Studycafe | Apr 9, 2020 |

Relaxation in TDS & TCS Compliances Due to COVID-19 Outbreak

Due to outbreak of the Covid-19 pandemic, there is severe disruption in the normal working of almost all sectors. To mitigate the hardships of taxpayers, the CBDT has issued the following directions / clarifications by exercise of its power u/s 119 of the Income-tax Act, 1961 (the Act):

1. All the assessees who have filed application for lower or nil deduction of TDS / TCS for FY 2020-21 and whose applications are pending for disposal as on date and they have been issued such certificates for FY 2019-20, then such certificates would be applicable till 30.6.2020 of FY 2020-21 or disposal of their applications by the Assessing Officers, whichever is earlier, in respect of the transaction and the deductor or collector if any, for whom the certificate was issued for FY 2019-20.

Comments

(i) An assessee, being a deductor, can file an application for NIL deduction of tax at source (TDS) u/s 197(1) of the Act.

(ii) An assessee, being a deductor, can also file an application for deduction of tax at source (TDS) at lower rate u/s 197(1) of the Act.

(iii) Such application can be made in respect of TDS under following sections of the Act:

(a) Section 193

(b) Section 193

(c) Section 194

(d) Section 194A

(e) Section 194C

(f) Section 194D

(g) Section 194G

(h) Section 194H

(i) Section 194-I

(j) Section 194J

(k) Section 194K

(l) Section LA

(m) Section LLB

(n) Section 194LBC

(o) Section 194M

(p) Section195

(iv) Such application is required to be filed before such income or such sum payable is credited to the account of the payee or is paid, as the case may be.

(v) Similarly, u/s 195(3) of the Act a non-resident person entitled to received any interest or other sum u/s 195(1) of the Act may make an application for received without TDS.

(vi) Similarly, u/s 206C(9) of the Act a buyer or licensee or lessee may make an application for TCS at lower rate u/s 206C(1) or 206C(1C) of the Act.

(vii) If –

(a) such applicant has been filed for the financial year 2020-21 and

(b) such application is pending as on date and

(c) such assessee has been issued such certificate for financial year 2019-20

then –

(a) the certificate issued for financial year 2019-20 would be applicable till 30.6.2020 for financial year 2020-21 or

(b) disposal of the application filed for financial year 2020-21 whichever is earlier in respect of the –

(a) the transaction and

(b) the deductor or

(c) the collector

for whom the certificate was issued for financial year 2019-20.

(viii) It means that if such application is disposed of before 30.6.2020, then the rate specified in the certificate shall be applicable.

2. In cases where the assessees could not apply for issue of lower or nil deduction of TDS / TCS in the Traces Portal for the FY 2020-21, but were having the certificates for FY 2019-20, such certificates will be applicable till 30.06.2020 of FY 2020-21. However, they need to apply at the earliest giving details of the transactions and the Deductor / Collector to the TDS / TCS Assessing Officer as per procedure prescribed.

Comments

(i) In case the assessee could not apply for lower or nil deduction for financial year 2020-21, but having such certificate for the financial year 2019-20, then such certificate shall be applicable till 30.6.2020 for the financial year 2020-21.

(ii) In case the assessee could not apply for lower collection for financial year 2020-21, but having such certificate for the financial year 2019-20, then such certificate shall be applicable till 30.6.2020 for the financial year 2020-21.

(iii) However, such assesses are required to apply to the Assessing Officer as per the procedure prescribed at the earliest fiving the following details :

(a) details of the transactions

(b) details of the deductor (in case of TDS)

(c) details of the collector (in case of TCS)

(iv) As per CBDT order issued u/s 119 of the Act dated 31.3.2020, such details are required to be furnished as soon as normalcy is restored or 30.6.2020, whichever is earlier vide the Annexure to the said Order, which is mentioned at the end of the update.

3. In case where the assessee has not applied for issue of lower or nil deduction of TDS / TCS on Traces portal, and he is also not having any such certificate for financial year 2019-20, a modified procedure of application and handling by the TDS/ TCS Assessing Officer is laid down which is enclosed as annexure.

Comments

(i) In case the assessee has neither applied for lower/ nil certificate nor have any such certificate for FY 2019-20, he will have to follow the modified procedure mentioned in the Annexure to the Order dated 31.3.2020, which is mentioned at the end of the update.

4. However, on payments to Non-residents (including foreign companies) having Permanent Establishment in India, where the above applications are pending, tax on payments made will be deducted at the subsidised rate of 10% including surcharge and cess, on such payments till 30.06.2020 of FY 2020-21, or disposal of their applications, whichever is earlier

Comments

(i) In case of payment to non non-resident, including foreign company, who have Permanent Establishment (PE) in India, tax is required to be deducted u/s 195(1) of the Act.

(ii) In such case, where an application is pending for the financial year 2020-21, the tax shall be deducted at the subsidised rate of 10%, including applicable surcharge and cess On such payments till 30.6.2020, or disposal of the application, whichever is earlier.

(iii) It means that if such application is disposed of before 30.6.2020, then the rate specified in the certificate shall be applicable.

5. In case of pending applications for lower / nil rate of TDS / TCS for FY 2019-20, the Assessing Officers have been directed to dispose off the applications through a liberal procedure by 27.04.2020, so that the taxpayers may not have to pay extra tax which may cause liquidity issues to them.

Comments

(i) Where the applications for the financial year 2019-20 have been filed and are pending for disposal, the Board has directed the Assessing Officer to dispose off such applications by 27.4.2020.

6. To mitigate the hardships of small taxpayers, it has been decided that if a person had submitted valid Form 15G and Form 15H to the Banks or other institutions for FY 2019-20, then these Forms would be valid up to 30.06.2020.

7. This will safeguard the small tax payers against TDS where there is no tax liability.

Comments

(i) In respect of declaration required to be filed u/s 197A of the Act in Form No, 15G or Form No. 15H, as the case may be, for the financial year 2020-21, if the assesses have already furnished such forms for the financial year 2019-20, the same shall be valid till 30.6.2020.

(ii) It means that for the financial year 20120-20, till 30.6.2020, the forms submitted for the financial year 2019-20 shall hold valid.

(vii) As per CBDT order issued u/s 119 of the Act dated 31.3.2020, the details are required to be furnished in the following manner:

Annexure to the Order u/s 119 dated 31.3.2020

Application for lower tax deduction certificate

1. The applicant shall apply for the lower / Nil deduction / collection certificate u/s 197/ 206C(9) of the Income Tax Act vide an e-mail address to the Assessing Officer concerned. The e-mail shall contain data / detail as under:

(a) Duly filled Form 12 (Annexure I and / or Annexure III)

(b) The document / information required to be uploaded on TDS – CPC website whiling filing up of Form 13

(c) Projected Balance Sheet and Profit & Loss Account of FY 2020-21

(d) Provisional Balance Sheet and Profit & Loss Account of FY 2019-20

(e) Balance Sheet and Profit & Loss Account of FY 2018-19

(f) Form 26AS for FY 2019-20 and FY 2018-19

(g) ITR pertaining to FY 2018-19

2. For issue of certificate for lower / NIL deduction of tax u/s 195(2) and 195(3), the process of furnishing of application will continue to be same with the modification that the application will be filed via e-mail and certification will also be issued via e-mail.

Issuance of the Certificate

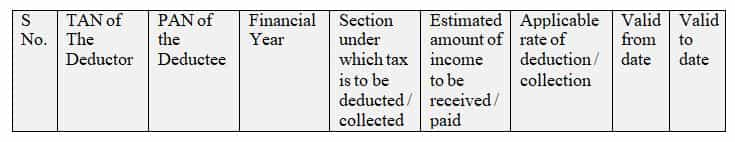

3. The certificates shall be issued up to 30.6.2020 or any other date (earlier than 30.6.2020) as specified by the AO. The Assessing Officer shall communicate the issuance of certificate vide mail containing following information:

Relaxation in TDS & TCS Compliances Due to COVID-19 Outbreak

The issuance of certificate shall be communicated to the applicant who in turn shall share the same with the deductor / collector.

Disclaimer

This document has been prepared for academic use only, to understand the scope and implications of the CBDT Order issued u/s 119 dated 31.3.2020 relating to relaxation in the compliance provisions relating to application and issue of certificate for lower or nil TDS / TCS and to share the same with the fellow professionals and all concerned. Though every effort has been made to avoid errors or omissions in this document yet any error or omission may creep in. Therefore, it is notified that I shall not be responsible for any damage or loss to any one, of any kind, in any manner there from. I shall also not be liable or responsible for any loss or damage to any one in any matter due to difference of opinion or interpretation in respect of the text. On the contrary it is suggested that to avoid any doubt the user should cross check the status from the available materials on the issue including the order.

This article has been authored by By CA. Rajiv Kumar Jain. He can be contacted at 9810288997

Click Here to Download the Article

Here is the link of video on Webinar on Interpretation of Relief Ordinance, 2020 dated 31 03 2020:

You May Also Refer:

Tags: TDS, TCS, Lower tax deduction certificate

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"