GST Council

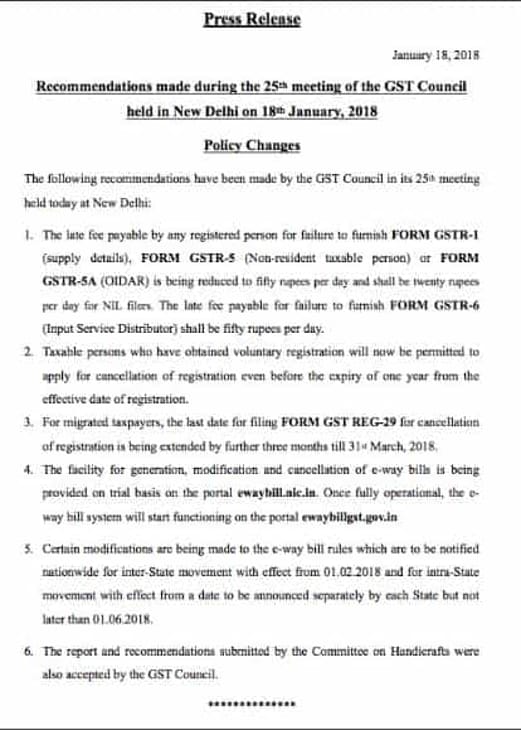

Here is theextract of some of the recommendations made by the GST Council during its 25th meeting held in New Delhi on 18th January:

For complete list of recommendations please refer the press release attached herewith.

A. Policy Changes

The following recommendations have been made by the GST Council in its 25th meeting held today at New Delhi:

1. The late fee payable by any registered person for failure to furnish FORM GSTR-1 (supply details), FORM GSTR-5 (Non-resident taxable person) or FORM GSTR- 5A (OIDAR) is being reduced to fifty rupees per day and shall be twenty rupees per day for NIL filers. The late fee payable for failure to furnish FORM GSTR-6 (Input Service Distributor) shall be fifty rupees per day.

2. Taxable persons who have obtained voluntary registration will now be permitted to apply for cancellation of registration even before the expiry of one year from the effective date of registration.

3. For migrated taxpayers, the last date for filing FORM GST REG-29 for cancellation of registration is being extended by further three months till 31st March, 2018.

4. The facility for generation, modification and cancellation of e-way bills is being provided on trial basis on the portal ewaybill.nic.in. Once fully operational, the eway bill system will start functioning on the portal ewaybillgst.gov.in (Also seeE-Way Bill Registration)

5. Certain modifications are being made to the e-way bill rules which are to be notified nationwide for inter-State movement with effect from 01.02.2018 and for intra-State movement with effect from a date to be announced separately by each State but not later than 01.06.2018.

6. The report and recommendations submitted by the Committee on Handicrafts were also accepted by the GST Council.

Click here to download the Press Release

B. Recommendations for changes in GST/IGST Rate & Clarifications in respect of GST Rate of Certain goods

LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 28% TO 18%:

1.) Old and used motor vehicles [medium and large cars and SUVs] on the margin of the supplier, subject to the condition that no input tax credit of central excise duty/value added tax or GST paid on such vehicles has been availed by him

2.) Buses, for use in public transport, which exclusively run on bio-fuels.

LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 28% TO 12%:

All types of old and used motors vehicles [other than medium and large cars and SUVs] on the margin of the supplier of subject to the conditions that no input tax credit of central excise duty /value added tax or GST paid on such vehicles has been availed by him.

LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 18% TO 12%:

On LPG supplied for supply to household domestic consumers by private LPG distributors GST rate has been recommended for reduction from 18% to 5%.

On Cigarette filter rods GST rate has been recommended for increase from 12% to 18%

OnDiamonds and precious stoneshas been recommended for reduction from 3% to 0.25%.

Cess on Old & used motor cars has been abolished.

For detailed list of recommendations please refer the press release:

Click here to download the Press Release

C. Decisions relating to Services

Some of the important recommendations are as follows:

For detailed list of recommendations please refer the press release:

Click here to download the Press Release

You May also refer

E WAY BILL A BIG BOOST FOR EASE OF DOING BUSINESS

All About Electronic Way Bill in GST

TAGS: 25th gst council meeting press release, cbec press release, gstcbec press release, gst council press release,Recommendations made during the 25th meeting of the GST Council ,Recommendations made during the 25th meeting of the GST Council,gst council press release today, press note gst

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"