Shubhra Goswamy | May 7, 2024 |

SSC CHSL Exam 2024 Application Portal Closed Today; Check Essential Details

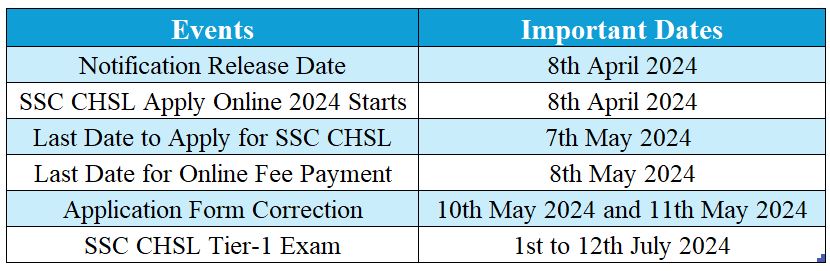

SSC CHSL Exam 2024: The Combined Higher Secondary Level Examination (CHSL) 2024 registration period was scheduled to expire today, 7th May 2024, by the Staff Selection Commission (SSC). Hence, the SSC CHSL Exam 2024 Application Portal is now closed. The SSC CHSL application form 2024 was needed to be completed by candidates who wished to take the recruitment exam, before the deadline via the official website, ssc.gov.in. The application correction window was opened from 10th May and 11th May by the commission.

The purpose of this hiring drive is to fill 3712 positions for data entry operators, junior secretariat assistants, postal assistants, sorting assistants, and lower division clerks. Tier 1 and Tier 2 will be the two stages in which it is conducted. To be hired for the desired position, candidates must pass both phases.

The SSC CHSL Tier 1 examination is set for July 1, 2, 3, 4, 5, 8, 9, 10, 11, and 12, 2024. The exam will take place in 4 shifts: 9 am to 10 am, 11:45 am to 12:45 pm, 2:30 to 3:30 pm, and 5:15 to 6:15 pm.

To submit the application, students were required to make a payment of Rs.100. However, the fee was waived for, Women applicants and candidates belonging to Scheduled Castes (SC), Scheduled Tribes (ST), Persons with Benchmark Disabilities (PwBD) and Ex-servicemen (ESM) category.

The Important Date for SSC CHSL Exam 2024:-

The steps to apply for the SSC CHSL Exam 2024 Registration are mentioned below.

Tier 1 and Tier 2 are the two exam levels for the SSC CHSL. There will be 100 questions in the Tier 1 exam, each worth two marks, for applicants. There will be a 0.50 mark deduction for each wrong response. This assessment takes an hour to complete. Here is the distribution of questions by subject:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"