Reetu | Feb 13, 2024 |

Taxpayers can Opt Composition Scheme for FY 2024-25 on GST Portal by 31st March 2024

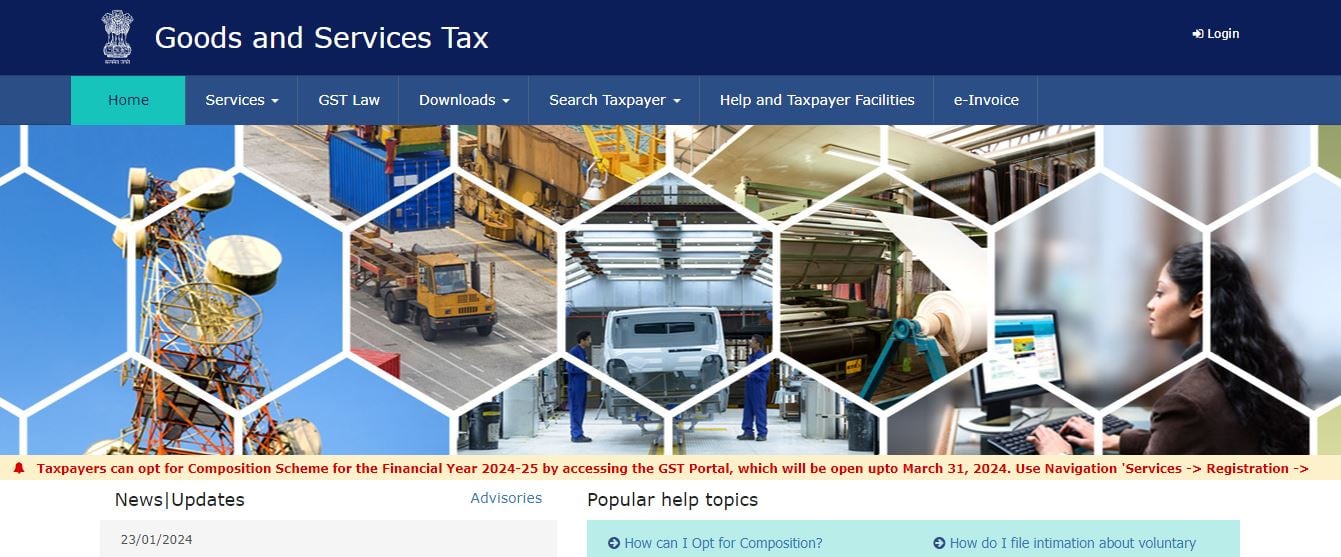

The Goods and Services Tax Network (GSTN) has released an important update, allowing taxpayers to choose the Composition Scheme for the financial year 2024-25. The act is intended to expedite tax compliance procedures and provide relief to eligible firms. The option is available via the GST Portal until March 31, 2024.

The GST Composition Scheme simplifies compliance for small firms by allowing them to pay a fixed amount of tax depending on their turnover, eliminating the need for comprehensive invoicing or input tax credit claims.

Eligible enterprises that participate in the plan benefit from lower regulatory burdens and a simpler tax structure.

The GSTN, which controls the technological infrastructure for GST operations, has issued an update that allows taxpayers to choose the Composition Scheme for the financial year 2024-25.

The change demonstrates the GSTN’s commitment to improving taxpayer convenience and streamlining the compliance process.

Taxpayers who wish to participate in the Composition Scheme must first visit the GST Portal.

They can go to ‘Services -> Registration -> Application to Opt For Composition Levy’.

Once there, taxpayers must file Form CMP-02, supplying the appropriate information and selecting the Composition Scheme.

The GST Portal will be open for taxpayers to choose the Composition Scheme until March 31, 2024.

It is vital for eligible enterprises to take advantage of this opportunity within the timeframe specified to benefit from the streamlined tax system for the upcoming financial year.

Reduced Compliance Burden: Businesses who use the Composition Scheme benefit from fewer paperwork and compliance requirements, allowing them to focus more on their core business.

Fixed Tax Rates: Under the programme, firms pay tax at a predetermined rate based on their turnover, ensuring that their tax liabilities are secure and predictable.

Greater Competitiveness: Small businesses frequently find difficulties in complying with the complex GST structure. By utilising the Composition Scheme, they can increase their competitiveness by focusing on business growth rather than tax compliance issues.

The GSTN’s update allowing taxpayers to choose the Composition Scheme for FY 2024-25 is a significant step towards simplifying tax compliance for small enterprises.

Eligible firms who use the GST Portal and file Form CMP-02 before March 31, 2024, can benefit from lower compliance requirements and a simpler tax regime in the following financial year.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"