Deepak Gupta | May 13, 2018 |

Requirement of audit under Goods and service tax regime (GST) |Requirement of audit under GST | Audit under GST | Audit Requirement under GST | GST Audit

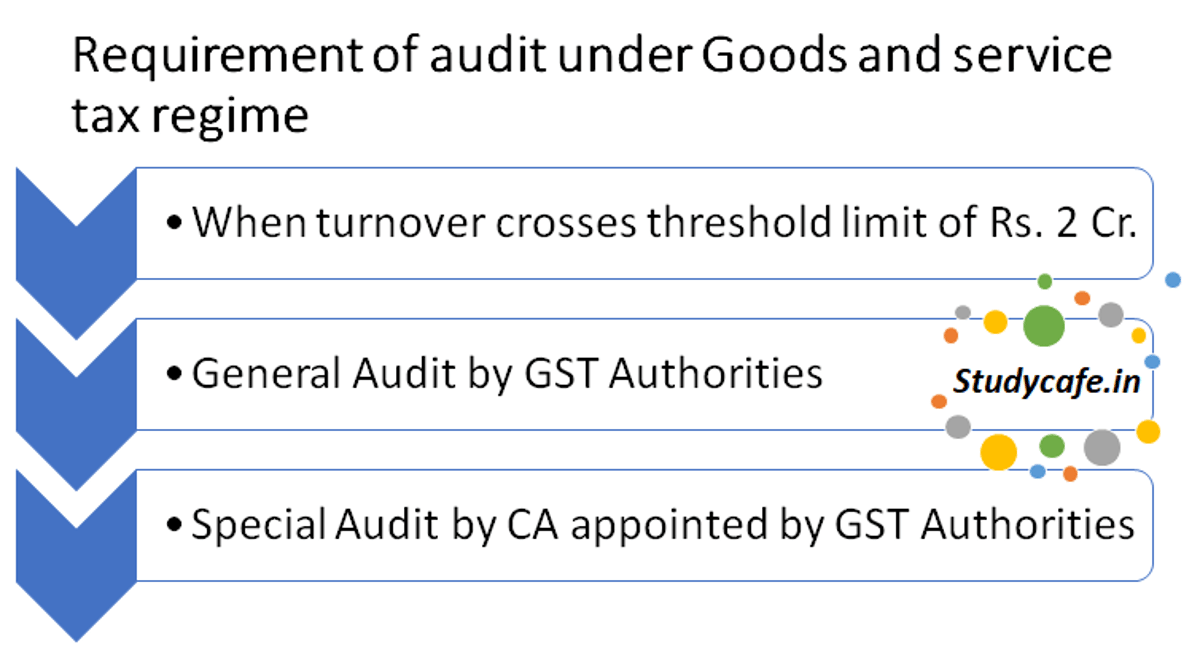

When is Audit under Goods and service tax regime is required to be conducted

If Turnover crosses the threshold limit of Rs. 2 cr (In this case tax payer is supposed to File Audited Return + Audited Accounts + Reconciliation Statements)

Audit by GST Authorities

Audit has been defined in section 2(13) of the CGST Act, 2017 and it means the examination of records, returns and other documents maintained or furnished by the registered person under the GST Acts or the rules made there under or under any other law for the time being in force to verify the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and toassess his compliance with the provisions of the GST Acts or the rules made thereunder.

Every registered person whose aggregate turnover during a financial year exceeds two crore rupees has to get his accounts audited by a chartered accountant or a cost accountant and furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in FORM GSTR-9C. [Rule 80 of Goods and service tax rules 2017]

The Commissioner or any officer authorised by him, can undertake audit of any registered person for such period, at such frequency and in such manner as may be prescribed.[Section 65 of Central Goods and Service tax Act 2017 read with Rule 101 of Central Goods and Service Rules 2017]

Time period of issuing notice

The registered person shall be informed by way of a notice in FORM GST ADT-01 in not less than fifteen working days prior to the conduct of audit.

Time limit on Completion of Audit

The audit shall be completed within a period of three months from the date of commencement of the audit.

In case the Authorities want to extend the time period of Audit they have to provide reasons in writing. Also this period can further be extended for upto 6 months only.

Obligations of taxpayer during the audit

During the course of audit, the authorised officer may require the registered person to:

(i) provide the necessary facility to verify the books of account or other documents as he may require;

(ii) furnish such information as he may require and render assistance for timely completion of the audit.

Conclusion of Audit

On conclusion of audit, the proper officer shall, within thirty days, inform the registered person, whose records are audited, about the findings, his rights and obligations and the reasons for such findings in form GST ADT-02.

In Special Audit the registered person can be directed to get his records including books of account examined and audited by a chartered accountant or a cost accountant during any stage of scrutiny, inquiry, investigation or any other proceedings, depending upon the complexity of the case.[Section 66 of Central Goods and Service tax Act 2017 read with Rule 102 of Central Goods and Service Rules 2017]

The directions shall be give in FORM GST ADT-03.

The chartered accountant or cost accountant shall be nominated by the Commisioner.

Time limit on Completion of Audit

The chartered accountant or cost accountant shall, within the period of ninety days, submit a report of such audit duly signed and certified by him to the said Commissioner.

In case the Authorities want to extend the time period of Audit on request of taxable person or his auditor they have to provide reasons in writing. Also this period can further be extended for upto 90 days only.

Cost

The expenses for examination and audit including the auditors remuneration will be determined and paid by the Commissioner.

Communication of Findings of Audit

On conclusion of the special audit, the registered person shall be informed of the findings of the special audit in FORM GST ADT-04.

Requirement of audit under Goods and service tax regime shows that government is quite serious in curbing transactions which are against provisions of GST Act and business man has has to adhere to the GST provisions in order to avoid future litigation and penalties.

Penalty of Non-Audit

In case of failure to get accounts audited from CA, there is a penalty of upto Rs. 25000/-

Tags : Audit under GST- When You Might Get Audited by Tax Officers , audit by ca under gst, compulsory audit under gst, prescribed limit for audit under gst, gst audit applicability, who can audit under gst, threshold limit for audit under gst, gst audit process, gst audit turnover limit, Audit under GST, Audit Conducted Under GST Law, Process & Assessment, Type of Audit in GST, Requirement of audit under Goods and service tax regime, audit under Goods and service tax regime, gst audit, audit under section 65 audit under section 66, gst audit report, gst audit applicability, gst audit section, gst audit by ca, gst audit process, gst audit due date, gst audit rules, gst audit turnover limit, gst audit limit, Requirement of audit under Goods and service tax regime (GST), Requirement of audit under GST, Audit under GST, Audit Requirement under GST, GST Audit

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"