The Employees of Tata Consultancy Services (TCS) as getting Tax Demand Notices from the Income Tax Department for AY 2024-25.

Reetu | Sep 11, 2024 |

TCS Employees getting Tax Demand Notice despite TDS being paid by Employer

The Employees of Tata Consultancy Services (TCS) as getting a Tax Demand Notice from the Income Tax Department for AY 2024-25.

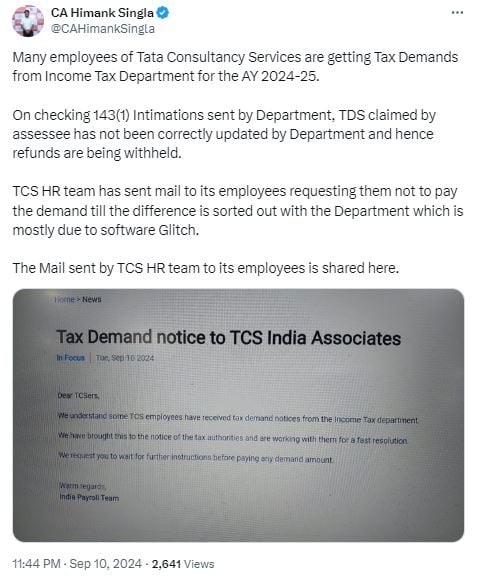

Checking 143(1) Intimations sent by the Department, TDS claimed by the assessee has not been accurately updated by the Department, hence refunds are being withheld.

TCS HR team has sent an email to its employees requesting that they do not pay the demand until the difference is resolved with the Department, which is mostly due to a technical glitch.

CA Himank Singla shared this news on his Twitter Account. He wrote, “Many employees of Tata Consultancy Services are getting Tax Demands from the Income Tax Department for the AY 2024-25. On checking 143(1) Intimations sent by the Department, the TDS claimed by the assessee has not been correctly updated by the Department and hence refunds are being withheld. TCS HR team has sent mail to its employees requesting them not to pay the demand till the difference is sorted out with the Department which is mostly due to software Glitch. The Mail sent by the TCS HR team to its employees is shared here.”

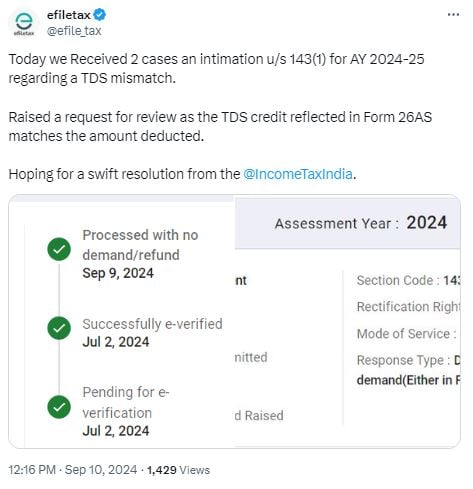

efiletax, a taxation service provider company also tweeted about the same. It wrote, “Today we Received 2 cases an intimation u/s 143(1) for AY 2024-25 regarding a TDS mismatch. Raised a request for review as the TDS credit reflected in Form 26AS matches the amount deducted. Hoping for a swift resolution from the @IncomeTaxIndia”

They further tweeted, “Not just TCS, many others are also receiving tax demands. Since yesterday, we’ve had 12 cases like this.”

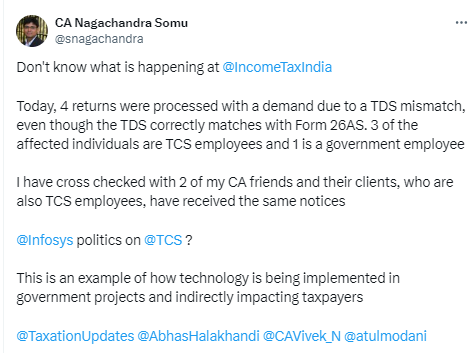

Another CA Nagachandra Somu wrote “Don’t know what is happening at @IncomeTaxIndia

Today, 4 returns were processed with a demand due to a TDS mismatch, even though the TDS correctly matches with Form 26AS. 3 of the affected individuals are TCS employees and 1 is a government employee I have cross checked with 2 of my CA friends and their clients, who are also TCS employees, have received the same notices @Infosys politics on @TCS? This is an example of how technology is being implemented in government projects and indirectly impacting taxpayers.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"