In a recent social media post, Ved Jain, ex-president of ICAI expressed concern over notices issued under Section 148 of the Income Tax Act.

Reetu | Sep 5, 2024 |

Several Taxpayer receive Time barred notices from Income Tax Department

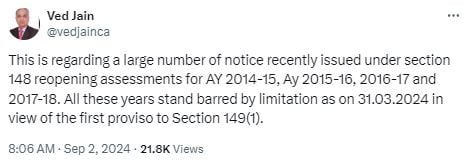

In a recent social media post, Ved Jain, ex-president of the Institute of Chartered Accountants of India (ICAI), expressed concern over notices issued under Section 148 of the Income Tax Act. These notices are about the reopening of assessments for the years 2014-15, 2015-16, 2016-17, and 2017-18.

Several individual taxpayers reportedly got Income Tax Notices under Section 148, which deals with the reopening of assessments for the financial years 2014-15, 2015-16, 2016-17, and 2017-18. Ved Jain, former president of the Institute of Chartered Accountants of India (ICAI), the professional body for chartered accountants, claims that the tax notices were issued wrongly because the six-year limitation period expired on March 31, 2024.

The ex-ICAI president pointed out that as per the first proviso of Section 149(1) of the Income Tax Act, the limitation period expired on March 31, 2024, and these assessments are no longer valid.

He further noted that these notices could be contested through writ petitions because the statutory six-year limitation period has already expired. He further assured assessees and taxpayers that notices issued in search cases where previous assessments under Sections 153A/153C were invalidated by the ITAT, High Courts, or the Supreme Court due to a lack of incriminating evidence are equally time-barred. Jain urged aggrieved taxpayers to file writ petitions before the High Court to have these notices dismissed.

Section 148 of the Income Tax Act authorizes an assessing officer to reassess or assess any taxable income that has been wrongly computed and has not been previously assessed in accordance with the provisions. Once a notice is given under this section, the taxpayer must submit their income tax returns (ITR) within 30 days or within the time frame provided in the notice.

Importantly, Section 148 requires that the evidence presented to the assessing officer be extremely substantial and not based on insignificant facts. Before issuing a notice under this provision, the assessing officer must document and present written reasons why they suspect the taxpayer is evading income assessment.

A chartered accountant located in Mumbai expressed similar views, noting that several of his clients had also recieved such notices.

Ved Jain went on to say, “All of these notices can be challenged through writ petitions and dismissed because the six-year period has already expired as of 31.3.2024. Similarly, notices issued under Section 148 in search instances where earlier assessments under Sections 153A/153C were annulled by the ITAT, High Courts, or the Supreme Court due to a lack of incriminating evidence are equally time-barred and can be overturned by filing a writ with the High Court.”

This viewpoint is consistent with the concerns expressed by other tax professionals, who have also criticized the sending of these notices after the limitation period has expired.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"