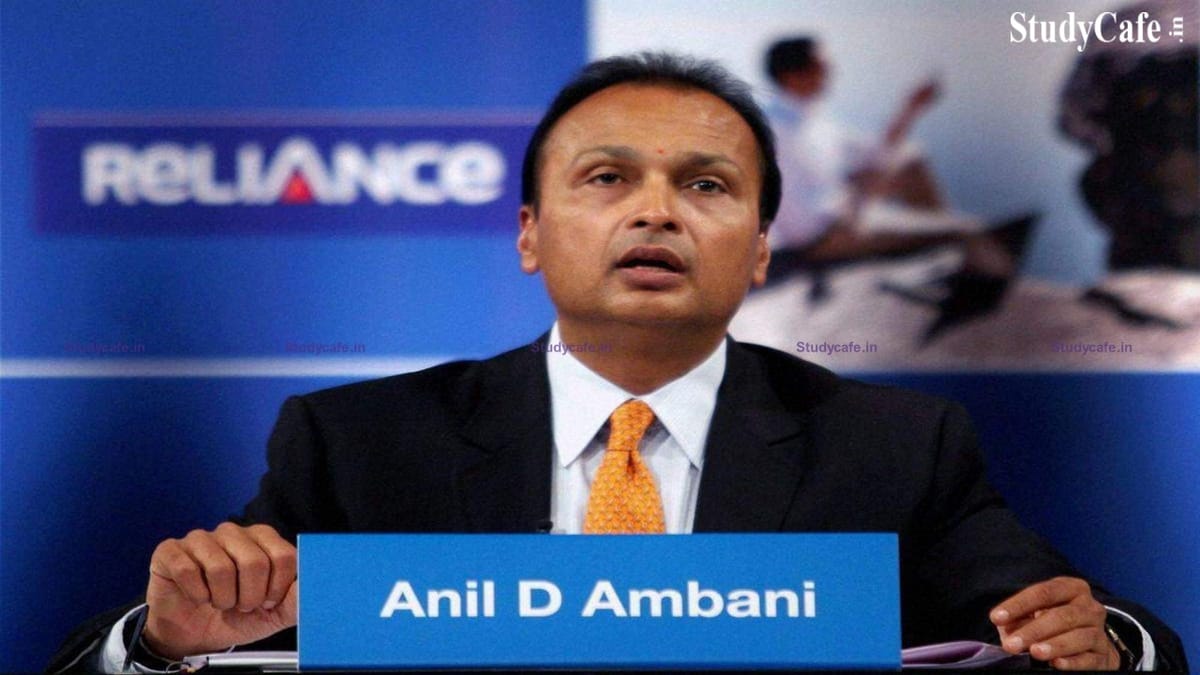

Sebi Bars Reliance Home Finance, Anil Ambani and 3 others from Securities Market

SANDEEP KUMAR | Feb 12, 2022 |

Sebi Bars Reliance Home Finance, Anil Ambani and 3 others from Securities Market

The Securities and Exchange Board of India (Sebi) barred Reliance Home Finance Ltd, billionaire Anil Ambani, and three other individuals from trading in the securities market on February 11 for allegedly syphoning funds from the company. Amit Bapna, Ravindra Sudhakar, and Pinkesh R Shah are the other three people.

In a 100-page interim order issued by SEBI whole-time member SK Mohant, the regulator further barred Ambani and the three persons from interacting with any listed company or intermediary, or from functioning as a director or promoter of any listed firm, until further orders.

RHFL, Amit Bapna, Ravindra Sudhakar, and Pinkesh R. Shah, who were the company’s senior managerial staff in 2018-19, have been prohibited from the capital market till further notice, according to the late-night ruling. SEBI took action after receiving many allegations about RHFL promoters and management syphoning off or diverting funds.

The company engaged in money laundering, misrepresentation of books of accounts, and falsification of financial statements, according to Sebi, resulting in non-disclosure of true and fair information to the general public.

According to SEBI, its inquiry revealed how Anil Ambani, the Promoter/Chairman and the person under whose control and influence the Company has acted, has gone outside of his jurisdiction by granting loans that are in flagrant violation of regulations (internal as well as regulatory)

The order further added that “Such a misconduct on the part of Notice no. 2 (Anil Ambani) as the chairman of the company smacks of fraudulent intent of the top management of the company, first, to divert the borrowed funds of the company meant to be advanced to genuine 3rd party borrowers to the coffers of various promoter group entities under the garb of series of sham GPC (general corporate purpose) lending, and then to cover up the losses & NPA (non performing asset) arising out of such transactions by concealing actual financial health of the company from the shareholders and general investing public, who could never know the real financial status of RHFL by looking at the cooked up books of accounts presented to them through the stock exchanges.”

According to the regulator, the company’s other three key managerial persons (KMPs) allegedly conspired with high management and actively participated in funds diversion from Reliance Home. According to Sebi, these executives have also allegedly misrepresented accounts and made misleading public disclosures.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"