Recently, many Taxpayers have received Notices U/S 133(6) of the Income Tax. One should Know what is Notice u/s 133(6) of the Income Tax Act, is it important to comply with the same, and how to comply with it.

CA Pratibha Goyal | Feb 21, 2024 |

Taxpayers receive Income Tax Notice u/s 133(6): Know how to comply

Recently, many Taxpayers have received Notices U/S 133(6) of the Income Tax. Know what is Notice u/s 133(6) of the Income Tax Act, is it important to comply with the same, and how to comply with it.

Section 133 of the Income Tax Act deals with the investigative powers of the Income Tax Assessing Officers and their officials to call for information through notices related to tax-related inquiries and proceedings. Section 133(6) is quoted below for your reference:

133. The Assessing Officer, the Deputy Commissioner (Appeals), the Joint Commissioner or the Joint Commissioner (Appeals) or] the Commissioner (Appeals) may, for the purposes of this Act,….

.. (6) require any person, including a banking company or any officer thereof, to furnish information in relation to such points or matters, or to furnish statements of accounts and affairs verified in the manner specified by the Assessing Officer, the Deputy Commissioner (Appeals), the Joint Commissioner or the Joint Commissioner (Appeals) or the Commissioner (Appeals), giving information in relation to such points or matters as, in the opinion of the Assessing Officer, the Deputy Commissioner (Appeals), the Joint Commissioner or the Joint Commissioner (Appeals) or] the Commissioner (Appeals), will be useful for, or relevant to, any enquiry or proceeding under this Act:

Examples of taxpayers receiving Notice u/s 133(6) of Income Tax:

Mr X purchased goods worth Rs. 30,00,000 from Mr. Y but Mr. Y Did not disclose the sale in his ITR. Mr. X can be called to give the required information helpful in the Departmental enquiry against Mr. Y.

Mr. A, an Indian citizen until 2022, has settled in the United States. Upto 2022 he was a regular ITR Filler. But he stooped Filing ITR from 2023, but he is still receiving Interest, Dividend Income from Indian Banks and Companies. The Indian Banks and Companies can be called in this case to provide the the required information helpful in the Departmental enquiry against Mr. A.

Can I skip complying with Section 133(6)?

The Answer is No. As per Section 272A if any person fails to furnish in due time any of the particulars mentioned in section 133 he shall pay, by way of penalty, a sum of 500 hundred rupees for every day during which the failure continues.

How to Respond to Notice issued under Section 133(6)?

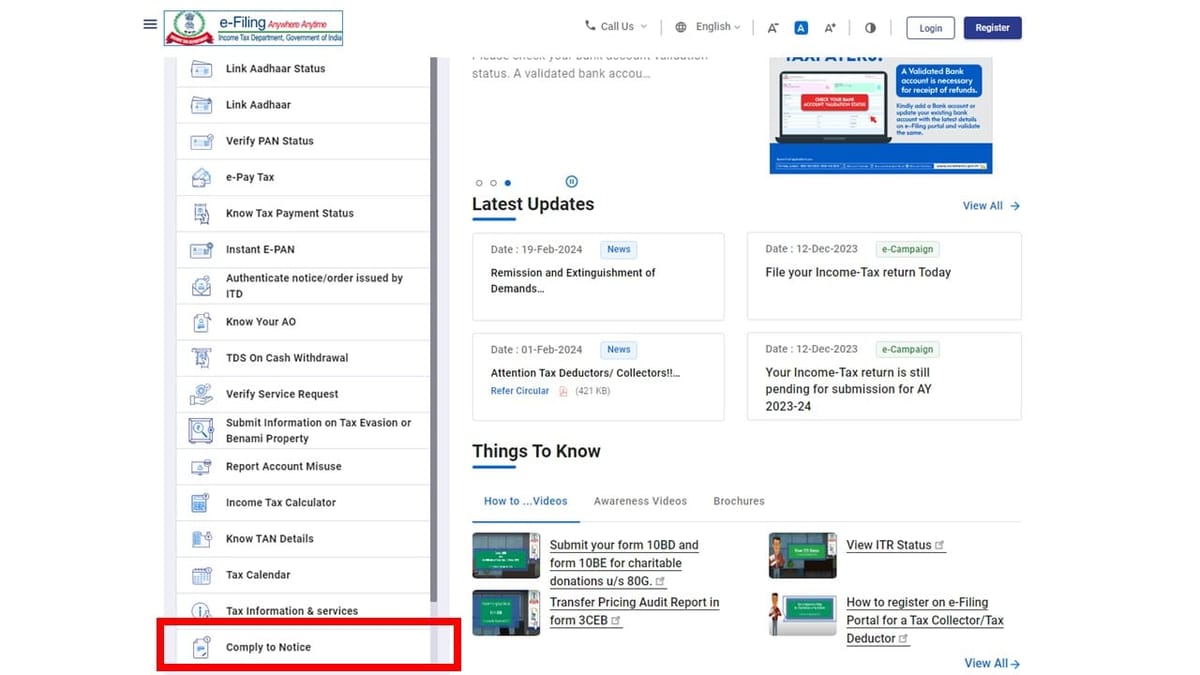

If user is having E-Filing Account, the user can submit the response by login to the Income Tax Portal.

If the user is not having E-Filing Account the facility for submitting responses under this section has now been made available on the Income Tax Portal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"