CA Pratibha Goyal | Aug 6, 2024 |

Tax relief for property sale: Choose between Flat rate of 12.5% or 20% with Indexation

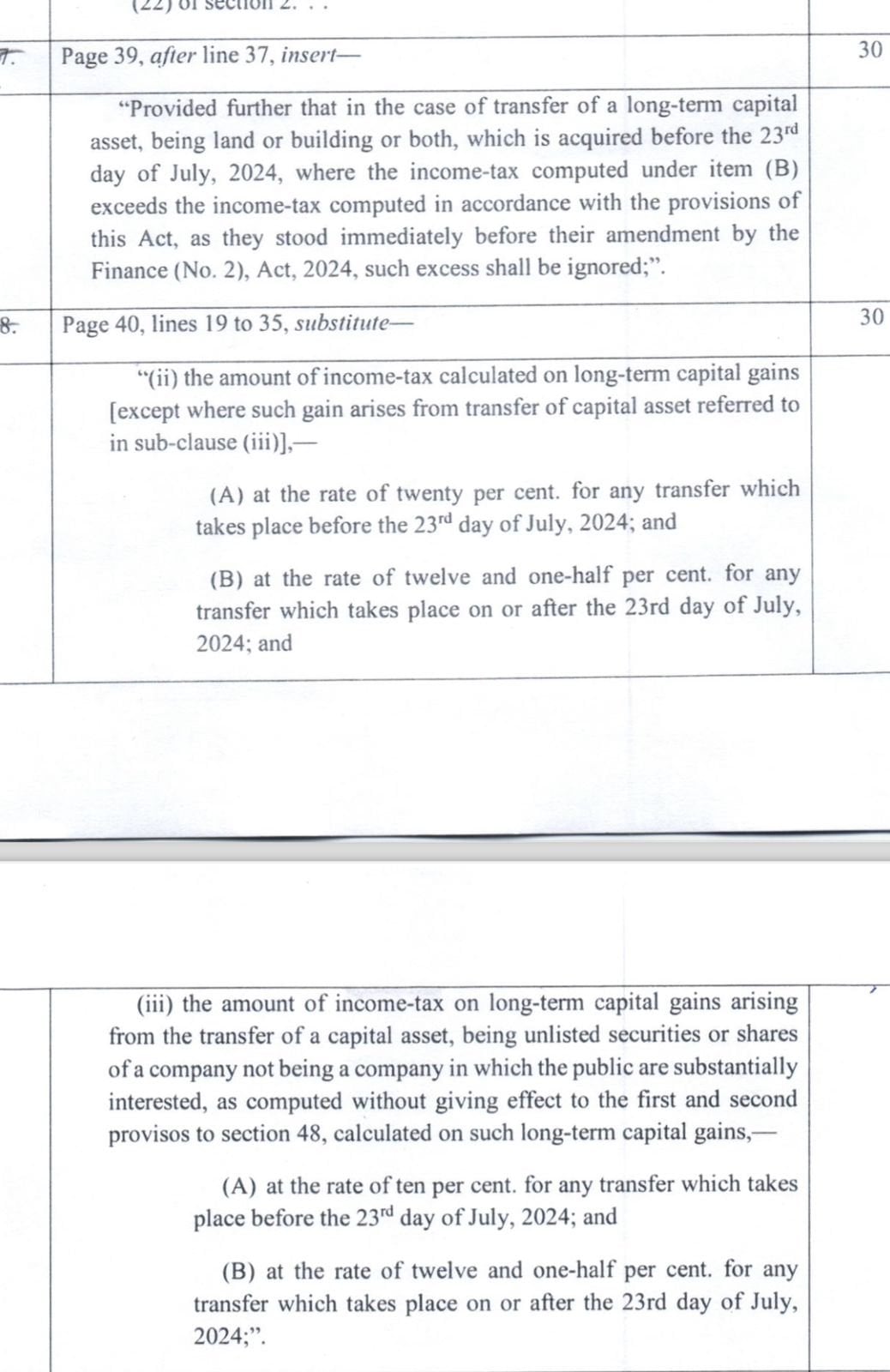

The government is allowing Taxpayers to choose between more beneficial rate of 12.5% without Indexation or 20% with Indexation for property acquired prior to July 23, 2024.

The relevant screenshot of amendments to Finance Bill (No. 2) 2024 is given below:

It must be noted that the LTCG relief is applicable only to immovable assets, i.e. house, land, buildings and unlisted securities. No LTCG relief is proposed for listed equity shares and equity-oriented mutual funds.

List of Amendments to be moved by the Finance Minister related to Budget 2024 is given below.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"