Deepak Gupta | Mar 26, 2022 |

Summary of Parameters for Scrutiny of GST returns (FY 17-18 & 18-19) as per SOP issued

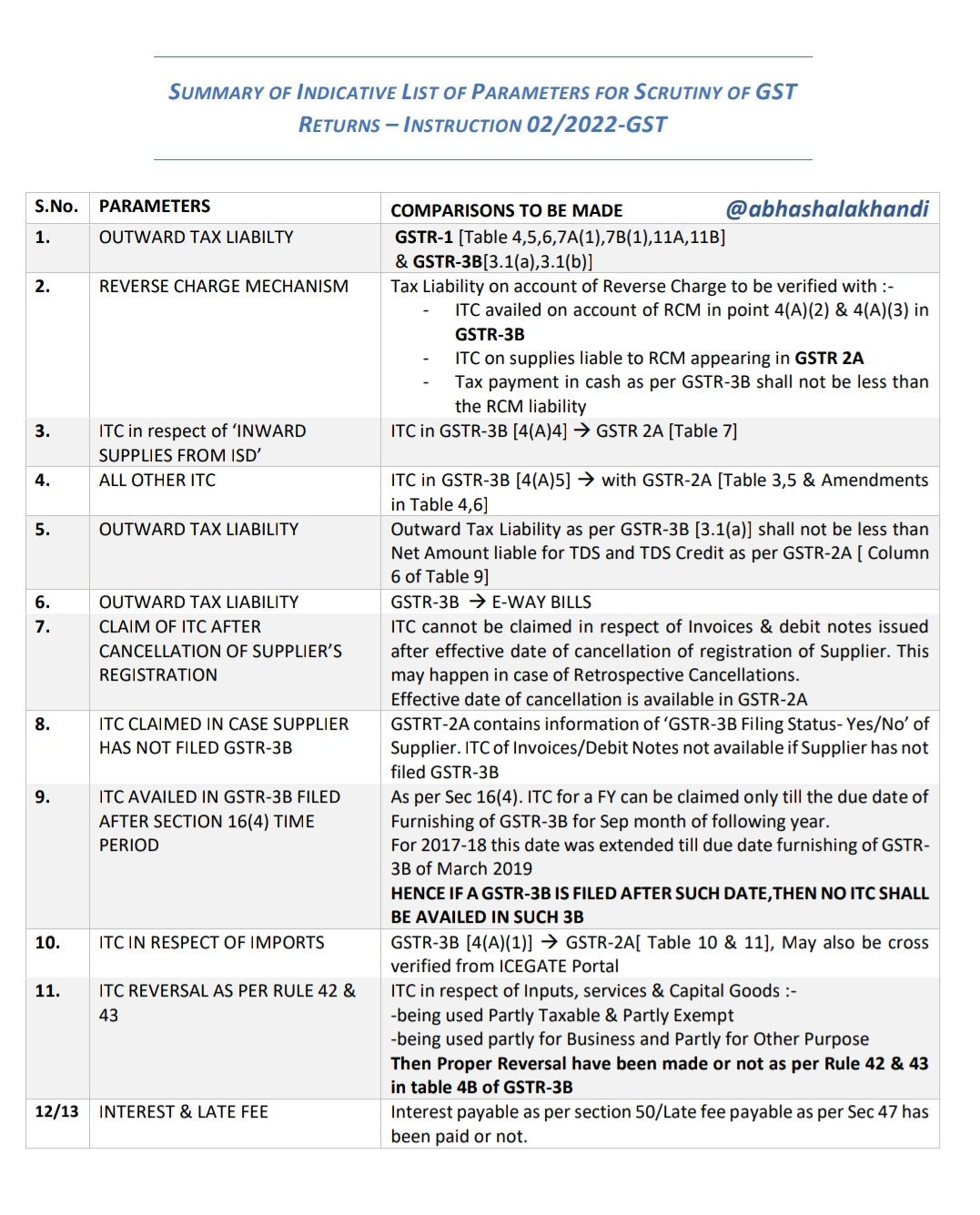

Central Board of Indirect Taxes and Customs (CBIC) has released Standard Operating Procedure (SOP) for Scrutiny of returns for FY 2017-18 and 2018-19.

The returns to be scrutinized will be chosen based on specific risk parameters.

CA Abhas Halakhandi has shared 13 Parameters for Scrutiny of returns for FY 2017-18 and 2018-19.

1. Outward Tax Liability

GSTR-1 [Table 4,5,6,7A(1),7B(1),11A,11B] & GSTR-3B (3.1(a),3.1(b)]

2. Reverse Charge Mechanism

Tax Liability on account of Reverse Charge to be verified with :-

3. ITC in respect of ‘Inward Supplies From ISD’

ITC in GSTR-3B (4(A)4] ➔ GSTR 2A [Table 7]

4. All 0ther ITC

ITC in GSTR-3B (4(A)S] ➔ with GSTR-2A [Table 3,5 & Amendments in Table 4,6]

5. Outward Tax Liability

Outward Tax Liability as per GSTR-3B [3.1(a)] shall not be less than Net Amount liable for TDS and TDS Credit as per GSTR-2A [ Column 6 of Table 9]

6. Outward Tax Liability

GSTR-3B ➔ E-WAY BILLS

7. Claim of ITC After Cancellation of Supplier’s Registration

ITC cannot be claimed in respect of Invoices & debit notes issued after effective date of cancellation of registration of Supplier. This may happen in case of Retrospective Cancellations.

Effective date of cancellation is available in GSTR-2A

8. ITC Claimed in Case Supplier has not filed GSTR-3B

GSTRT-2A contains information of ‘GSTR-3 B Filing Status- Yes/No’ of Supplier. ITC of Invoices/Debit Notes not available if Supplier has not I filed GSTR-3B

9. ITC Availed in GSTR-3B Filed After Section 16(4) Time Period

As per Sec 16(4). ITC for a FY can be claimed only till the due date of Furnishing of GSTR-3B for Sep month of following year.

For 2017-18 this date was extended till due date furnishing of GSTR- 3B of March 2019

HENCE IF A GSTR-3B IS FILED AFTER SUCH DATE, THEN NO ITC SHALL BE AVAILED IN SUCH 3B

10. ITC in Respect of Imports

GSTR-3B (4(A)(1)] ➔ GSTR-2A[ Table 10 & 11], May also be cross verified from ICEGATE Portal

11. ITC Reversal as Per Rule 42 & 43

ITC in respect of Inputs, services & Capital Goods :

Then Proper Reversal have been made or not as per Rule 42 & 43 in table 4B of GSTR-38

12. Interest & Late Fee

Interest payable as per section 50/Late fee payable as per Sec 47 has been paid or not. CA Abhas Halakhandi has shared 13 Parameters for Scrutiny of returns for FY 2017-18 and 2018-19 in his Twitter Account.

CA Abhas Halakhandi has shared 13 Parameters for Scrutiny of returns for FY 2017-18 and 2018-19 in his Twitter Account.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"