TCS Rates under Income Tax Act: TCS Rate Chart FY 22-23

Reetu | Apr 15, 2022 |

TCS Rates under Income Tax Act: TCS Rate Chart FY 22-23

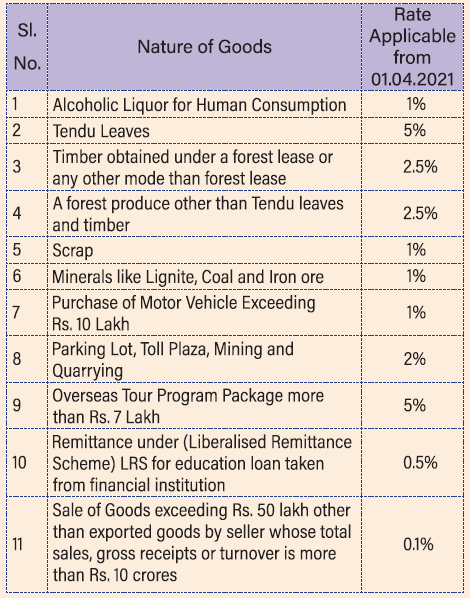

1. Tax collection at source (TCS) is an additional amount collected as tax by a seller of specified goods from the buyer at the time of sale over and above the sale amount and is remitted to the government account. As per Income-tax Act, 1961 certain persons, being the sellers must collect a specified percentage of tax (as given in para 8 below) at the time of receipt of amount from their buyers or at the time of debiting of the account of the buyer whichever is earlier. Section 206C of the Income-tax Act mentions the particulars of goods, on sale of which tax needs to be collected from the purchasers.

2. However, no collection of tax (TCS) shall be made in case of buyer, who is resident of India, if such buyer furnishes to the collector (seller) the declaration in writing to the effect that the goods are to be utilized for the purpose of manufacturing, processing or producing article or things (all for the purpose of generation of power) and not for trading purpose. One copy of such declaration is required to be submitted to the Chief Commissioner of Income-tax or Commissioner of Income Tax on or before expiry of 7 days from the end of the month in which the sale is effected.

3. Besides sale of goods, every person who enters into an agreement of lease, license or contract for parking lot, toll plaza or mining or quarrying will collect an amount @ 2% from such parties as TCS.

4. The person collecting tax has to obtain Tax Collection Account Number (TAN) and quote it in all challans, certificates and returns and all other documents pertaining to the transactions. The buyer shall furnish his Permanent Account Number (PAN) to the seller, failing which tax shall be collected at the higher rate (twice or 5 percent whichever is higher).

5. If the person responsible for collection of TCS fails to collect or after collecting fails to remit, he shall be deemed to be an assessee in default in respect of the tax and various consequences will follow.

(a) Under TCS mechanism a Seller is defined as any of the following:

(1) Central Government

(2) State Government

(3) Local Authority

(4) Statutory Corporation or Authority

(5) Company registered under Companies Act

(6) Partnership firms

(7) Co-operative Society

(8) Any person or HUF who is subjected to an audit of accounts under Income-tax Act for a particular financial year.

(b) A buyer is classified as a person who obtains goods or the right to receive goods in any sale, auction, tender or any other mode.

a. Public Sector Companies

b. Central Government, State Government, Embassy or High Commission

c. Consulate and other Trade Representative of a Foreign Nation

d. Clubs such as Sports Clubs and Social Clubs

e. Local authority for the purpose of purchase of vehicle

Note:

1. If the payer does not furnish PAN/ Aadhaar to TCS collector then rate of TCS is double or 5% whichever is higher for SI. No. 1 to 10 and for SI. No. 11 it is 5%.

2. With effect from 01.07.2021 if the payer (other than Non-resident who does not have Permanent Establishment in India) and has not filed the IT Return for last 2 Assessment Years, TCS rate is double or 5% whichever is higher.

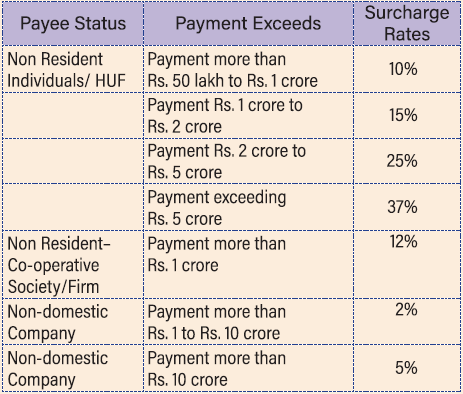

Health & Education Cess @ 4% on TCS + Surcharge as applicable.

(a) The seller shall deposit the TCS amount in Challan 281 within one week of the last day of the month in which the tax was collected. This remittance can be made in any branch of RBI, SBI or any other authorized bank or the same can also be remitted electronically.

(b) All sums collected by any Government office should be deposited on the same day of collection.

a. If the tax collector responsible for collecting the tax and depositing the same to the Government does not collect the tax, then he will be liable to pay interest at the rate of 1% per month or part of the month in addition to the amount of TCS which he fails to collect. If, after collecting the TCS, he does not remit the same to the Government within due dates, then he is liable for interest at the rate of 1% per month of delay.

b. The person would also be liable for penalty u/s 271CA of the Act, which would be equal to amount of tax liable to be collected.

c. The person will also be liable for prosecution u/s 27688 of the Act, the term of which is upto 7 years of imprisonment.

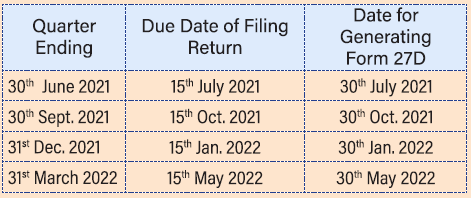

It is mandatory for all collectors of tax at source to furnish Quarterly TCS returns (Form 27EQ) to CPCTDS in electronic mode within the prescribed time. The collector can also file correction statement for rectification of any mistake, add/delete or update the information already furnished.

Note: The Late Filing Fee of Rs. 200/- per day is chargeable for delay in filing ofTCS returns.

The Collector of TCS has to provide a TCS certificate in Form 27D to the purchaser of the goods. The due dates for filing TCS quarterly returns and issue of TCS certificates is as under:

Note: Failure to furnish certificate may attract penalty of Rs. 100/for every day of delay.

Tax collection at source is exempt in the following cases:

(a) When the eligible goods are used for personal consumption

(b) The purchaser buys the goods for manufacturing, processing or production and not for the purpose of trading of those goods.

The buyer (licensee) can apply to the Assessing Officer {TDS) for a lower rate Certificate by filing Form No. 13. Subject to the provisions of the Act, if the AO is convinced that the total income of the buyer (licensee) justifies the lower rate, the AO may issue a certificate specifying the rate of collection u/s 206C. This Certificate will be issued by the AO online through the TRACES portal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"