Anisha Kumari | Jan 14, 2025 |

Tax Department Implements new measures to Curb Fake GST Registrations

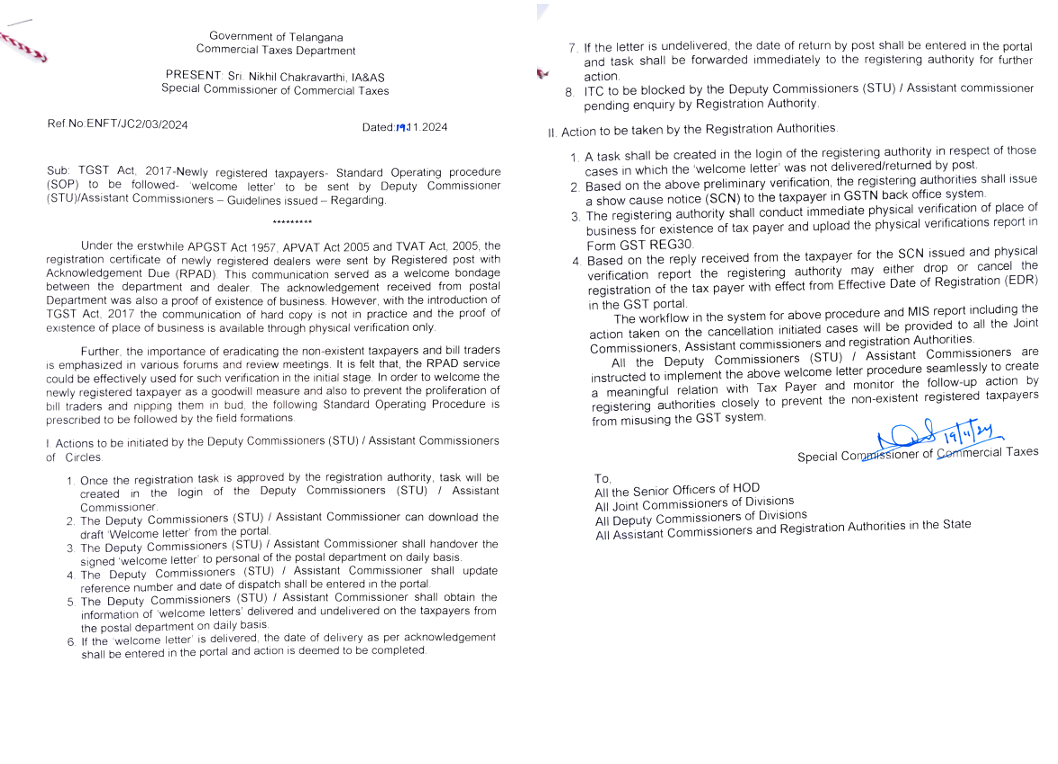

The Commercial Tax Department of Telangana has introduced a series of measures to combat the growing issue of fake GST credit claims, including the introduction of welcome letters to registered business premises and the establishment of 14 GST Suvidha Kendras. On average, the department processes 15 to 20 requests for new GST registrations daily. In order to upgrade the verification procedures, the department has decided to send welcome letters to the registered addresses of business units. If those letters are undelivered, the Assistant Commercial Tax Officer will issue a show-cause notice for cancellation of the GST registration.

Under this scheme, if a business entity is not found to exist at the registered address, then the GST registration will be canceled after a physical inspection by the tax official. The department has undertaken this reform after delegations were sent to different states to study best practices that resulted in these proactive measures. Earlier, the registration certificates used to be sent through RPAD. However, this practice was stopped after the enactment of the TGST Act, 2017, and communication was restricted to email. This restricted physical verification of business locations to instances where complaints were lodged.

Tax Department Implements Measures to Curb Fake GST Registrations

Inspired by similar practices adopted by Tamil Nadu, the welcome letters are being introduced to prevent fraudulent activities at the initial stages of registration. As part of an anti-fake registration drive, the department recently identified 3,000 suspicious taxpayers and unearthed 800 non-existent businesses. This crackdown has led to the blocking of Rs. 300 crore in fraudulent claims since August, with show-cause notices issued to the involved entities.

The department will implement these steps so that verification becomes stronger and claims of fraudulent GST are reduced to higher compliance and integrity in the tax system.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"