Deepak Gupta | Mar 16, 2019 |

Regular taxpayer can opt for Composition Scheme upto 31.03.2019, Facility enabled

GST taxpayer who wants to convert themselves from Regular taxable person to Composition taxable person can apply for conversion to Composition scheme before 31.03.2019. Facility for the same has now been enabled on the GST Portal.

Opting for Composition Scheme : Any registered person who opts to apply for Composition Scheme and pay tax under section 10 shall electronically file an intimation in FORM GST CMP-02, duly signed or verified through electronic verification code, on the common portal, either directly or through a Facilitation Centre notified by the Commissioner, prior to the commencement of the financial year. This means persons who are interested in opting for composition scheme For FY 2019-20 shall file form CMP-2 by 31st March 2019

You may Also Refer : GST composition scheme limit hiked to Rs 1.5 crore [Read Notification]

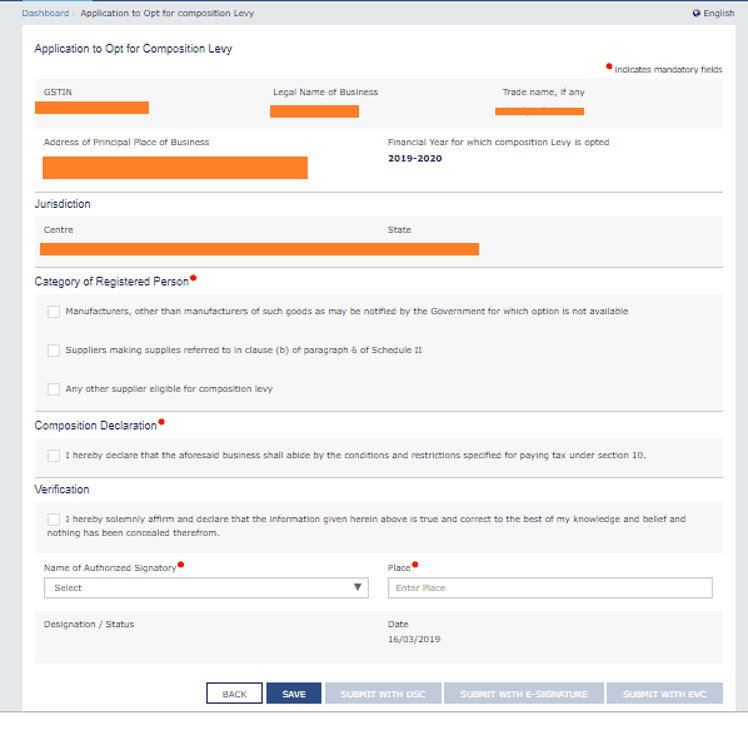

How to Excess FORM GST CMP-02 : LogintoGST Portal and click on services option. Regular Tax payers will have an option for applying in GST Composition Scheme there. After you click on the same, below mentioned form will appear.

Further if taxpayer has opted for composition scheme he shall furnish the statement in FORM GST ITC-03 in accordance with the provisions of sub-rule (4) of rule 44 within a period of sixty days from the commencement of the relevant financial year i.e. for FY 2019-20, stock declaration in ITC-03 should be filed before 30-09-19

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"