Reetu | Sep 15, 2020 |

Stock Valuation method change valid if it was as per AS prescribed by ICAI

IN THE INCOME TAX APPELLATE TRIBUNAL

The Relevant Text of the Order as follows :

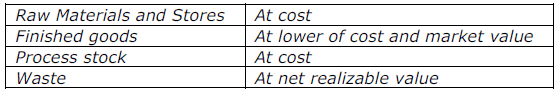

However, for a limited verification, we are restoring the matter back to the file of the AO for verification of the assessee’s contention that the assessee has consistently followed the above new method of valuing inventory in succeeding years also and no attempt is made to suppress income chargeable to tax of the relevant ay . Further, On perusal of the order of the Ld.CIT(A) , it is also observed by us that different methods are applied by assessee for valuing different components of inventory, as under:

If the assessee has to change method of valuing inventory in compliance with AS-2 issued by ICAI, then changed method of valuation has to be applied to all the components of inventory as prescribed under AS-2 and the assessee cannot be allowed to pick and chose method of valuing inventory to apply method to some components of inventory and leaving out other components of inventory. In that scenario, it will lose the character of being a change of method lacking bonafide and genuineness warranting change of method of valuation of inventory. So, also for limited verification by the AO, we are remitting matter back to the file of the AO , wherein the assessee is directed to justify as to why it is adopting different method for valuing different components of inventories and whether the said differential methods for valuing different components of inventory are consistent with AS prescribed by ICAI. The assessee is directed to give justification before AO for adopting different method of valuing different components of inventory and to prove that these differential methods are consistent with AS-2 prescribed by ICAI and hence accordingly, there was no intent to reduce tax by applying new method of valuing finished goods . We order accordingly.

5. In the result, the appeal filed by the Revenue in ITA No.984/Chny/2007 for ay: 2004-05 is partly allowed for statistical purposes.

Order pronounced on the 05th day of February, 2020 in Chennai.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"