CA Balwant Jain | May 14, 2019 |

Taxation of Mutual Funds By CA Balwant Jain

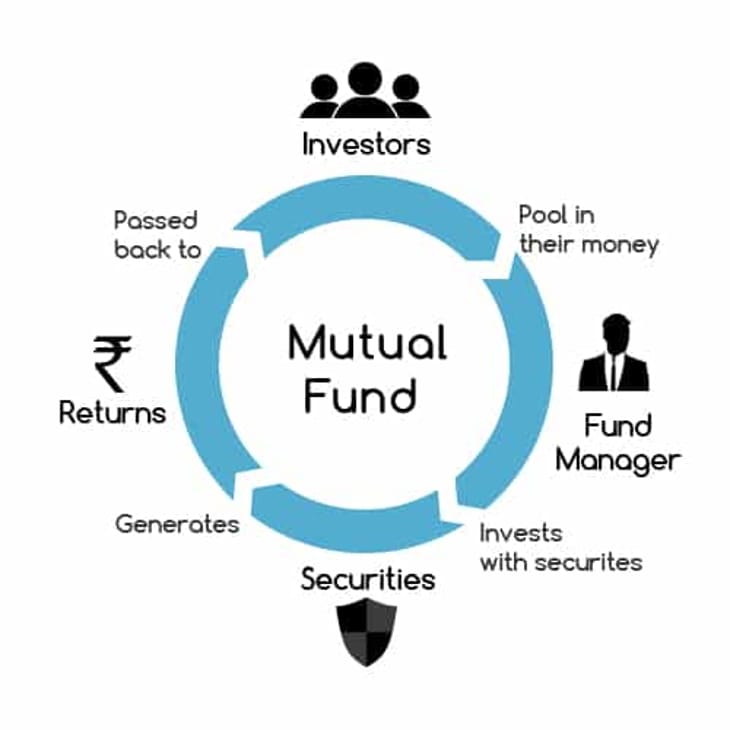

Mutual Funds are like a department store where many products are on display and every one can get product suitable to his needs, risk appetite, investment horizon. From product for parking your overnight funds to investing for decades, mutual funds can cater to needs to all investors. As the products offered by mutual fund houses differ, so does the tax treatment of various mutual fund products. Let us discuss various categories of mutual funds from taxation point of view.

All mutual fund products can be divided in two broad categories for taxation. First category comprises of various schemes in the broader sphere of equity oriented funds and the other category comprises of rest of the products.

Any mutual fund scheme which keeps invested minimum of 65% of investible corpus in shares of domestic companies listed on Indian stock exchanges qualifies as equity oriented scheme. It also includes a scheme which invests minimum of 90% of its total proceeds in another exchange traded fund which in turn also invest a minimum of 90% of their proceeds in equity shares of such companies.

All other mutual fund schemes which do not fall in the first category fall under the other category which includes all the debts funds like liquid funds, short term funds, income funds, G-Sec funds, Fixed Maturity Plans (FMPs) etc. Likewise all the gold ETFs, gold saving funds, other fund of funds, international funds, funds of foreign fun houses fall in this category.

Tax on sale/ redemption of schemes of mutual fund depends on the holding period, again classified in long term or short term. For equity oriented schemes the profits become long term if held for more than 12 months on sale/redemption. The profit on other scheme will become long term if held for more than 36 months. Any profits earned on units sold before the qualifying period is treated as short term.

For investments made through Systematic Investment Plan (SIP), each SIP is treated as separate investment and thus the holding period will be computed with reference to the units allotted on respective dates of SIP. So in case one does SIP in equity oriented funds for one year, only the units allotted on first SIP would become long term after one year of commencement of SIP. Likewise for the units allotted on 12th SIP, you will have to wait for another year to qualify for long term.

Dividends received from all mutual funds are fully exempt in the hands of the recipient as the dividend distribution tax is already paid by the mutual fund house at the time of payment of dividends.

As far as taxes of profits on equity oriented units are concerned, short term capital gains are taxed at flat rate of 15% whereas long term capital gains are taxed at flat rate of 10% after initial exemption of one lakhs along with profits on all listed shares. These concessional rates will apply only if the Securities Transactions Tax has been paid at the time of redemption/sale of such units. For determining cost of equity oriented funds, the NAV or market value as on 31st January 2018 can be taken as cost for units bought before 31st, January 2018. Please note that the benefit of indexation is not available for long term capital gains for equity oriented schemes.

Short term capital gains on units of second category are treated like your regular income and are taxed at the slab rates applicable to you. Long term capital gains on such other fund are taxed at flat rate of 20% after applying cost inflation index to the cost of acquisition.

You can avail exemption from tax on long term capital gains by investing the net sale proceeds for buying a residential house under Section 54F.

The rates of taxes and the other provisions discussed are the same whether you have invested lump sum or through SIP except for computing the holding period as discussed earlier.

For a resident tax payer if the total income excluding the long term capital gains, from both the categories, is less than the amount of basic exemption limit of income, your long term capital gains are reduced by the amount of such shortfall and the balance long term capital gains are only taxed. The same benefit is also available in respect of short term capital gains on equity oriented schemes.

In respect all the capital gains except the short term capital gains second category of schemes, you are not entitled to claim any deduction under chapter VIA against taxable capital gains. The deduction under this chapter includes deductions under Section 80 C, 80CCD, 80 D, 80TTA, 80TTB etc.

The rebate of tax under Section 87A which is available only to a resident individual and which has been raised to Rs. 12,500/- from the current year can also be claimed against the tax liability of tax payable for all the capital gains except the long term capital gains on equity oriented schemes.

Author is tax and investment expert and can be reached at jainbalwant@gmail.com and at @jainbalwant on twitter

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"